Continuous Profit Growth for 2 years

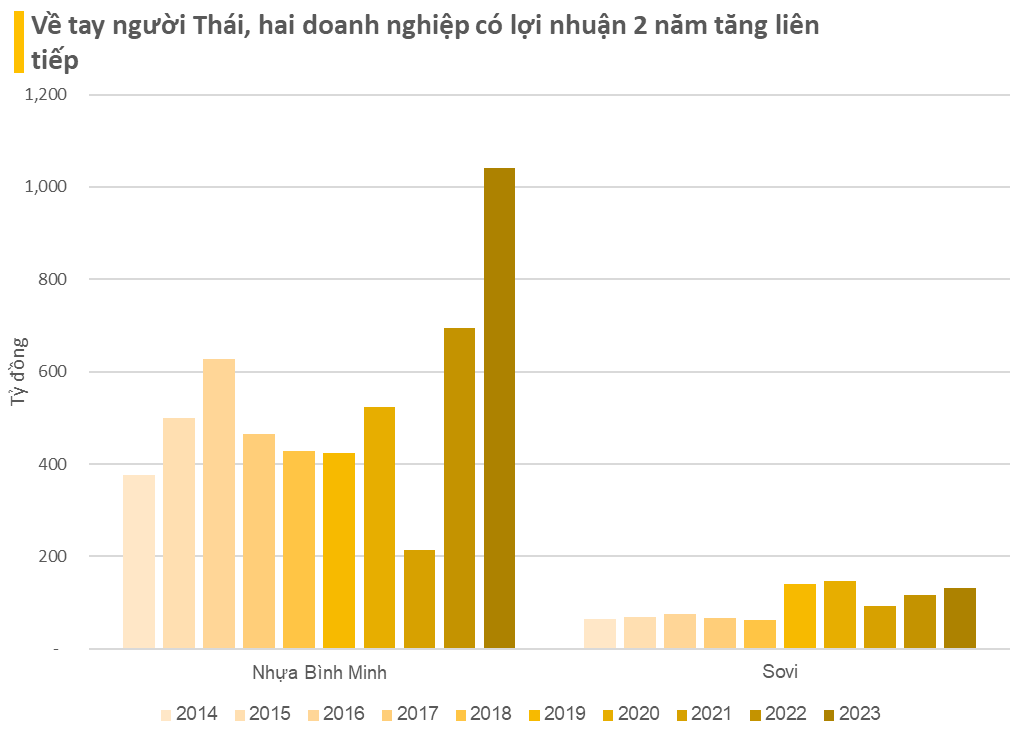

In 2023, Binh Minh Plastic (BMP) continued to achieve its best-ever profit. The company recorded a revenue of 5,156 billion VND, a 12.6% decrease compared to 2022. However, the significant decrease in cost of goods sold helped the company to achieve a net profit of 1,042 billion VND in the past year, a 50% increase compared to the same period last year. EPS increased from 8,481 VND to 12,717 VND.

