|

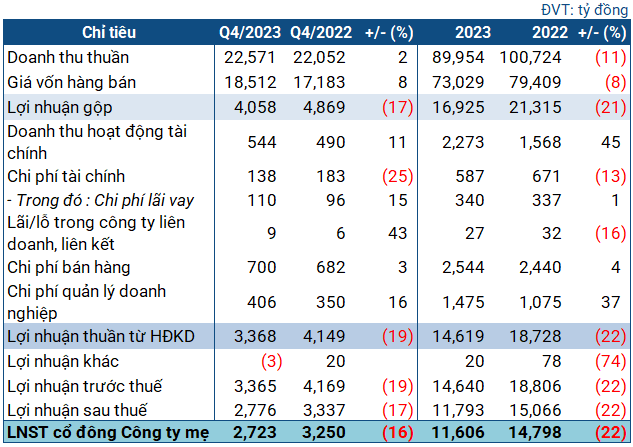

PV Gas Business Results in Q4 and 2023

Source: VietstockFinance

|

PV Gas ended Q4 with revenue of nearly 22.6 thousand trillion dong, slightly higher than the same period last year. However, the cost of goods sold in the period increased by 8%, to over 18.5 thousand trillion dong. After deductions, gross profit was still over 4 thousand trillion dong, a decrease of 17%.

Financial revenue in the period increased by 11%, reaching 544 billion dong. However, both sales and business management costs increased significantly. Finally, PV Gas achieved a net profit of 2.7 thousand trillion dong, a decrease of 16% compared to the same period.

PV Gas said that oil prices in Q4 decreased by 5% compared to the same period. At the same time, dry gas consumption decreased by 43%, leading to a decrease in revenue and profit.

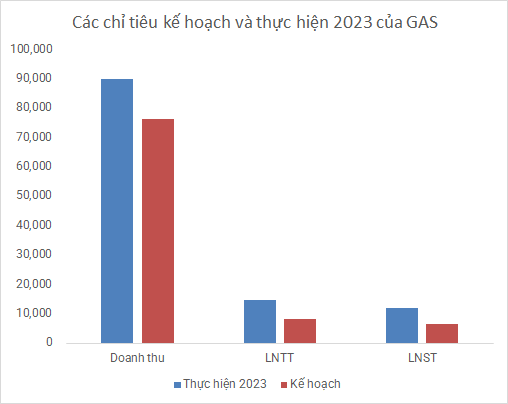

For the whole year, PV Gas’ business performance also declined compared to the high levels of the previous year. The company ended 2023 with revenue of nearly 90 thousand trillion dong, a decrease of 11%; net profit of 11.6 thousand trillion dong, a decrease of 22%. However, PV Gas still exceeded the 2023 Annual General Meeting plan, specifically exceeding the revenue target by 18% and exceeding more than 80% of the annual after-tax profit target.

Source: VietstockFinance

|

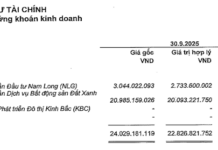

At the end of Q4, PV Gas’ total assets increased by 6% compared to the beginning of the year, reaching nearly 88 thousand trillion dong, of which more than 62 thousand trillion dong were short-term assets (an increase of 12%). The company held a considerable amount of cash with nearly 41 thousand trillion dong in cash and deposits, an increase of 18% compared to the beginning of the year.

Short-term receivables from customers increased significantly by 36%, reaching over 12.5 thousand trillion dong. Inventory decreased slightly to 3.9 thousand trillion dong.

The unfinished basic construction costs at the end of the period decreased sharply to nearly 1.5 thousand trillion dong (from nearly 5.9 thousand trillion dong at the beginning of the year), due to a significant reduction in storage costs for Thị Vải LNG.

On the other side of the balance sheet, short-term liabilities increased by 20%, reaching nearly 15 thousand trillion dong, corresponding to a current payment ratio of 4.2 times. In which, short-term borrowings increased significantly from 45 billion dong to over 1.6 thousand trillion dong, mainly long-term borrowings due for repayment. Long-term borrowings decreased by nearly 30%, to 4.3 thousand trillion dong. All are bank loans.