That is the information provided by the leadership of VPBank (HOSE: VPB) in an online meeting with investors last weekend.

X2 CASA

Building on the CASA platform, the personal customer segment is expected to experience exceptional growth in 2023, nearly double that of 2022, contributing more than half of the total CASA scale. The retail banking leadership of VPBank aims to double this figure in 2024.

To achieve this goal, VPBank will further deepen its customer segment strategy, focusing on exploiting the AF segment with the Diamond line and the MAF segment with the Prime line. Specifically, delving into sub-segments, VPBank will continue to develop “made-to-measure” financial products, services, and solutions to meet the specific needs of customers in each segment.

In addition, the popular product of attractive account numbers, which has generated significant growth in CASA in 2023, will be refined to attract more customers in 2024.

Furthermore, VPBank will continue to enhance the features on the POS and QR Code payment platforms to increase its competitive advantage in comprehensive payment solutions for individual customers, SMEs, and large enterprises, thereby attracting more CASA from an expanded customer base.

Meanwhile, with a strong capital foundation consolidated through the capital sale deal with SMBC, which elevated VPBank to the second position in terms of capital ownership scale, the bank can realize its CASA targets for 2024.

The FDI customer segment, which was exploited from 2023 to capitalize on the opportunities from the surge in FDI inflows into Vietnam in recent years, will be a new driving force helping VPBank diversify its customer base and optimize revenue. With a strength in retail banking, VPBank can meet the diverse needs of individual customers, including employees of existing and potential FDI enterprises, offering various solutions such as payment, consumer loans, and both term and non-term deposits.

Building the CASA foundation

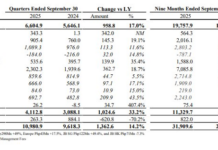

In 2023, amidst the global economic crisis and internal difficulties in Vietnam’s economy, all customer segments of the bank were affected. However, VPBank’s customer mobilization in 2023 still achieved a growth rate of 42.5%, four times higher than the market’s average growth rate, and accounted for approximately 74% of the total mobilization structure.

Notably, the individual customer segment, the segment most affected by unfavorable macroeconomic conditions, experienced outstanding growth, with a growth rate of nearly 75% (6.6 times the market’s growth rate).

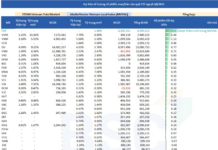

CASA, in particular, emerged as a bright spot in mobilization activities, with a scale of VND 78.2 trillion, a growth rate of 33% compared to the end of 2022, and individual customers accounting for 61% of the total. The improvement in CASA balances throughout each quarter helped increase VPBank’s CASA ratio in its mobilization structure to 17.6% at the end of Q4 2023.

The individual customer segment, taking the lead role, significantly contributed to CASA with a balance of VND 47 trillion by the end of 2023, doubling compared to 2022.

In practice, the CASA growth target has always been set by VPBank in recent years. High CASA is recognized as one of the factors supporting the bank’s cost of capital reduction and net interest margin (NIM) improvement.

However, attracting CASA is not easy for any bank, including VPBank, especially in the current low interest rate environment.

The advantages in digital transformation activities, pioneering in payment solutions, and increasing the number of users on digital platforms, along with a comprehensive segment coverage and individualization for customer profiles, have helped VPBank make breakthroughs in attracting non-term deposits.

A vivid advantage is that 98% of VPBank’s customer transactions are currently conducted via digital channels, with only 2% occurring at physical branches. VPBank NEO, the bank’s digital platform, attracted more than 3.2 million customers in 2023. Over 400 million transactions (79% of which are savings) were made on the VPBank NEO platform, a growth of over 55% compared to 2022.

Furthermore, in the same year, VPBank was the only bank to fully launch all payment features on various platforms, including Apple Pay, Google Pay, Samsung Pay, and Garmin Pay.

Another driving force comes from VPBank’s “massive” customer ecosystem, with over 30 million people. In the individual customer segment alone, VPBank recorded an additional 4 million customers compared to the end of 2022.

The bank’s leadership stated that with its outstanding technological platform and “massive” customer base, VPBank will leverage its growth potential in CASA for 2024.