Recently, the restructuring process has also been hindered when the separate issuance plan for Japanese investors was temporarily suspended. However, in the latest explanation, Pomina revealed that it has found new investors.

Pomina unexpectedly suspends private placement for strategic investor Nansei

Caught in a crisis, Pomina holds an extraordinary meeting to announce restructuring plans

The burden of massive debt

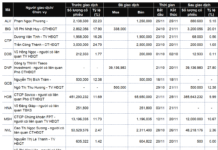

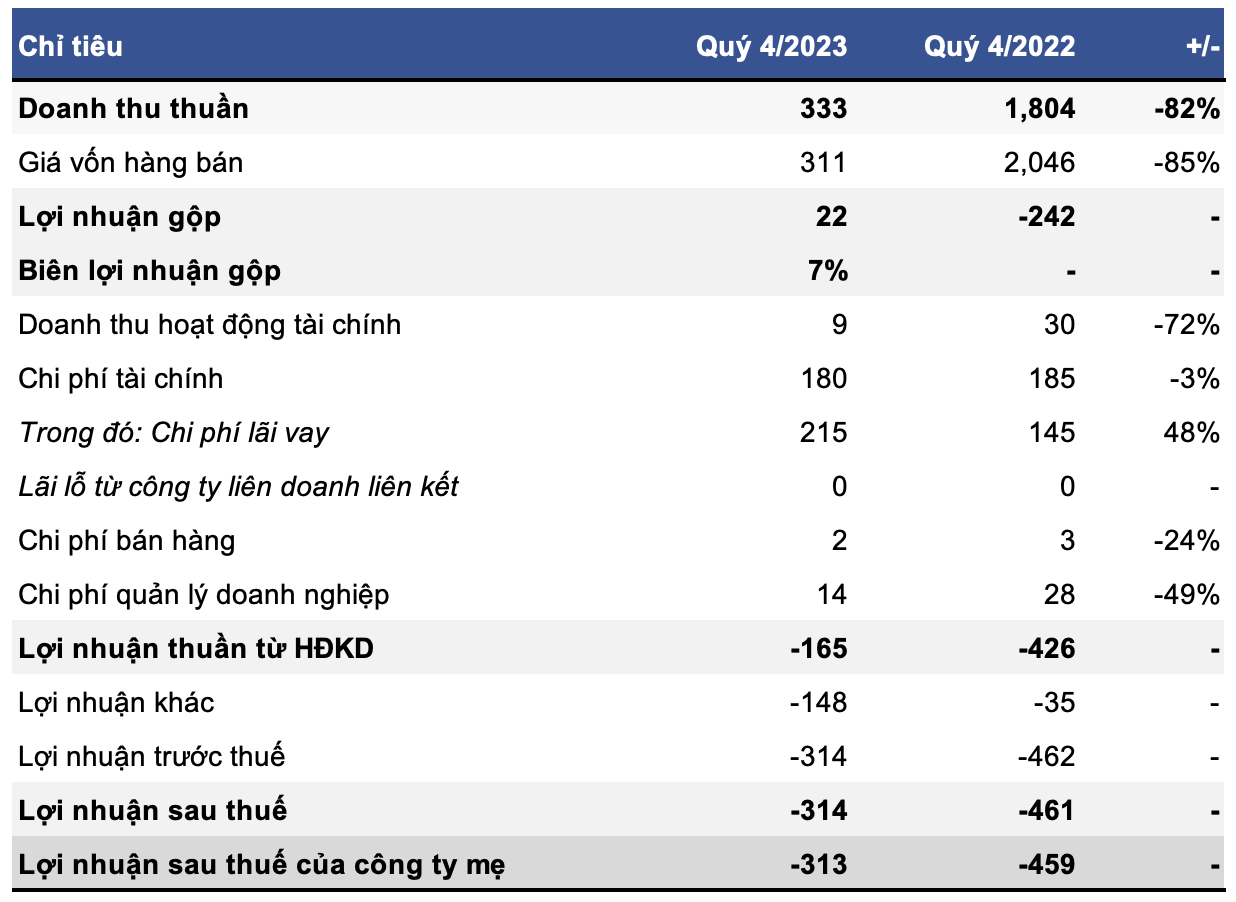

In the last 3 months of the year, Pomina witnessed a shocking 82% drop in revenue compared to the same period, reaching VND 333 billion. However, the company’s gross profit was VND 22 billion, better than the gross loss of VND 242 billion in the same period.

However, the company had to bear interest expenses of VND 215 billion, an increase of 48% compared to the same period. In addition, Pomina also incurred an additional loss of VND 148 billion in the fourth quarter of 2023.

These are the two main reasons that caused the steel company to incur a net loss of VND 313 billion in the fourth quarter of 2023, worse than the previous quarter, and marked 7 consecutive quarters of net loss.

Business results in the fourth quarter of 2023 of Pomina

Unit: VND billion

Source: VietstockFinance

|

A net loss of VND 2,200 billion in 7 quarters

For the entire year of 2023, Pomina recorded net revenues decreased by 75% compared to the same period, to nearly VND 3,300 billion; a net loss of VND 960 billion. Thus, in the past 7 quarters, this steel company has incurred a net loss of nearly VND 2,200 billion.

According to Pomina, the Pomina 3 steel plant is still not operational but still has to bear many costs, including interest expenses. In addition, the real estate market is freezing, steel consumption demand is declining sharply, while fixed costs and interest expenses are high.

Pomina: The long fall of a once-powerful steel company

Serious capital shortage

After a period of heavy losses and high interest expenses, Pomina is facing a serious capital shortage and has overdue debts of over VND 3,100 billion (of which VND 2,200 billion is borrowed and over VND 900 billion must be paid to sellers).

Meanwhile, on the balance sheet, at the end of 2023, Pomina only had over VND 10 billion in cash, over VND 1,600 billion in short-term receivables. In the long-term asset part, the company has over VND 5,800 billion in unfinished construction costs, mainly the costs of constructing a blast furnace and an electric arc furnace.

On the liability side, short-term debts are nearly VND 8,000 billion, including nearly VND 5,500 billion in short-term financial borrowings.

“Found new investors”

Therefore, the company has implemented various measures to mobilize capital, including transferring a part of capital at Pomina 3 Co., Ltd., borrowing from BIDV Bank, and privately placing 70 million shares at a price of VND 10,000/share for strategic investors Nansei from Japan.

However, recently, the steel company unexpectedly suspended the private placement of 70 million shares. This has made many investors skeptical whether Pomina has enough capital to restructure or not.

However, in the explanation of the business results in the fourth quarter of 2023, Pomina said, “Found new investors. All procedures are awaiting approval at the extraordinary General Meeting of Shareholders scheduled to take place on March 15, 2024. After that, the Company will resume operation of Pomina 3 plant, expectedly in the beginning of the second quarter of 2024.”