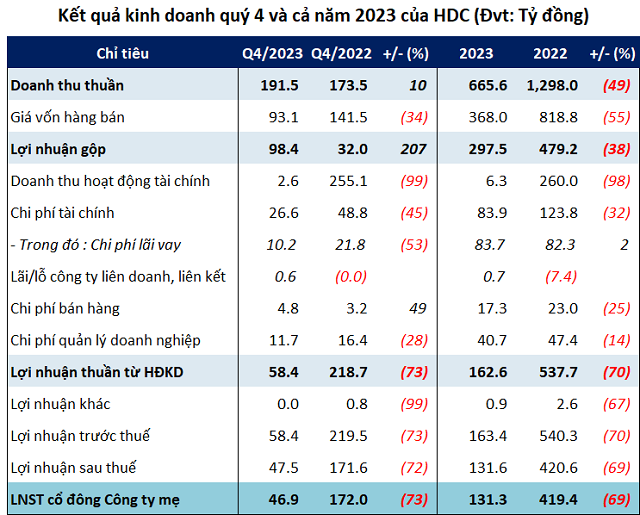

In Q4/2023, despite Hodeco’s net revenue reaching nearly VND 192 billion, a 10% increase compared to the same period, its net profit only amounted to nearly VND 47 billion, a 73% decrease.

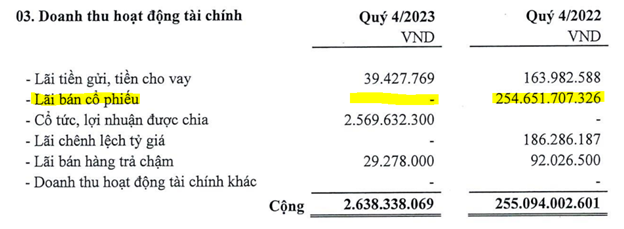

The main reason for the decline in Hodeco’s net profit is the 99% decrease in revenue from financial activities, amounting to just over VND 2 billion, compared to VND 255 billion in the same period.

Source: HDC

|

Hodeco explained that the decline in revenue from financial activities in the quarter was due to the company only recording profit from the sale of 5 million shares of the Ocean World Entertainment Investment and Construction JSC. The main revenue for HDC in Q4 came from the Ngoc Tuoc project and The Light project.

Source: VietstockFinance

|

At the end of 2023, Hodeco reported net revenue of nearly VND 666 billion and net profit of over VND 131 billion, a decrease of 49% and 69% respectively compared to 2022. This is also the year with the lowest net profit for HDC since 2019.

Net revenue and net profit of HDC from 2019 – 2023

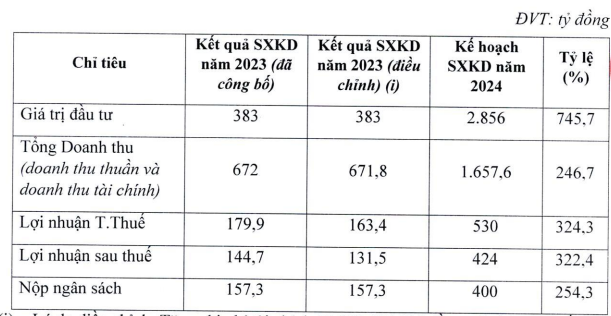

Compared to the plan, HDC only achieved 38% of the revenue target and 27% of the after-tax profit target for the whole year.

Although not meeting the plan for 2023, Hodeco continues to set ambitious targets for 2024. Specifically, the expected investment value is VND 2,856 billion, an increase of nearly 746%; the total expected revenue is nearly VND 1,658 billion, a 247% increase; and the expected after-tax profit is VND 424 billion, a 322% increase compared to the performance in 2023.

Source: HDC

|

HUB becomes an affiliated company

As of December 31, 2023, HDC’s total assets reached over VND 4,698 billion, a 6% increase compared to the beginning of the year. Among them, the main assets were in short-term receivables of VND 932 billion, accounting for 20%; inventory of over VND 1,137 billion, accounting for 24%; and mainly focused on the unfinished production and business costs of notable projects such as the Haidang P12 residential area (the Light City) with a value of nearly VND 882 billion and the 3/2 West residential area with a value of nearly VND 72 billion. Long-term unfinished assets were recorded at VND 1,407 billion, accounting for 30% of total assets.

Notably, in Q4/2023, HDC completed the acquisition of over 4.8 million shares of Thua Thien Hue Construction Corporation (HOSE: HUB) with a total value of nearly VND 82 billion. As a result, HDC’s ownership in HUB increased from 18.66% to 37.19% and HUB became an affiliated company of HDC.

Thua Thien Hue Construction Corporation sees a strong increase in Q4 profit

On the other side of the balance sheet, HDC has nearly VND 2,791 billion in liabilities, an increase of 9% compared to the beginning of the year. Among them, the total financial liabilities, both short-term and long-term, amounted to nearly VND 1,705 billion, a slight increase compared to the beginning of the year, accounting for 61% of total borrowings and 36% of the company’s capital sources.