On February 7, 2023, Bamboo Capital Group (HoSE: BCG) announced information about the adjustment of senior personnel positions.

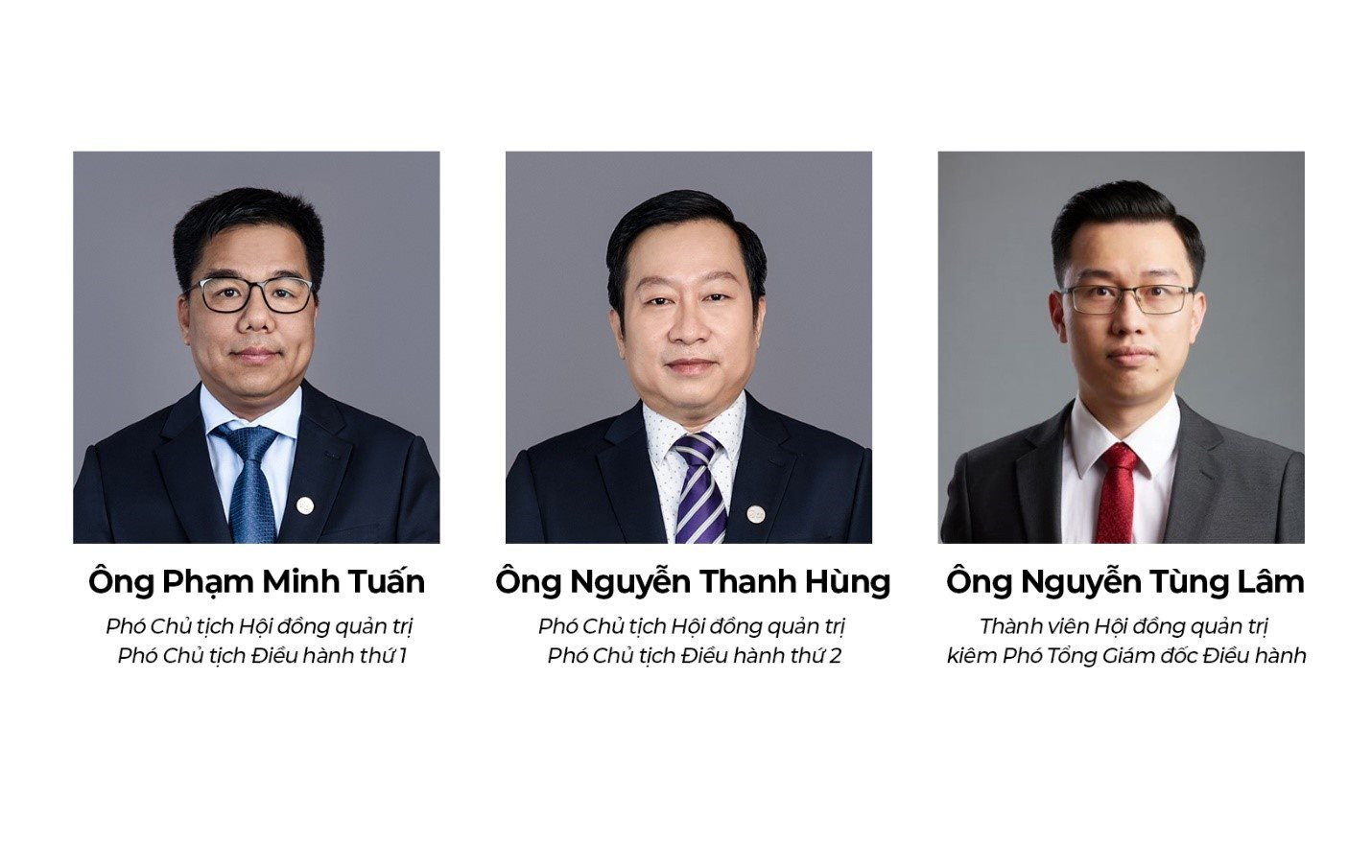

Accordingly, Mr. Pham Minh Tuan became the first Deputy CEO, and Mr. Nguyen Thanh Hung took on the role of the second Deputy CEO. To focus on management work at the parent company and create a clear path for young leaders to participate in management, Mr. Tuan and Mr. Hung will step down from their positions as Deputy General Directors at BCG. Mr. Nguyen Tung Lam (currently a member of the Board of Directors of BCG) was appointed as the Executive Deputy General Director.

Mr. Pham Minh Tuan and Mr. Nguyen Thanh Hung are two of the key leaders who have been with Bamboo Capital Group for many years. Currently, in addition to their roles as Deputy Chairmen of the Board of Directors – the first and second Deputy CEOs at BCG, Mr. Tuan and Mr. Hung also directly manage important subsidiary companies of the Group.

Currently, Mr. Pham Minh Tuan is the Deputy CEO and CEO of BCG Energy, Chairman of the Board of Directors of AAA Insurance Joint Stock Company. Mr. Nguyen Thanh Hung is currently the Chairman of the Board of Directors of TRACODI and the CEO of BCG Land.

The young factor born in 1987 has just been appointed as the Executive Deputy General Director of Bamboo Capital Group – Mr. Nguyen Tung Lam – is a person who has been associated with Bamboo Capital. Mr. Nguyen Tung Lam graduated from the Foreign Trade University in Hanoi with a Bachelor’s Degree in Business Administration, completed his Master’s Degree in Finance at Bently University (USA), and has many years of experience in business management and finance-banking activities. Currently, Mr. Nguyen Tung Lam holds the position of Member of the Board of Directors of Bamboo Capital Group and the Standing Deputy Chairman of BCG Land.

Bamboo Capital Group said that from 2023, the company will focus on streamlining operations, enhancing the management and operational capacity of its subsidiary companies, completing the corporate governance model to adapt to changing market conditions, and optimizing its internal resources. firstly, it will be implemented at the parent company, Bamboo Capital, where key leaders will gradually withdraw to the Board of Directors to manage and set strategies, while creating a clear path for young leaders to directly participate in management and development of investment projects. This personnel adjustment is part of the above plan, aiming to enhance the effectiveness of the operating system and empower young talented leaders.

At subsidiary companies that operate core activities such as BCG Energy and BCG Land, Mr. Pham Minh Tuan and Mr. Nguyen Thanh Hung will continue to be in charge. At other member companies, the Executive Board has been and will be rejuvenated by middle and senior leaders who have been trained and fostered by BCG over time.

In a recent sharing, Mr. Pham Minh Tuan said: “Bamboo Capital Group in 2024 will be much larger in scale than when it was first established in 2011. The activities of the Group, with thousands of employees, have reached a point where they need to transition from a model that depends on a few individuals to a professional management model, promoting delegation of authority and clear performance monitoring mechanisms. In order for Bamboo Capital to develop sustainably, a combination of the experience of the Board of Directors and the enthusiasm of the middle and senior leadership is needed.

Combining the use of young talented individuals with the experience of the founding members and the Board of Directors will create new vitality, create a strong driving force to push BCG forward quickly.”