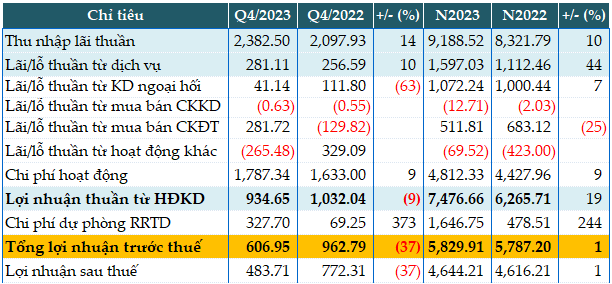

In Q4, MSB‘s net interest income increased by 14% compared to the same period, reaching nearly 2,383 billion VND.

Revenue from non-interest sources grew unevenly. Service income increased by 10% when earning over 281 billion VND in interest. Notably, the Bank earned 282 billion VND in income from securities trading and investment, while in the same period it suffered losses.

On the contrary, other activities incurred losses of more than 265 billion VND, while in the same period it earned 329 billion VND in profit.

In addition, this period, MSB set aside nearly 328 billion VND for credit risk provision, 4.7 times higher than the same period, resulting in the Bank only earning nearly 607 billion VND pre-tax profit, a decrease of 37%.

Year-to-date 2023, MSB achieved pre-tax profit of nearly 5,830 billion VND, a slight increase of 1% compared to the previous year. Therefore, the Bank has achieved 93% of the set pre-tax profit target of 6,300 billion VND for the whole year.

|

Business results of MSB Q4 and full year 2023. Unit: Billion VND

Source: VietstockFinance

|

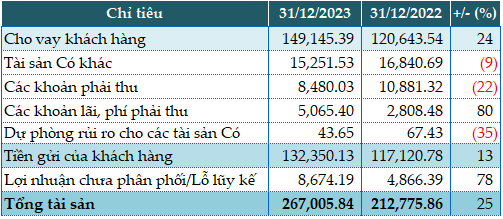

As of the end of 2023, MSB‘s total assets reached 267,005 billion VND, an increase of 25% compared to the beginning of the year. Credit growth reached 22.43%, with the credit portfolio allocated to the core sectors of the economy, thereby minimizing risks and increasing capital efficiency. The Bank also gradually reduced the proportion of real estate loans in the lending portfolio to corporate customers, as this proportion decreased from 13.5% in 2022 to 12.2% in 2023.

Total customer deposits reached over 132 trillion VND, an increase of 13% compared to the beginning of the year. Among them, time deposits reached 97 trillion VND, an increase of 21%; deposits from individual customers reached approximately 76 trillion VND in 2023, accounting for 57% of the total portfolio, an increase of 26%; CASA balance accounted for 26.54% of total funding.

The loan-to-deposit ratio (LDR) reached 67.55%, the short-term capital-to-medium-long-term loan ratio (MTLT) reached 24.87%. The consolidated capital adequacy ratio (CAR) increased to 12.76% from 12.33% at the end of 2022.

|

Some financial indicators of MSB as of December 31, 2023. Unit: Billion VND

Source: VietstockFinance

|

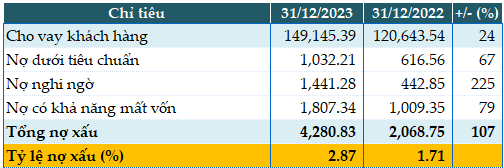

As of December 31, 2023, MSB‘s total bad debt recorded 4,280 billion VND, doubling the beginning of the year. The bad debt ratio to outstanding loans increased from 1.71% at the beginning of the year to 2.87%.

The standalone bad debt ratio remained at 1.77% before CIC and 1.94% after CIC, and the structured debt due to COVID-19 was only 86 billion VND.

|

Quality of MSB‘s loan portfolio as of December 31, 2023. Unit: Billion VND

Source: VietstockFinance

|