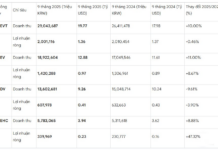

Particularly this afternoon, the amount of money flowing into successful transactions in bank stocks on HoSE almost doubled the morning session, reaching about VND 3,695 billion, equivalent to 36.4% of the total trading volume on this exchange. Throughout the day, bank stocks reached a trading volume of VND 5,632 billion, accounting for 33.2%, the highest level in 16 sessions, approaching the peak in early January.

The surprising thing is that the money seems to only focus on the banking group and increase in this group, while other stocks cannot attract better liquidity. Specifically, the total trading value on HoSE decreased more than 3% compared to the previous week’s session, reaching over VND 16,976 billion, equivalent to an absolute decrease of VND 576 billion. Meanwhile, the banking group (on HoSE) alone increased its trading volume to VND 2,313 billion.

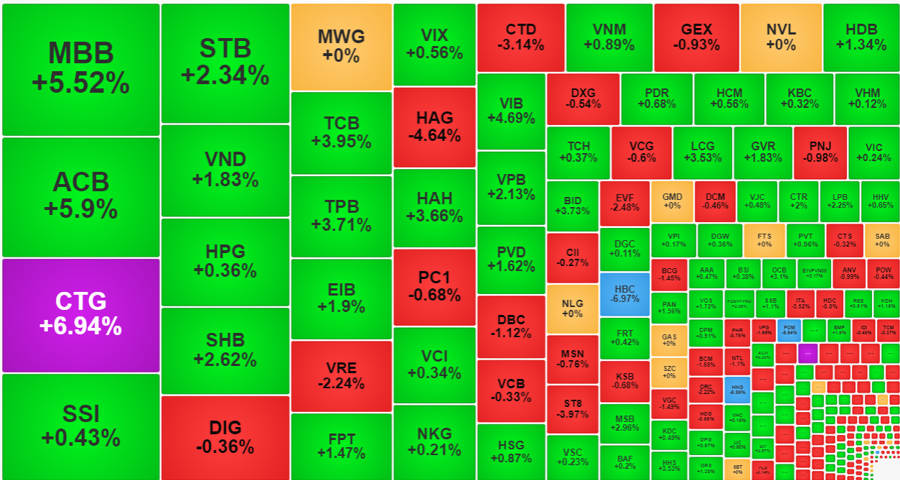

Banks accounted for 4/5 of the most active trading positions in the market today. Leading the group is MBB with VND 837.8 billion, a price increase of 5.52%; ACB with VND 758.8 billion, a price increase of 5.9%; CTG with VND 721 billion, a price increase of 6.94%; and STB with VND 618.4 billion, a price increase of 2.34%. Other high liquidity bank stocks with trading volume over VND 200 billion include SHB, TCB, TPB, EIB, HDB, VIB, VPB.

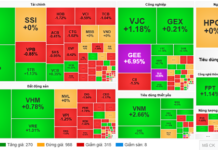

All 27 bank stocks except VCB decreased by 0.33%, while the remaining 23 stocks increased by over 1%, and 10 stocks increased by over 3%, with CTG leading the way with a ceiling increase. The strength of the concentrated money flow is reflected in this significant amplitude that pushed prices up very effectively.

Benefiting greatly from the banking group, the VN30-Index today increased the most on the exchanges at +1.92%, while the VN-Index increased 1.15%, Midcap increased 0.48%, and Smallcap increased 0.22%. The banking group contributed to 7 out of 10 stocks that pulled the strongest points. However, besides bank stocks, the remaining stocks in the VN30 basket are not significant, despite a breadth of 21 stocks increasing and 6 stocks decreasing. Specifically, in addition to the banking group, only GVR increased by 1.82%, and FPT increased by 1.47% were noteworthy. In short, the VN30 increase today belongs to bank stocks, not to the overall blue-chip group.

In fact, the expanded HoSE is similar, despite having 80 stocks closing up more than 1% compared to the reference price, but 78% of the liquidity is concentrated in the banking group. The remaining stocks have the majority of trades being very small. Some relatively notable stocks include VND which increased 1.83% with a liquidity of VND 477.7 billion; FPT increased 1.47% with VND 278.1 billion; HAH increased 3.66% with VND 264 billion; PVD increased 1.62% with VND 189.4 billion; LCG increased 3.53% with VND 129.7 billion; GVR increased 1.83% with VND 128.4 billion.

The closing breadth of HoSE at the end of the session did not differ significantly, with 270 stocks increasing and 212 stocks decreasing. The differentiation is clear despite the excitement in the banking group. About 70 stocks closed down more than 1%, of course, the liquidity is far behind the increasing group because it cannot compare to the advantage of bank stocks. VRE, HAG, CTD, DBC, ST8 are stocks that were sold off significantly, with liquidity all above VND 100 billion and a decrease of more than 1%. The HBC, HNG, and POM groups decreased to the floor with relatively high liquidity.

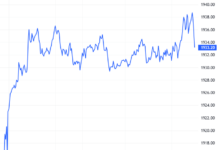

The comeback of bank stocks has achieved an important task of resuming the short-term uptrend that has been interrupted in the past 10 sessions. Today, the VN-Index gained 13.51 points, returning to the peak of January 2024 at around 1188 points. The VN30-Index, of course, has stronger momentum, closing above the January peak.

With only 2 sessions left until the Lunar New Year holiday, the sudden resurgence of bank stocks may drain the money. However, it is likely that only the banking group will have large liquidity as the opportunity is clearer. In the second half of January 2024, bank stocks have not adjusted much and liquidity has dropped to a low level, which means that money is still staying in this group. The consecutive upward momentum will be an opportunity to take profit with a greater weight.