Finally, bank stocks plunged and turned the tide with a large amplitude. When the score is lost, the psychology cannot be calm, and there is no trace of the money flow affecting the small market capitalization anymore. All in the same direction is to sell…

The highlight today is the relatively high liquidity, with the two exchanges trading 23.1 trillion VND, which is not unusual. The banking group traded sharply and prices declined simultaneously, confirming short-term risk. When this group turns around, the overall market is certainly affected because the score is lost more.

The market’s deterioration today quickly affects short-term speculative positions with small stocks, many of which only increased until T+2 was finished. The simple reason is that the favorable context for speculative capital pushing up small stock prices has been violated. If the pressure on the banking group and other blue-chips continues, the opportunity for penny stocks is very small, depending on the ability to support prices in regulated liquidity codes.

The decrease today is strong compared to the average of January. Liquidity is also quite high, along with a wide range of declines in stocks. It is clear that the sellers took the lead in the trading. Not to mention the intraday downward trend lasting throughout the session and the indices as well as the stocks closing at the lowest level of the day. When the market is volatile, the index is not an important signal, but at this time the bank has entered a decline, other weak blue-chips available, the VNI will attract attention psychologically. The decrease today also broke through the old MA20 level as well as the adjustment bottom point 4 sessions ago, confirming a lower peak in the short term. Technically, this development also matches the divergent signal that had already existed.

Simply put, the market has entered a clear short-term correction phase. Whatever the reason, from the psychology of Lunar New Year break to “running out of steam” for Q4/2023 profits, it is still falling. Managing risks is the most important thing. In the 3 volatile sessions before today, the market gave a sense that the correction phase was over and managed to attract quite a bit of money to buy bottoms, especially with penny stocks. Once favorable factors for the ability to increase are no longer there, it is best to correct mistakes.

In the medium and long term, the market does not have any worrying risks, but in the short term it must rely on supply and demand. With the weakness of the leading group, the best scenario is still to retreat to create a stable platform before having a chance to move on. Adjusting the portfolio in the short term is to reduce general risks and have better buying power in the stabilizing phase in the future. When the market declines, there will always be appropriate negative information to justify. The search for reasons is not important, but taking advantage of those fluctuations to make a profit is.

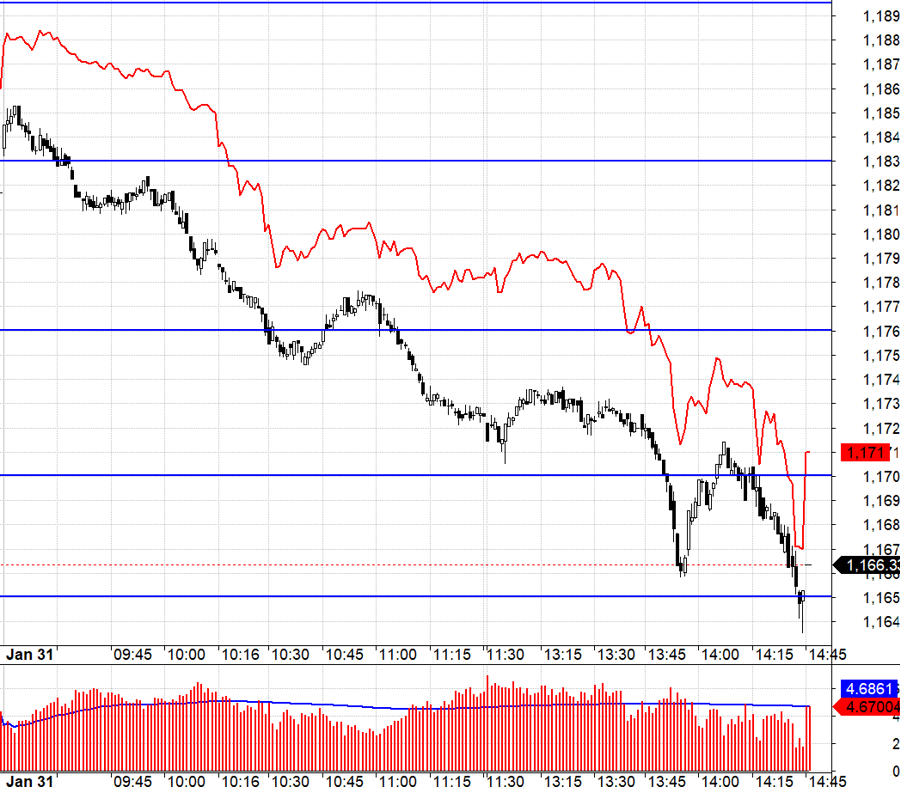

The opportunity to Short on the derivative market today is very large, the strange thing is that the banking group can collapse at any time and F1 still accepts a wide positive basis. When VN30 broke through 1183.xx, even reaching nearly 6 points apart. This difference is like a “fat cat’s mouth”, simply because there is no pillar to support VN30, whether it falls fast or slow is just a matter of time. The index each step broke through the levels of 1176.xx, 1170.xx and stopped at 1165.xx.

With the ongoing short-term adjustment risk of the banking group, VN30 will hardly have a chance to increase. However, there will still be times when the price bounces back and the index rises before new shares appear. The strategy is still to look for Short, not to buy stocks hastily.

VN30 closed today at 1166.33. The nearest resistance tomorrow is 1170; 1176; 1180; 1190. Support 1165; 1159; 1151; 1146; 1140; 1134; 1129.

“Blog chứng khoán” is a personal manner and does not represent the views of VnEconomy. The opinions and evaluations are those of individual investors and VnEconomy respects the views and style of the authors. VnEconomy and the author are not responsible for any issues related to the assessments and investment opinions published.