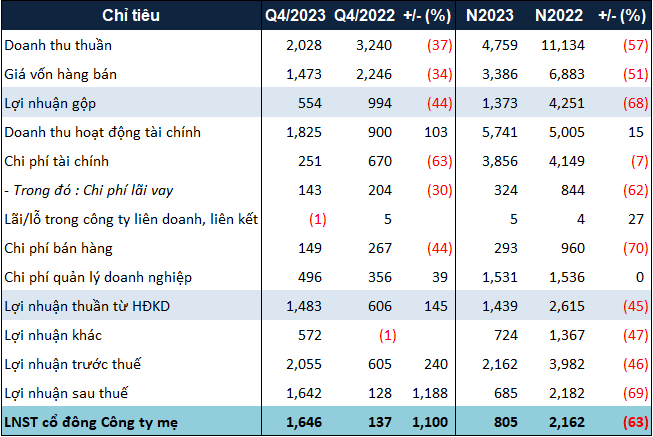

Specifically, in Q4/2023, NVL unexpectedly performed positively. Thanks to the doubled revenue compared to the same period and other profits of VND 572 billion, NVL reported a net profit of VND 1,646 billion, 12 times higher than in Q4/2022.

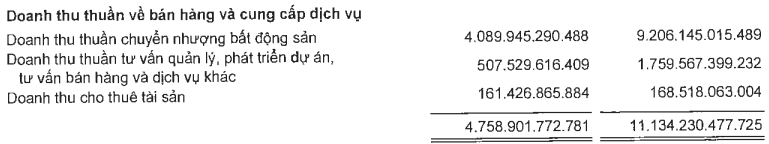

In 2023, NVL achieved a net revenue of VND 4,759 billion, a 57% decrease compared to the previous year, and the lowest level since 2015. The company stated that the main revenue came from real estate transfer activities through handovers in projects such as NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City, Palm City, Lakeview City, Saigon Royal, and other central real estate projects.

|

NVL’s net revenue in 2023

Source: NVL

|

Financial revenue became a bright spot for the company with VND 5,741 billion, a 15% increase, thanks to a nearly VND 415 billion profit from securities trading. In addition, the profit from investment cooperation also increased by 39%, reaching nearly VND 3,226 billion. As a result, NVL achieved a net profit of VND 805 billion in 2023, a 63% decrease compared to the previous year.

Furthermore, NVL not only achieved its targets but also exceeded the business plan for 2023 by 220% with a post-tax profit of VND 685 billion, mainly from the company’s efforts to restructure debts, optimize costs, and financial activities during the restructuring period.

|

NVL’s business results in 2023

Source: VietstockFinance

|

On the balance sheet, NVL’s total assets as of December 31, 2023, were nearly VND 241.4 trillion, a 6% decrease compared to the beginning of the year. The inventory recorded VND 138.6 trillion, of which the value of land funds and ongoing projects accounted for 93.4% (equivalent to VND 129.5 trillion), and the remaining part was completed real estate and completed real estate waiting for handover to customers.

Regarding debts, the company’s payable debt decreased by 8% to nearly VND 195.9 trillion. Among them, borrowings accounted for about VND 57.7 trillion, a decrease of 11%. Bonds still had the largest proportion in borrowings, but decreased by 13% compared to the beginning of the year, to over VND 38.6 trillion.

Regarding bonds, on December 15, 2023, Novaland announced the restructuring of a USD 300 million international convertible bond package. Restructuring the terms of this bond package helped ease the pressure on Novaland in the difficult context.

NVL shareholders approve adjustments to stock issuance plans

Hà Lễ