Investment Opportunities in Bonds

In the context of a thriving economy, many leading and reputable companies in key sectors of Vietnam’s economy have the conditions to issue corporate bonds. In developed economies, alongside the strength of the business community, the investment form of corporate bonds is a popular choice for investors seeking stable income. One of the core values of the corporate bond investment channel is the expectation of higher profits than savings interest rates, safer than stock investments, and easy buying and selling…

Currently, a positive point in the bond investment channel is that the bank savings interest rate has plummeted, while the issuance interest rate of corporate bonds has become much more attractive, so it is not ruled out that it can attract some of the deposit-to-shift money.

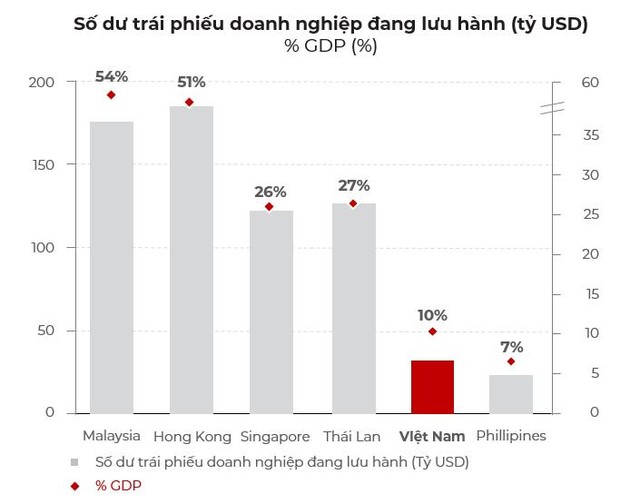

Not outside the trend of the world financial market, in the future, corporate bonds in Vietnam will be an investment channel that is expected to continue to receive attention and sustainable growth. The bond market is growing rapidly and optimistically, but in fact it is still in its infancy. For comparison, currently, Vietnam’s corporate bond market accounts for only about 18% of GDP, which is still very low compared to other countries in the region.

Vietnam’s corporate bond market accounts for only about 18% of GDP, which is still very low compared to other countries in the region.

When placed in the context of Vietnam’s financial market as it is, the choice of investing in corporate bonds requires investors to carefully select from the stage of selecting reputable issuing organizations, good debt repayment history… In addition, it is very important to choose a consulting organization that has a good risk management system, a rigorous assessment and screening process before the bonds reach the hands of investors.

“Hunting” for golden bonds, even with an interest rate lower than 0.5 – 1% compared to other organizations

When searching for “golden” bonds, the interest rate may be slightly lower, but in return, that is the safety and effectiveness that investors receive.

According to a representative of Kien Thong Securities Joint Stock Company (TCBS) – a reputable advisory organization currently occupying 50% of the bond advisory market share in Vietnam – the brand of bond issuing companies is an easily recognizable criterion for most individual investors. Investors will feel assured when the issuing organization is familiar names in the media, as they are leading corporations or pioneering businesses with a sustainable development history over many years and continue to maintain their leading position.

So far, only bonds that are within Techcombank’s risk appetite have TCBS offerings sold to Investors, and only Issuing Organizations listed in Techcombank’s managed list and maintaining relationships will be used for retail. In particular, TCBS has officially signed cooperation agreements with leading credit rating companies, aiming to leverage the advantages of each party in meeting the comprehensive needs and increasing the experience of customers. Specifically, applying voluntary credit ratings, with the goal of accompanying to contribute to build a healthy, transparent and sustainable corporate bond market.

Typically, the interest rates on bonds issued by these issuing organizations are lower by 0.5 – 1% compared to other organizations, but this is a relatively safe option for investors who do not have experience evaluating bonds. On the contrary, if the issuing organization is a less reputable business, investors need to be very careful, not be attracted by high interest rates and ignore evaluating that business before deciding to invest.

Ms. Nguyen Thi Hoat, Deputy General Director of TCBS said, “Bonds are called “gold” when they meet enough factors: (i) The quality of the issuing organization, (ii) Bonds have good risk management, are rigorously screened before reaching the hands of investors, (iii) Bonds have transparent information files, investors have the right to request transparent bond files to have complete information before making investment decisions, (iv) Liquidity support services when buying bonds at agents.”

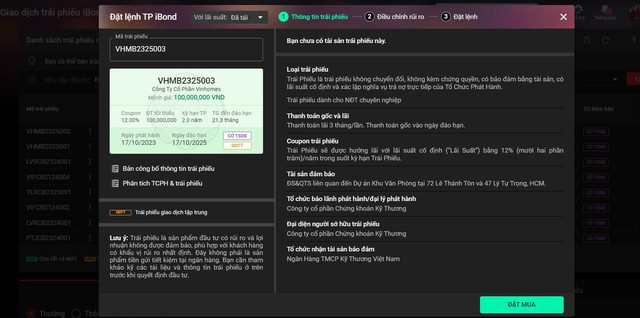

Customers receive complete transparent information in 3 stages (before, during and after) when buying bonds at TCBS, on the TCInvest system

In addition, Decree No. 08/2023 ceases to be effective in enforcing certain provisions of Decree No. 65/2022 on private placement, trading of private corporate bonds (regulations on determining the status of professional securities investors as individuals; mandatory credit rating for bond-issuing enterprises; shortening the distribution time of each issuance round) effective from the end of 2023. From 2024, issuing organizations must have a credit rating to be eligible for bond issuance.

Clearly, through the screening process, the corporate bond market in 2024 opens up opportunities for both investors and reputable issuing organizations.

TCBS – advisory organization with a market share of over 50%, with a direction to always ensure a rigorous assessment process to bring high-quality bonds to the market, aiming to provide investors with efficient and safe investment products. The bond assessment and advisory process at TCBS goes through 9 rigorous steps: (i) Evaluating the needs of the issuing business as well as investors; (ii) Understanding the business and conducting in-depth assessments; (iii) Bond structure; (iv) Primary offering; (v) Building issuance files; (vi) Approving issuance; (vii) Closing accounts; (viii) Listing; (ix) Post-issuance follow-up.