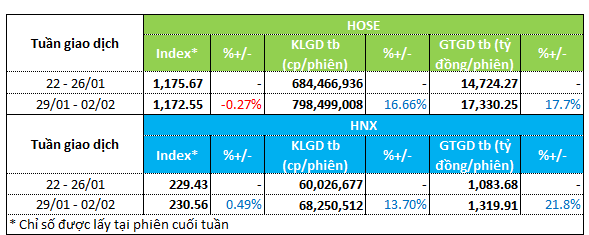

During the week of January 29th to February 2nd, the two main indexes of the market had fluctuating movements. The VN-Index decreased by nearly 0.3% to 1,172.55 points, while the HNX-Index increased by 0.5% to 230.56 points.

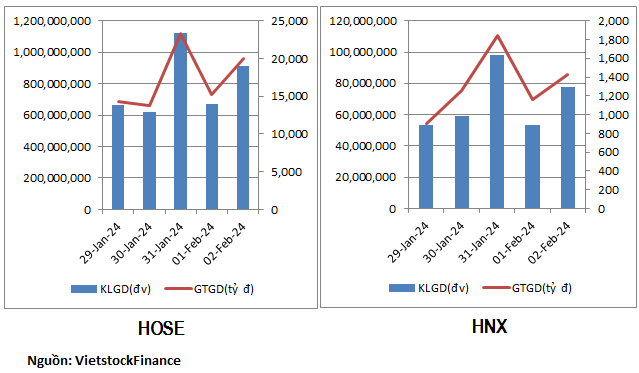

Market liquidity recovered significantly on both exchanges. For HOSE, trading volume and trading value increased by 16-18% compared to the previous week, reaching nearly 800 million units per session and 17.3 trillion VND per session, respectively.

As for HNX, the average trading volume increased by nearly 14%, reaching 68.2 million units per session. The average trading value increased by 22%, reaching over 1.3 trillion VND.

|

Overview of liquidity in the week of January 29th to February 2nd

|

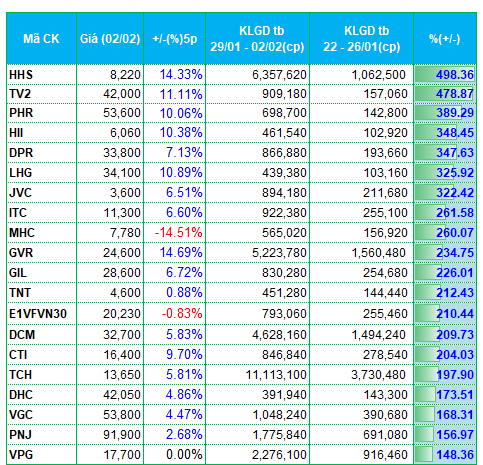

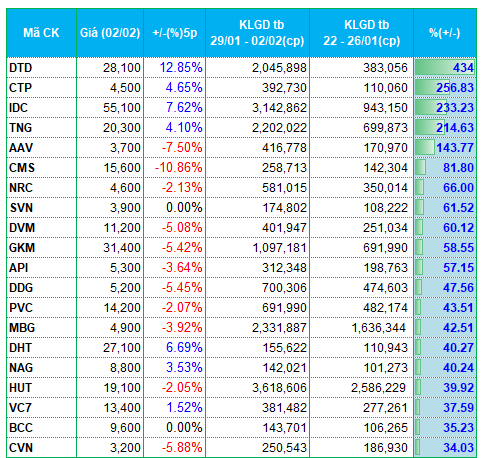

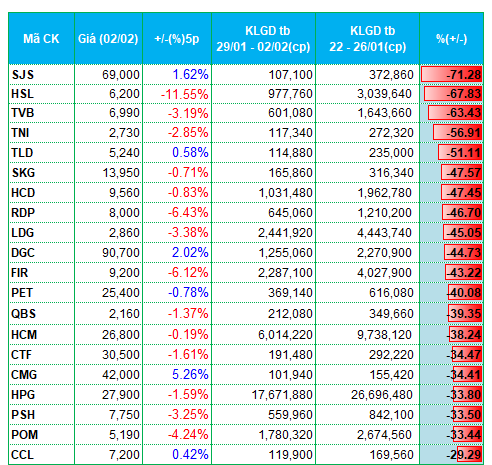

Liquidity recovered, but money flows differentiated across various sectors. The real estate sector stood out with divergent developments. Last week, LHG, ITC, TCH, DTD, AAV, NRC, API, VC7 recorded a significant increase in trading volume. On the other hand, SJS, LDG, FIR, CCL, NDN, L14, TIG were representatives of a sharp decline in liquidity.

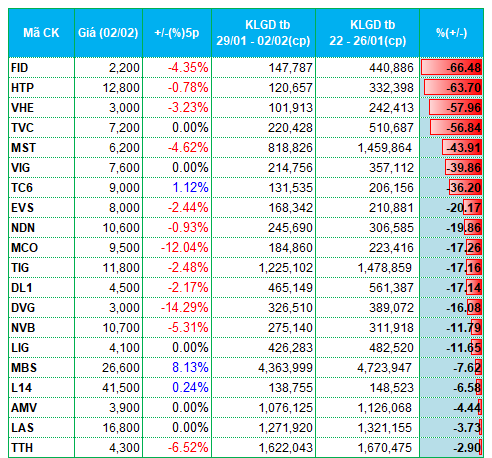

The construction and building materials groups also saw similar developments. The liquidity-increasing group included TV2, CTI, CMS, HUT, VGC, GKM. Conversely, TLD, MST, MCO, LIG, DVG experienced a decline in liquidity.

Metal stocks also showed slight differentiation. TNT, VPG experienced an increase in liquidity, while HPG, POM saw a decrease.

The securities sector faced withdrawal of funds. TVB, HCM, TVC, VIG, EVS, MBS were among the companies with a sharp decline in liquidity on both exchanges.

In terms of an upward trend, rubber and plastic stocks had a positive week in terms of capital inflows. PHR, DPR, GVR, HII, which are traded on HOSE, witnessed an increase in liquidity. These stocks saw liquidity increase by 200% to nearly 400% compared to before.

|

Top 20 stocks with the highest liquidity increase/decrease on HOSE

|

|

Top 20 stocks with the highest liquidity increase/decrease on HNX

|

The list of stocks with the highest liquidity increase and decrease is based on the average trading volume of over 100,000 units per session.

Chí Kiên