Specifically, on December 31st, 2023, the outstanding loans (mostly margin loans) of the expanded securities companies block increased significantly – nearly one and a half times compared to the previous year, approximately 180,000 billion VND and increased by about 8% compared to the end of the third quarter.

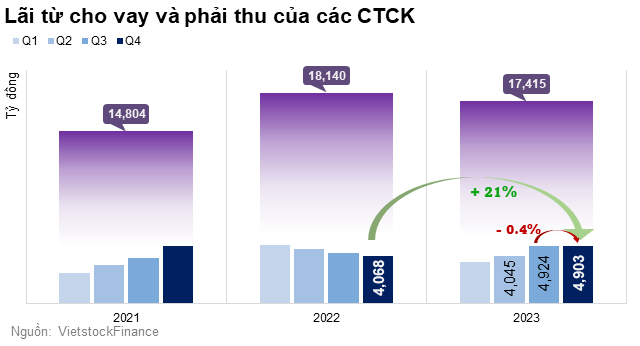

In 2023, this activity generated interest income of over 17,415 billion VND, a decrease of 4% compared to the previous year. In the year, interest from loans, receivables increased in the first 3 quarters and leveled off in the fourth quarter, in terms of value.

In the fourth quarter of 2023, the securities companies earned over 4,903 billion VND from lending activities, an increase of 21% compared to the same period last year, but a slight decrease of 0.4% compared to the third quarter of 2023.

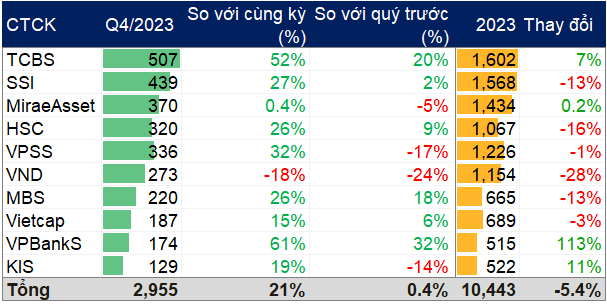

Some securities companies in the top 10 with the largest margin debts in the market, also the group with the largest stock brokerage market share on HOSE in 2023 (excluding VPBank Securities – VPBankS), recorded a decline in revenue from lending activities in the fourth quarter.

For instance, VNDIRECT Securities (VND), this securities company earned 273 billion VND from lending activities, 24% lower than the previous quarter. KIS Securities (KIS) and VPS Securities (VPSS) saw a decrease of 14-17% in profit from loans and receivables, while Mirae Asset Vietnam Securities (MiraeAsset) had the lowest decrease, down 5%. On the other hand, other securities companies such as Kỹ Thương Securities (TCBS), SSI, HSC, MBS, Vietcap, and VPBankS saw growth rates ranging from 2-32%, with an average growth of 15%.

If calculated since the beginning of the year, the number of securities companies with declining revenue in the lending sector is higher than in the fourth quarter. In which, VND saw the most significant decline (-28%), to 1,154 billion VND; VPS had the lowest decline (-1%) to 1,226 billion VND; and MiraeAsset (+0.2%) remained relatively stable compared to the previous year, recording 1,434 billion VND.

|

Profit from lending and receivables of securities companies with the largest market share in 2023

Unit: Billion VND

Source: VietstockFinance

|

In general, the revenue from lending interest of the top 10 securities companies differentiated in the fourth quarter, but considering the whole year of 2023, most of these companies experienced setbacks.

One noteworthy point is that the market debt in the fourth quarter increased amidst the stock market not experiencing much breakthrough. The VN-Index hovered around the 1,100-point mark, accompanied by low liquidity (on HOSE, the average trading value per session in the fourth quarter was 15,762 billion VND, a decrease of 26% compared to the previous consecutive quarter). Therefore, it may be that a significant amount of margin debt did not enter the market, or some securities companies did not lend to individual investors to trade stocks. According to ABS Research, the surge in lending pledge was not proportional to the growth of trading volume and market share, indicating that a considerable amount of debt was lent to businesses for financial and operational purposes, not to individual investors for stock trading.

The analyst group also noted that there is still much room for securities companies to expand margin loans because the new lending balance is only equivalent to 77% of the industry’s equity, much lower than the maximum allowed level of 200%. Therefore, although the margin lending ratio on market capitalization has remained at a high level over the past three years (around 3%), the risk of forced liquidation has not increased proportionally to this ratio.

