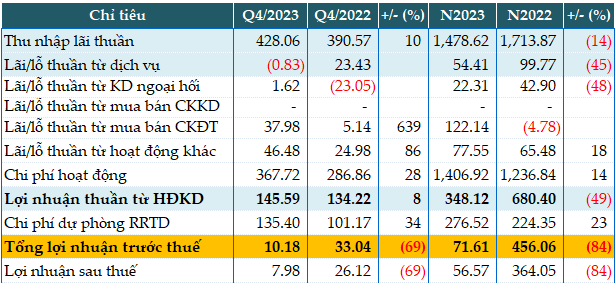

BVBank has reported that due to the difficult business situation of individual and corporate customers, along with the implementation of the State Bank of Vietnam’s policy of sharing difficulties with customers through promoting interest rate advantages and implementing measures to reduce interest rates, its net interest income has been affected. In 2023, BVBank’s net interest income reached 1,479 billion VND, a decrease of 14% compared to the previous year.

Income from services reached over 54 billion VND, a decrease of 45% compared to the previous year, mainly due to the impact of income from linked insurance. Income from foreign exchange business reached 22 billion VND, a decrease of 48% mainly due to market conditions.

Notably, the profit from securities trading reached over 122 billion VND, thanks to almost doubling of bond trading volume. In addition, profit from other activities reached nearly 78 billion VND, an increase of 18% compared to the previous year, thanks to an increase in the recovery of processed bad debts through the provision fund.

The operating expenses in 2023 increased by 14% to 1,407 billion VND. This increase is mainly due to the investment costs in expanding the network, with the number of business units increasing nearly 50% compared to 5 years ago, in order to increase presence in local areas and boost retail business. In addition, in 2023, BVBank marked a change in brand identity in 31 provinces and simultaneously increased investment in digital banking, leading to higher costs.

In 2023, BVBank increased credit risk provisioning by 23% compared to the previous year (276 billion VND), therefore the bank’s pre-tax profit was nearly 72 billion VND, a decrease of 84% compared to the previous year.

If compared to the set pre-tax profit target of 502 billion VND for the whole year, BVBank only achieved 14% of the target.

|

Fourth quarter and full year 2023 business results of BVB. Unit: Billion VND

Source: VietstockFinance

|

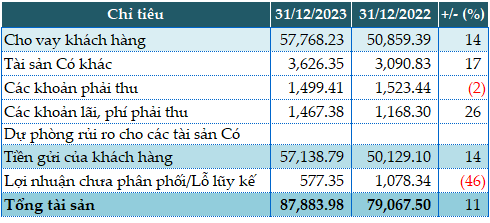

As of the end of 2023, the bank’s total assets expanded to 87,833 billion VND, an increase of 11% compared to the beginning of the year. Of which, customer loans increased by 14%, reaching 87,768 billion VND.

In 2023, BVBank successfully shifted to the segment of individual customer loans. If in the period of 2019-2022, the average proportion of personal loans accounted for only 54% of the total outstanding loans, by 2023, this figure has increased to 70%.

Customer deposits increased by 14% compared to the beginning of the year, reaching 57,138 billion VND. Total deposits increased by nearly 10% to 79,700 billion VND, of which, the scale of deposits from individual customers and economic organizations reached nearly 67,200 billion VND, increasing by 13%.

|

Some financial indicators of BVB as of December 31, 2023. Unit: Billion VND

Source: VietstockFinance

|

Regarding the quality of loans, the total non-performing loans as of December 31, 2023 recorded 1,915 billion VND, an increase of 35% compared to the beginning of the year. The ratio of non-performing loans to outstanding loans increased from 2.79% to 3.31%.

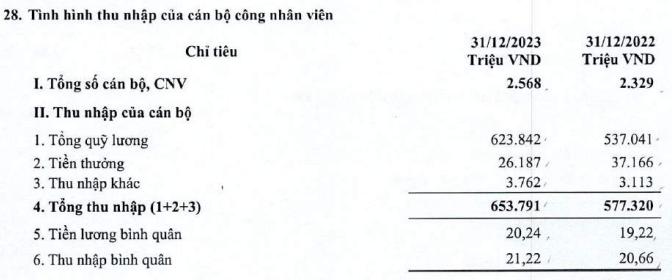

The total number of employees as of the end of the year was 2,568, an increase of 10% compared to the beginning of the year. The average income of BVBank employees is 21.22 million VND per person per month.