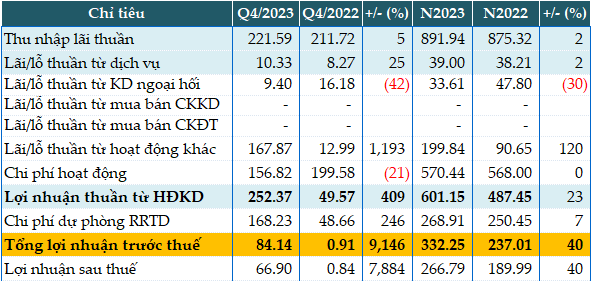

In Q4, the main source of revenue for the Bank increased by 5% compared to the same period, generating nearly 222 billion VND in net interest income.

Non-interest revenue also grew. Notably, other income brought in nearly 168 billion VND in profit, compared to just over 13 billion VND in the same period. This is the exceptional source of income that contributed to the increase of the net profit from business activities in the quarter to 252 billion VND, five times higher than the same period.

The Bank did not specifically disclose where the other income came from, but usually, this item is recorded from recovered debts, bad debt handling, capital transfer.

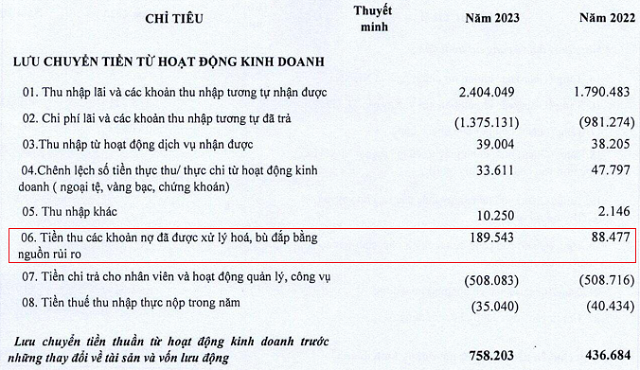

In the cash flow statement, Saigonbank also recorded nearly 190 billion VND in recovered debts in 2023, offset by risk reserves.

|

The debt has been handled with the risk provision of SGB

Source: Consolidated Financial Statements of Q4/2024 of SGB

|

Although Saigonbank set aside over 168 billion VND for credit risk provisions, 3.5 times more than the same period, the Bank still made a pre-tax profit of over 84 billion VND, 92 times higher than the profit of 910 million VND in the same period.

Accumulated for the whole year of 2023, Saigonbank’s pre-tax profit exceeded 332 billion VND, a 40% increase compared to the previous year. Compared to the planned pre-tax profit of 300 billion VND for the whole year, Saigonbank achieved nearly 11% above the target.

|

Business performance in Q4 and the year 2023 of SGB. Unit: Billion VND

Source: VietstockFinance

|

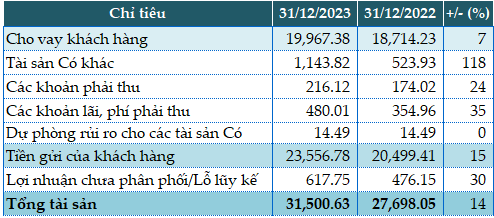

As of the end of 2023, the Bank’s total assets increased by 14% compared to the beginning of the year, reaching 31,500 billion VND. Notably, deposits with the State Bank of Vietnam increased significantly to 3,759 billion VND, while at the beginning of the year, only 885 billion VND was recorded. Customer loans increased by 7% to 19,967 billion VND. Meanwhile, customer deposits increased by 15%, reaching 23,556 billion VND.

|

Some financial indicators of SGB as of 31/12/2023. Unit: Billion VND

Source: VietstockFinance

|

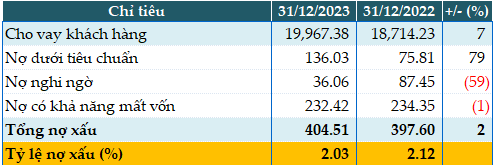

The Bank’s total bad debts as of 31/12/2023 is 404 billion VND, approximately the same as the beginning of the year. However, the potentially loss-making debts (category 5) account for 57% of the total bad debts, totaling 232 billion VND. The ratio of bad debts to outstanding loans decreased slightly from 2.12% at the beginning of the year to 2.03%.

|

The loan quality of SGB as of 31/12/2023. Unit: Billion VND

Source: VietstockFinance

|

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)