The race to increase margin lending capital

With the lending ratio still at 77% of the industry’s equity, there is still a significant potential to expand margin loans, especially in the context where the stock market in 2024 is expected to be more positive.

A recent 2024 strategic report from HSC indicated that many large securities companies plan to increase capital in the 2024-2025 fiscal year, which shows their capital readiness to meet higher trading demand from investors as the KRX system operates and the pre-funding requirement is processed. In addition, the capital source is more flexible and less dependent on bank funding.

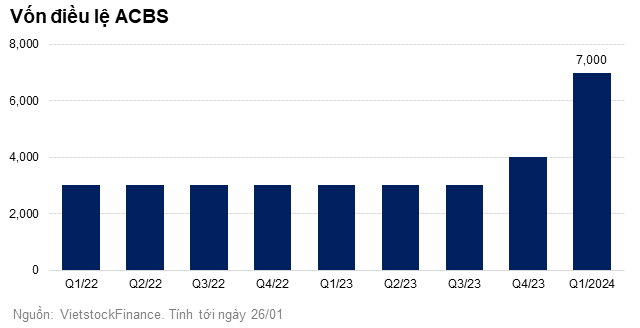

On the other hand, in addition to the aforementioned large securities companies, several securities companies with bank ownership such as ACB Securities (ACBS), LBank Securities (LBPS), and Tiên Phong Securities (ORS) have either increased or are planning to increase their charter capital.

The most prominent one is ACBS, which has increased its capital twice in just a few months (increased by 1,000 billion VND in November 2023 and 4,000 billion VND in January 2024), bringing the company’s charter capital to 7,000 billion VND.

The purpose of these capital increases is partly to serve lending activities. In the first capital increase, Mr. Nguyễn Đức Hoàn – CEO of ACBS said that the purpose is to increase capacity for margin trading business, by maximizing lending to customers (3% of equity) and maximizing lending limits to shares (10% of equity).

Tiên Phong Securities is also planning to increase its charter capital by 1,000 billion VND, to 4,000 billion VND, through a private placement of 100 million shares. The registration period for purchase is from February 5th to March 11th, 2024.

In the near future, with the charter capital increase to 3,888 billion VND from 250 billion VND, or 16 times, with a maximum of 363.8 million shares offered to existing shareholders, LPBank Securities is expected to make a comeback in many securities business areas, including the service of lending money to buy stocks for margin trading.

In the past, LPBS had ceased to be a member of HOSE and HNX since 2013. Currently, the Company only provides some products such as shareholder management, financial consultancy, investment consultancy, and auction organization.

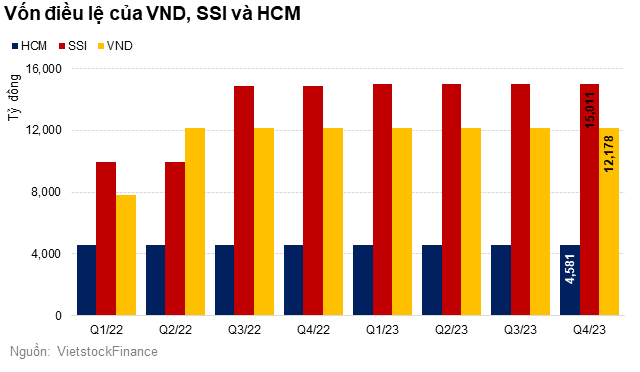

In addition, many securities companies have plans for “huge” capital increases from previous years. For example, SSI at the end of December 2023, the Company’s shareholders approved a plan to issue over 453 million additional shares to increase its capital to 19,645 billion VND, including two options for increasing charter capital (issuing bonus shares at a 20% ratio and offering additional shares to existing shareholders at a price of 15,000 VND per share, with a 10% ratio) and issuing 10 million shares.

Another well-known company, HSC, also plans to increase its capital to over 7,552 billion VND through the issuance of more than 297 million additional shares. In which, the Company will allocate 78.13% of the 2,286 billion VND raised from the offering to margin trading activities, while the remaining will be used for proprietary trading activities.

Earlier, in August 2023, the Board of Directors of VNDIRECT Securities also approved a plan to offer 243.57 million shares to existing shareholders (20% ratio, expected offering price of 10,000 VND per share) and issue over 60.89 million shares to pay a 5% dividend to shareholders. As a result, the company’s charter capital reached 15,223 billion VND, and 40% of the amount received will be used for margin trading.

As of January 26th, 2024, there is no updated information on the above-mentioned capital increase deals. If these capital increase points fall in 2024, the lending potential of securities companies will be further expanded.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)