Hòa Bình Construction Corporation (stock code HBC-HOSE) announces the results of its early bond buyback.

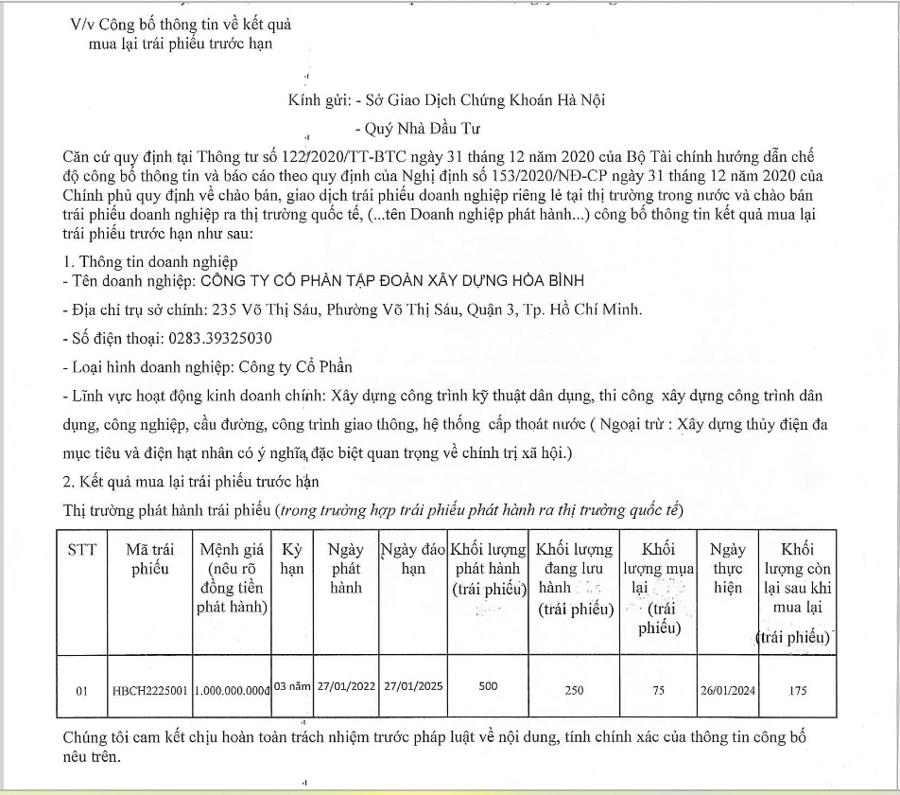

Specifically, according to information from HNX, Hòa Bình Construction Corporation has successfully repurchased VND 7.5 billion worth of HBCH2225001 bonds.

The HBCH2225001 bonds were issued on January 27, 2022, and mature on January 27, 2025 (a 3-year term), with a total issuance value of VND 50 billion and an issuance interest rate of 9.75% per annum.

Prior to this, on January 17, 2024, HBC also repurchased VND 2.5 billion of the outstanding value of this bond. Thus, as of the current time, HBC has reduced the outstanding value of the bond to VND 1.75 billion.

Ending 2023, HBC recorded consolidated revenue of VND 7.546 trillion, a 49% decrease compared to 2022 (VND 14.149 trillion); after-tax profit of negative VND 782 billion, a significant decrease compared to the negative VND 2.57 trillion in 2022.

As of December 31, 2023, the accumulated loss at the end of 2023 reached nearly VND 2.878 trillion (compared to negative VND 2.10069 trillion at the beginning of the year), and the equity decreased sharply from VND 1.21855 trillion to only VND 453 billion.

Also as of December 31, 2023, HBC’s financial debt reached VND 4.718 trillion – including short-term financial tax debt of VND 3.9885 trillion.

It is known that on February 2, 2024, HOSE sent a reminder letter to Hòa Bình Construction Group Joint Stock Company regarding the possibility of delisting if the organization fails to submit the audit financial statements (AFS) for 3 consecutive years. Therefore, HOSE warned that HBC shares may be delisted if the company continues to be late in submitting the audit financial statements for 2023 (meaning AFS must be submitted before April 1, 2024).

HBC stated that this is just a reminder from HOSE that the company needs to be aware of submitting the audit financial statements for 2023 on time.

HBC affirms that Hòa Bình will strictly comply with regulations to prevent the risk of HBC shares being delisted. Currently, the Group is making efforts to complete the audit financial statements for 2023 ahead of the deadline. Hòa Bình has implemented measures to address the delay in completing the audit financial statements and committed to prevent any risks in ensuring the deadline for submitting the audit financial statements for 2023.

As of now, our measures to address and control risks have been recognized, and on January 19, 2024, HBC shares were officially allowed to resume trading as normal.