Illustrative image

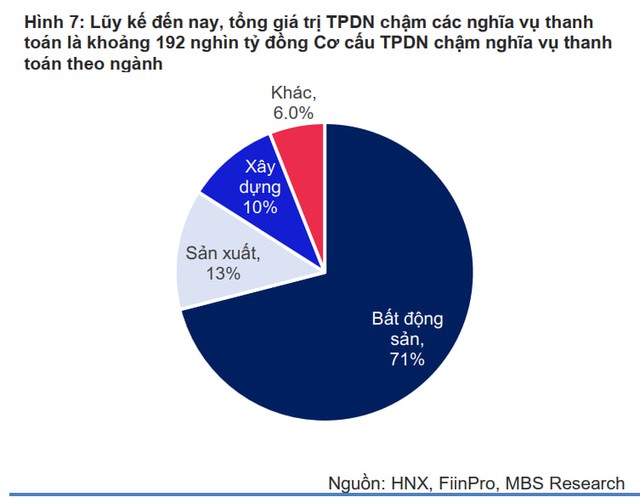

In a report on the new bond market, MB Securities (MBS) estimates that the value of corporate bonds will mature in 2024 at around VND 200 trillion (excluding repurchased bonds), especially the largest value of maturing bonds will fall in the second and third quarters of this year.

Among them, the real estate sector accounted for the largest proportion with an expected total value of VND 37 trillion, accounting for 18% of the total value of maturing bonds. Next is the banking sector with an expected value of VND 17 trillion, accounting for 9%.

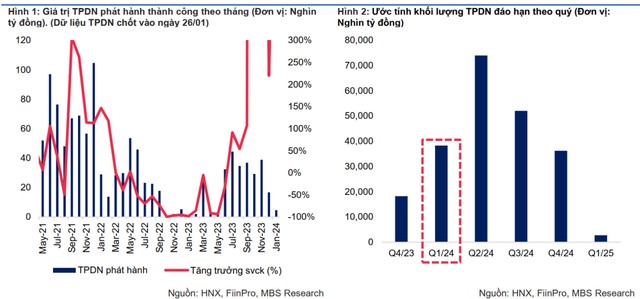

As of January 26, about 105 companies have reported delays/defaults in bond principal and interest payments. MBS estimates the total value of delayed corporate bond payments at around VND 193 trillion, accounting for nearly 19% of the total outstanding corporate bond debt in the market, of which the real estate sector accounts for the largest proportion of about 71% of the delayed payments.

According to MBS, the corporate bond market operated sluggishly in the first half of 2023 and gradually picked up in the second half of the year. Accumulated for the whole year, the total value of corporate bonds issued reached over VND 317 trillion, an increase of 17% compared to the previous year. MBS’s estimate shows that the average annual coupon rate in 2023 is about 8%, equivalent to 2022, despite the significant decline in deposit interest rates of about 3.4% by the end of 2023.

The banking sector is the group with strong growth in issued value, increasing by 31% compared to 2022, accounting for 56% of the total value in 2023, with an estimated average coupon rate of 6.5% per year, and an average term of 4.7 years. The value of issuance of the real estate sector increased by 18% and accounted for 25% of the total value, with an estimated average coupon rate of 9.9% per year, and an average term of 3.5 years.

Industries that saw a decrease in issuance activities in 2023 include construction and building materials (-91%), securities (-27%), energy (-59%). Throughout the year 2023, about VND 244 trillion of corporate bonds were repurchased before maturity, an increase of 9% compared to 2022, of which the banking sector still accounted for the largest proportion of about 50% of the total repurchased value, while the real estate and construction sectors accounted for 14% and 13%, respectively.

According to MBS, in 2023, businesses have intensified bond repurchases (with an estimated value of up to VND 244 trillion), especially activities mainly coming from the banking sector due to surplus liquidity (accounting for 50% of the total repurchase value). Repurchasing bonds before maturity will help banks reduce excess capital, improve capital utilization efficiency, improve capital adequacy ratio (CAR), and at the same time significantly reduce the pressure on the value of bonds maturing in 2024 for this sector.

As of January 31, the total value of successfully issued bonds in January was estimated at over VND 4.5 trillion, with issuance activities decreasing significantly by 73% compared to the previous month. Among them, the construction sector accounted for a large proportion with an issuance value of about VND 4.1 trillion. Of note, Ho Chi Minh City Infrastructure Investment JSC issued public bonds with a value of VND 2,813 billion at an interest rate of 10% per year and a term of 10 years.

The analysis team expects the corporate bond market to improve in 2024 thanks to factors such as macroeconomic recovery supporting business expansion; the low-interest rate environment will also stimulate capital demand as well as attract investment flows; the real estate industry will have a more positive outlook; legal regulations will boost confidence in bond issuers as well as investors.