CTCP Kinh doanh Than Miền Bắc – Vinacomin (stock code: TMB) announced its business results for Q4 2023 with a revenue of 8,238 billion VND, a decrease of nearly 5% compared to the same period last year. However, thanks to a sharp decrease in the cost of goods sold with a rate of nearly 6%, down to 7,843 billion VND, gross profit increased by 17.6% to 395 billion VND.

During the period, the company recorded a financial revenue of negative 24 billion VND. Although not explicitly explained, this could possibly be a loss caused by the company’s exchange rate loss. Financial expenses amounted to negative 22.5 billion VND, of which interest expenses were negative 63 billion VND. Other expenses of the company did not change significantly.

As a result, TMB achieved a net profit of over 145 billion VND, up 27.2% compared to the same period last year. EPS increased from 7,617 VND to 9,677 VND.

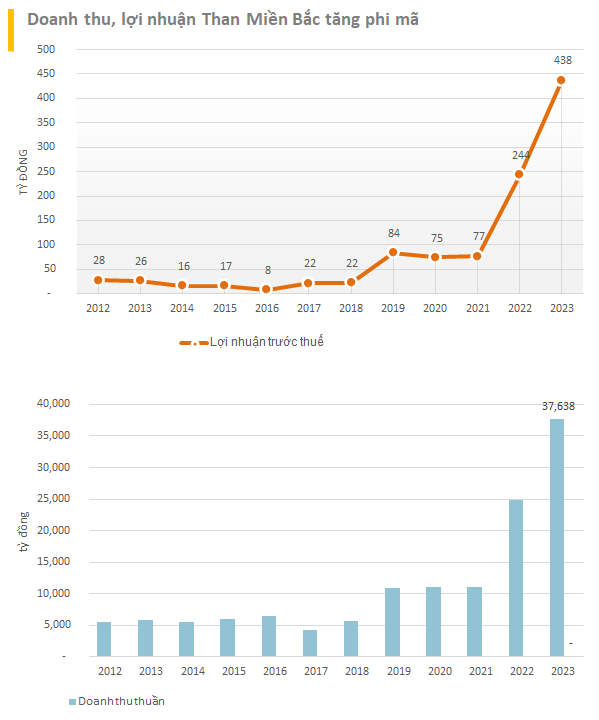

Accumulated in 2023, TMB recorded a revenue of 37,113 billion VND, an increase of nearly 50% compared to the same period last year.

Pre-tax profit increased by nearly 200 billion VND to 438 billion VND. This profit level is equivalent to the 2023 profit of many major real estate and infrastructure companies such as Dat Xanh Group (458 billion VND), CII (428 billion VND), and Deo Ca Infrastructure – HHV (424 billion VND).

After-tax profit reached 343.4 billion VND, an increase of 76% compared to the same period last year. EPS surged from 12,981 VND to 22,893 VND. This is also the record profit level of the company since its establishment.

As of December 31, 2023, TMB’s total assets reached 3,940 billion VND, an increase of 1,672 billion VND compared to the beginning of the year. Among them, the largest proportion in the company’s assets (70%) is inventory, with a value of 2,755 billion VND, an increase of 755 billion VND compared to the beginning of the year. However, the company only had over 27 billion VND in cash.

The company’s capital is mainly financed by loans. Specifically, TMB’s financial loans amounted to 2,420 billion VND. Equity reached 734 billion VND.

The predecessor of CTCP Kinh doanh Than Miền Bắc – Vinacomin was the Coal Management and Distribution Corporation, established in 1974, with the task of managing the state’s coal products and distributing them according to the state’s planning objectives for the needs of the national economy. The company is currently a member of the Vietnam National Coal-Mineral Industries Group (Vinacomin). The company’s main business is coal sales in the northern provinces from Ha Tinh and northward.

In the market, after about half a year of sideways movement, the stock price of TMB of CTCP Kinh doanh Than Miền Bắc – Vinacomin suddenly had a strong increase, with 5 consecutive sessions of gains (January 29 – February 2), including three sessions reaching the limit up. TMB’s price subsequently increased by nearly 38% from 43,300 VND/share to 59,800 VND/share. This is a new peak price of TMB since trading on the HNX in mid-January 2017. Looking further ahead, the stock has increased by 130% after six months.