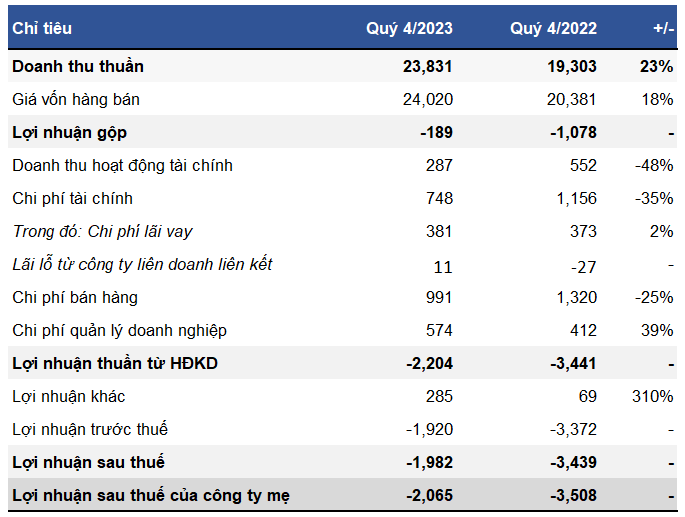

| Business results of Vietnam Airlines for the quarter |

In the last 3 months of the year, Vietnam Airlines witnessed a decline in core operations compared to the previous 3 quarters. Despite recording a significant increase in revenue compared to the same period, the airline still incurred a gross loss of 189 billion VND.

The bright spot lies in the sharp reduction in financial and sales expenses compared to the same period, down to 750 billion VND and 990 billion VND, respectively. In addition, the company had an additional profit of 285 billion VND in the fourth quarter of 2023.

Overall, Vietnam Airlines incurred a net loss of 2,065 billion VND in the fourth quarter of 2023. Although the loss figure is lower than the same period, it cannot alleviate the shareholders’ concerns. They have suffered from consecutive losses for 16 quarters and there are no signs of turnaround from the national airline.

Business results for the fourth quarter of 2023 of Vietnam Airlines

Unit: Billion VND

Source: VietstockFinance

|

Accumulated for the whole year of 2023, the national airline recorded net revenue of nearly 91,460 billion VND, an increase of 30% compared to the same period, thanks to a strong increase in output in the post-COVID-19 era. But the net loss was over 5,800 billion VND.

As explained by Vietnam Airlines, in 2023, the international transportation market has not fully recovered, and passenger transport activities both domestically and internationally still face difficulties due to reduced demand, excess capacity, and high competition. In addition, the aviation market is also facing many negative factors such as high fuel prices, political conflicts, and exchange rate risks.

Net loss for 4 years, but Vietnam Airlines shares still remain on HOSE?

Up to now, the national airline has incurred a net loss for 4 consecutive years, with accumulated losses of nearly 41,000 billion VND and negative equity of nearly 17,000 billion VND. Therefore, Vietnam Airlines shares have violated the regulations of HOSE and are at risk of delisting.

However, these shares can still remain on HOSE if the draft amendment and supplement to the Securities Law is passed and the Government wants HVN to stay on the exchange.

In the draft amendment and supplement, some provisions of Decree No. 155/2020/ND-CP dated December 31, 2020 of the Government detailing the implementation of some provisions of the Securities Law have been added with Clause 7, which stipulates “Special cases that need to maintain listing as considered and decided by the Government”.

This additional draft provision can be seen as a lifeline for the HVN shares of the national airline Vietnam Airlines to continue to be listed on HOSE.

Unstable financial situation

In addition, the financial situation of Vietnam Airlines is also concerning.

On the balance sheet, the airline owns over 14,800 billion VND of short-term assets at the end of 2023, including nearly 3,500 billion VND in cash and short-term financial investments, and 6,000 billion VND in short-term receivables.

Meanwhile, short-term liabilities amount to 60,600 billion VND, including over 17,500 billion VND in short-term borrowings.