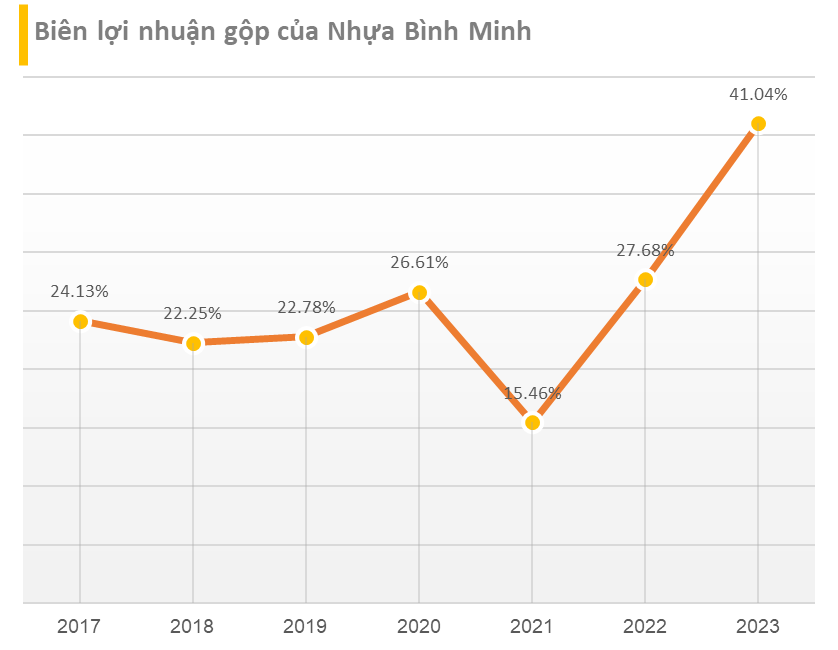

Binh Minh Plastic’s gross profit margin in 2023 reached 41.04%, a significant improvement compared to 27.68% in 2022 and 22.3% in 2018, the year when SCG Group officially announced the successful acquisition of the company.

Similarly, Bien Hoa Packaging (Sovi, SVI) also achieved a consecutive increase in profit for the second year with a net profit of over 132 billion VND, a nearly 14% increase compared to the same period. EPS increased from 9,086 VND to 10,319 VND. SVI’s gross profit margin in 2023 also improved to 17.34% from 14.2% in 2022.

Notably, both Binh Minh Plastic and Sovi are owned by Thai conglomerate SCG. The group became a major shareholder of Binh Minh Plastic since March 2012 and has continued to acquire more shares. After “owning” the entire BMP shares from SCIC in the share auction in March 2018, SCG successfully acquired Binh Minh Plastic. The estimated total amount that the Thai group spent on this deal is around 2,800 billion VND. Currently, this Thai “giant” holds 55% of Binh Minh Plastic’s capital through its subsidiary Nawaplastic.

After Binh Minh Plastic, SCG Group, through its subsidiary TCG Solutions, continued to acquire Sovi in 2020. Sovi is the precursor of the first corrugated paper factory in Vietnam. At the present time, TCG Solutions holds approximately 94% of SVI’s shares.

Maintaining Cash Dividends

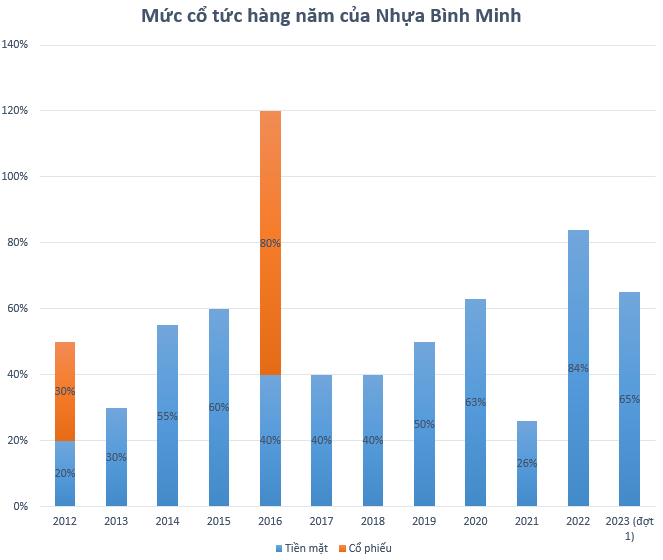

Both Binh Minh Plastic and Sovi are companies that maintain annual cash dividends. In particular, Binh Minh Plastic is also known for its high cash dividend payout ratio. In 2022, the company allocated almost the entire profit to distribute dividends at a ratio of 84% in cash, with Thai shareholders pocketing 376 billion VND. This is also the record dividend ratio in a year of Binh Minh Plastic.

On December 12, 2023, the leading plastic company distributed an advance dividend for the first quarter of 2023 at a ratio of 65%, with SCG continuing to collect 293 billion VND. It is estimated that the total dividend amount that the Thai “giant” has earned since becoming a major shareholder of Binh Minh Plastic has reached nearly 1,800 billion VND.

In June 2023, Sovi also paid dividends for 2022 with an actual implementation ratio of 23.4%, with SCG receiving over 28 billion VND.

In addition, SCG also made a big win as BMP shares surged in 2023. At the end of the trading session on February 6, 2024, BMP shares reached a price of 108,000 VND/share. Since the beginning of 2023, BMP has nearly doubled its market value. Binh Minh Plastic’s market capitalization has also increased by over 4,600 billion VND, reaching approximately 8,800 billion VND.