Annual General Meeting of Shareholders 2023 of Thanh Nien Media. Source: Thanh Nien Media

|

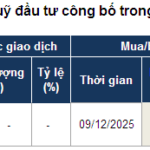

Q4 “plunges” throughout the year

It can be said that the fourth quarter of Thanh Nien Media Corporation (OTC: Thanh Nien Media) faced many disadvantages. In the context of a slight 6% decrease in revenue, cost of goods went in the opposite direction, increasing by 16% compared to the same period in 2022 with the main source of income still coming from events, media. This “eroded” gross profit, leaving only over 1.3 billion VND, a decrease of 73%.

Furthermore, the financial activities of the Company with a revenue of 350 million VND were also not any better, almost negligible compared to the previous figure of 6.1 billion VND.

A little consolation comes from the strong reduction in business management costs, nearly 60%, but it is not enough to help the media company make a profit, resulting in a loss of 1.7 billion VND. This is also the second consecutive quarterly loss of Thanh Nien Media.

Source: VietstockFinance

|

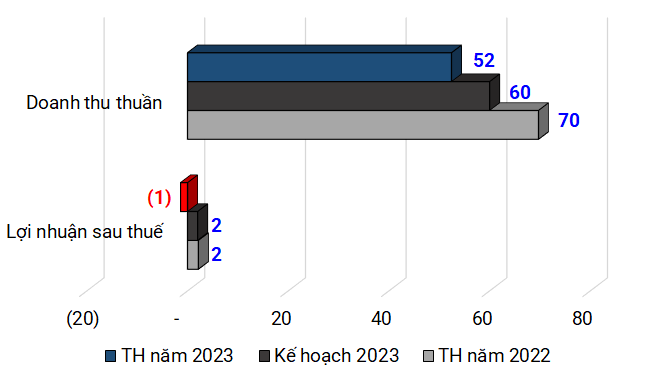

Business results for the whole year 2023 of the Company have narrowed compared to the same period in many aspects. Revenue decreased by 25%, reaching 52 billion VND; gross profit decreased by 40%; financial activities decreased by nearly half, resulting in a net loss of 1.3 billion VND, while in the same period there was a profit of 1.6 billion VND.

Although the difficulties of 2023 had been anticipated and set lower revenue targets, Thanh Nien Media has only achieved 87% so far. This is the third consecutive year the company’s revenue has declined, falling from 84 billion VND in 2021, 70 billion VND in 2022 to over 52 billion VND in 2023. The same trend holds true for net profit, decreasing from 5.1 billion VND to 1.6 billion VND and a loss of 1.3 billion VND.

|

Performance results compared to the 2023 plan of Thanh Nien Media (Unit: billion VND)

Source: VietstockFinance

|

Actively investing in real estate

In terms of financial position at the end of 2023, the total assets of Thanh Nien Media of 274 billion VND did not change significantly compared to a year ago. However, short-term assets have decreased by half, with over 60 billion VND due to a 74% decrease in cash and cash equivalents, leaving 12 billion VND, and a 76% decrease in investments held until maturity, leaving 11 billion VND.

In return, long-term assets increased by 40%, mainly due to increased capital contributions to other units, totaling 67.3 billion VND and twelve times higher than the beginning of the year. Among them, the largest amount is 40 billion VND invested together with the Member of the Board of Directors Nguyen Anh Nghia, followed by 19 billion VND in cooperation with Ms. Huynh Thi Nhu Ngoc and 3 billion VND with Vietnam Health Food Joint Stock Company.

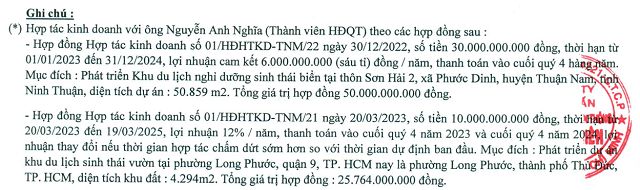

Specifically, 40 billion VND is the amount of business cooperation between Mr. Nghia and Thanh Nien Media, including two contracts of 30 billion VND and 10 billion VND. Under the larger agreement, the two parties will cooperate for a period until the end of 2024, with a promised interest of 6 billion VND per year, with the aim of developing a 5-hectare eco-resort in Ninh Thuan. This is a project worth 50 billion VND, according to the financial statements.

Source: Thanh Nien Media

|

In the remaining agreement, the planned maturity date will be at the end of March 2025, with a profit of 12% per year for the purpose of developing a garden eco-tourism project in Thu Duc City, Ho Chi Minh City, with an area of 4.2 thousand square meters, valued at nearly 26 billion VND.

Similarly, Thanh Nien Media cooperated with Ms. Ngoc in a contract until the end of 2024 with a promised profit of 7% per year to develop an office leasing project on plot No. 511, map sheet No. 9 in District 7, Ho Chi Minh City. The total value of this project is nearly 24 billion VND. The profits from these transactions are paid at the end of the fourth quarter each year.

Repayment of contributed capital due to suspended projects

Notably, in the past year, the owner’s capital of Thanh Nien Media increased by 300 billion VND, but at the same time, it also decreased by 302 billion VND. The cash flow statement from financial activities shows that the Company received 300 billion VND from stock issuances and capital contributions from shareholders, but also paid out 301 billion VND with the same content.

In the semi-annual reviewed financial statements for 2023, Mr. Nguyen Cong Khe, who was the Chairman of the Board of Directors of Thanh Nien Media at the time, was recorded to have two related transactions, “additional capital contribution” of 302 billion VND and “repayment of contributed capital” of 227 billion VND.

