To minimize the negative effects, at a conference chaired by the Prime Minister last week, many businesses hoped for stable exchange rates, interest rates, and additional supportive policies.

HIGH INTEREST RATES AND UNSTABLE EXCHANGE RATES PLAGUE THE “BIG SHOTS”

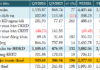

After an unexpected surge in the last month of 2023, data from the State Bank of Vietnam shows that for the first two months of 2024, total credit to the economy has experienced negative growth, declining by 0.72% compared to the end of 2023. Debt in most economic sectors has decreased, except for the real estate sector.

In detail, the agricultural sector decreased by 0.17%, the construction industry decreased by 0.13%, the trade and services sector decreased by 0.91%, consumer loans decreased by 1.77%, and only real estate credit increased by 0.23%… However, the rate of decline in February slowed down (-0.05%) compared to January (-0.6%).

It is rare to see such a paradoxical situation as the first two months of the year when banks have excess money but find it difficult to lend, while businesses are in need of funds.

This reality is present in every industry and field, and it especially attracted attention at the “Conference on Implementing Monetary Policy Tasks in 2024 to Overcome Difficulties in Production and Business, Promote Economic Growth and Stability” chaired by the Prime Minister last week.

Expressing the desire for interest rate support, especially long-term interest rates, for businesses affected by the pandemic, Mr. Dang Ngoc Hoa, Chairman of the Board of Directors of Vietnam Airlines, said the airline is gradually recovering its business activities, reaching about 80-90% of pre-pandemic production capacity, but the recent interest rates are still high and difficult to access.

Vietnam Airlines also suggested that the State Bank of Vietnam extend the 4,000 billion VND capital recovery package to provide time to repay debts; at the same time, it hopes that banks will increase credit limits.

In its restructuring plan, Vietnam Airlines proposed an increase in its equity capital. Therefore, the company’s leadership hopes that the Government and the State Bank will direct financial institutions to support the airline.

In addition, exchange rate fluctuations also have a significant impact on the national airline. Vietnam Airlines’ leaders said that for every 1% increase in the exchange rate, the airline loses up to 300 billion VND, and if the fluctuation is 5%, the cost will be 1,500 billion VND per year, so Mr. Hoa hopes for exchange rate stability.

Sharing at the conference, Mr. Le Manh Hung, Chairman of the Board of Directors of the Vietnam Oil and Gas Group (PVN), also expressed the desire for support from credit institutions, especially the 4 major state-owned commercial banks, to consider increasing the credit limit for each case involving large corporations and large projects.

In this way, large enterprises and super projects can access domestic credit sources. During the period 2021-2025, PVN plans to mobilize about 250.3 thousand billion VND from credit for investment and development.

According to Mr. Hung, the total credit debt in the entire group is about 240,000 billion VND. If the interest rate increases, the Group’s capital cost will increase by about 2,400 billion VND per year. Currently, PVN is in the process of negotiating with banks to restructure its loans with lower average capital costs, helping to optimize production and business costs in difficult market conditions.

“With the sensitivity of interest rates affecting PVN’s capital usage costs, we hope that the Government and the State Bank will continue to maintain optimal and stable interest rate policies, avoiding impacts on the production, business, and investment activities of the Group in particular and businesses in general,” Mr. Hung expressed.

Regarding exchange rates, PVN leaders informed that PVN’s foreign debt is currently about 38,000 billion VND, equivalent to about 1.55 billion USD, so exchange rate fluctuations and risks have a significant impact on the Group’s production and business activities. Therefore, PVN hopes that in the coming time, the State Bank will have solutions to reduce exchange rate fluctuations and risks.

IN NEED OF NON-CREDIT SOLUTIONS

In 2023, many real estate businesses had to struggle through difficulties due to the prolonged stagnant market, despite many “lifebuoys” being thrown by ministries, industries, and localities to support businesses.

Evaluating the effectiveness of the previous policies, Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association, said that thanks to the support, the real estate market has overcome the most difficult phase, and the recovery process, although slow, is solid; this is an encouraging signal.

When the leaders of the State Bank of Vietnam affirmed the extension of Circular 02/2023/TT-NHNN on restructuring debts, extending the repayment period, and keeping the controlling interest rate, it helped credit institutions to have conditions to reduce interest rates and have cheap capital supply. These are policies that partly overcome the difficulties for real estate businesses.

However, according to Mr. Chau, legal issues are currently the biggest obstacle, accounting for 70% of the difficulties for businesses and projects. Therefore, the Association proposes that relevant state agencies focus on resolving legal barriers for real estate projects to have the necessary conditions to access credit.

This is a non-credit solution that is highly effective in promoting credit growth. Without complete legal provisions, credit institutions have no basis for lending.

From the perspective of large financial institutions, Mr. Nguyen Duc Vinh, CEO of VPBank, believes that interest rates are only one of the factors. The State needs to have its own program and continue to support through fiscal policies because credit support alone is not enough. One issue that the Government needs to focus on but has not yet been able to address is boosting domestic demand. This is a major problem and requires more specific programs.

Mr. Vinh said that VPBank has over 40,000 businesses, with a credit limit of 240,000 billion VND but total disbursements are over 60,000 billion VND, leaving the rest undischarged for various reasons. Among them, many businesses meet the criteria but do not have outlets or feasible production and business plans.

Listening to the concerns and obstacles of many businesses at the conference, the Prime Minister directed the State Bank to closely monitor the global and domestic situations to actively, flexibly, timely, and effectively manage monetary policies, especially balancing and rationalizing interest rates and exchange rates…

The content of the article is published in Economic Magazine Vietnam Issue 12-2024 released on March 18, 2024. Please find the article here.