In addition, two related persons of the Chairman of the Board of Directors, Ms. Dang Thi Thanh Xuan (Mr. Khe’s wife) and Ms. Dang Thi Thanh Trang (Mr. Khe’s sister-in-law), were also recorded to have transactions related to “repayment of contributed capital” amounting to 30 billion VND and 15 billion VND, respectively.

Regarding the reduction of capital, information from Thanh Nien Media states that in 2014, the Company completed the increase of capital by issuing private shares to invest in the high-end Vung Hy eco-resort project in Ninh Thuan province, but now it has been suspended and Ninh Thuan province has decided to terminate its operation as well as proceed to withdraw the investment certificate.

The withdrawal of 300 billion VND contributed by Mr. Khe was approved by the General Meeting of Shareholders in 2019, but in order to comply with the Enterprise Law, Securities Law, Mr. Khe had to re-contribute it to the Company’s account.

The panoramic view of Vung Hy Bay in Ninh Thuan. Source: ninhhai.ninhthuan.gov.vn

|

Previously, the 2022 financial statements of Thanh Nien Media were audited and AASCS gave an audit opinion excluding the failure to recognize the business loss of the Hanoi Branch in the consolidated financial statements amounting to 913 million VND. According to the audit, this amount is being recorded as an individual compensation receivable of the Branch Director, Mr. Do Ngoc Tuan, and it is assessed that there is no evidence of recoverability.

Explaining this issue, Thanh Nien Media said that the branch in Hanoi is in the process of dissolution, and it is normal for personal accountability to result in losses in a company. The Board of Directors has held a meeting and assigned personal responsibility to Mr. Tuan for this compensation. Accordingly, the amount receivable for Mr. Tuan as of June 30, 2023, is 5 billion VND.

Unable to conduct public transactions

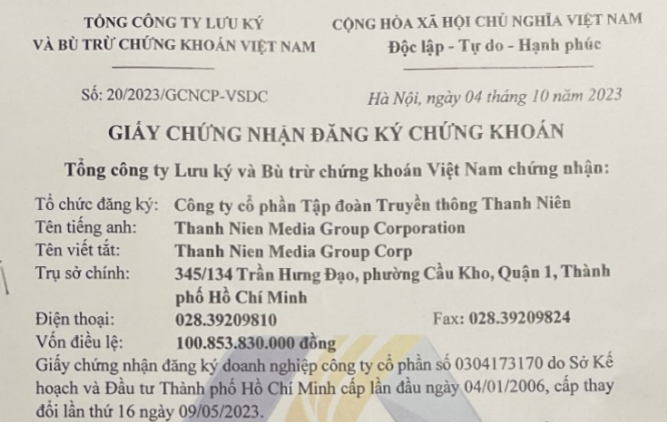

In October 2023, Thanh Nien Media officially received a certificate of securities registration for over 10 million shares of the Company from the Vietnam Securities Depository and Trading Clearing Corporation (VSDC) and started trading on UPCoM with the ticker symbol MTN.

Securities registration for Thanh Nien Media. Source: Thanh Nien Media

|

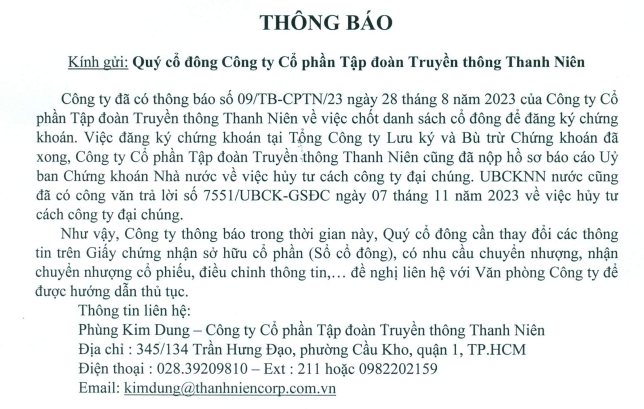

However, two months earlier, the Board of Directors approved the content of revoking the public company status of the Company according to the regulations in the Securities Law and the guiding documents to be implemented in the third quarter of 2023. It is known that Thanh Nien Media sent a letter to this effect to the State Securities Commission of Vietnam on October 23, 2023.

In the response letter, the State Securities Commission stated that it will consider revoking the public registration of the company based on the report on the company’s compliance with the public company conditions one year from the date the company does not meet these conditions, namely from October 12, 2023. At the same time, the State Agency requested Thanh Nien Media to continue to fully comply with the regulations related to public companies until it receives notice of the cancellation of the registration.

In November, Thanh Nien Media announced that although the securities registration has been completed, the Company has submitted a report to the State Securities Commission on revoking its public company status and requested shareholders to change related information as well as contact the Company’s office in District 1, Ho Chi Minh City regarding reception and transfer needs.

Notification of revoking the public company status of Thanh Nien Media. Source: Thanh Nien Media

|

Thanh Nien Media, formerly known as Thanh Nien General Service Trading Joint Stock Company, was established and operated since 2006 in Ho Chi Minh City with an initial charter capital of 10 billion VND. The company’s main activities now include event organization, advertising, printing, and publishing newspapers and magazines.

By mid-2023, Mr. Nguyen Cong Khe was the Chairman of the Board of Directors and the legal representative, while Mr. Dang Vu Nhat Quang was the CEO. At that time, Mr. Khe and his wife held over 85% of the capital in Thanh Nien Media.

At the beginning of 2024, the Security Investigation Agency of the Ho Chi Minh City Police issued a decision to temporarily detain Mr. Khe for the crime of “Violation of regulations on the management and use of state assets causing losses and waste”.

Mr. Nguyen Cong Khe being served with a prosecution decision by the Security Investigation Agency

|

Ho Chi Minh City Police arrest Nguyen Cong Khe and Nguyen Quang Thong