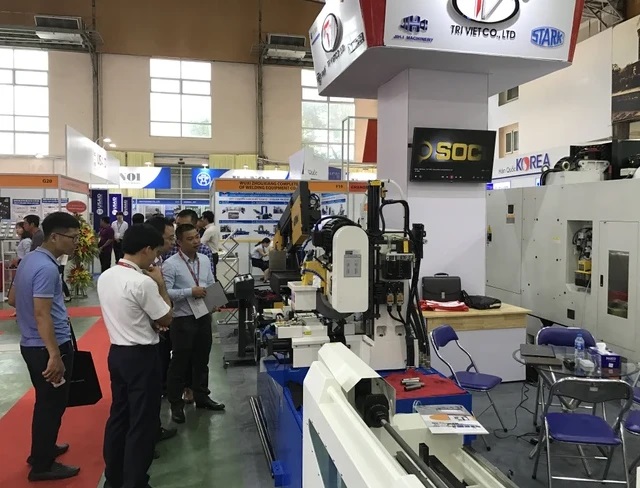

Computers, electronic products, and components are the largest export items. (Photo: PV/Vietnam+)

|

On February 7, HSBC’s Global Research Department published a report titled “Vietnam at a glance” that highlighted Vietnam’s continued strong export performance of 42% thanks to the electronics industry.

Strong export growth

According to HSBC experts, despite the impact of the base effect, Vietnam’s trade continued to recover in January. Exports grew at an astonishing rate of 42% compared to the same period last year, thanks to the steady recovery in electronic exports. Furthermore, the high number of pre-orders for the new Samsung Galaxy S24 phones also adds to the optimistic outlook.

However, the optimism is not limited to the electronics industry as other sectors that have suffered in 2023, such as textiles, machinery, and wood products, have also shown significant growth. Nevertheless, HSBC experts advise Vietnamese businesses to exercise caution during this early stage of trade recovery.

Additionally, the Purchasing Managers’ Index (PMI) for January shows a cautious but optimistic sentiment. The PMI finally returned above 50 after 5 months of decline. However, new orders and new export orders continue to increase strongly but have not been enough to stimulate hiring. Furthermore, delayed deliveries have increased manufacturing costs, reminding about the ongoing risks of the Red Sea disruption.

Inflation remains under control, with core inflation in January decreasing to 3.4% compared to the same period last year. Although significantly lower than the Government’s inflation target of 4%-4.5% for 2024, there are still noteworthy risks of rising inflation.

HSBC analysts believe that Vietnam is particularly vulnerable to market fluctuations. While transport inflation has stabilized in recent months, housing inflation, including electricity inflation, has witnessed high price increases, which may continue to rise. Moreover, the energy supply tensions domestically and increasing input costs have prompted the Ministry of Industry and Trade to propose another increase in electricity prices this year, following two price hikes in November 2023 and May 2023, to alleviate financial difficulties for the Vietnam Electricity Group.

HSBC headquarters. (Photo: Vietnam+)

|

In addition to energy, food prices continue to be in focus, especially due to the impact of the El Niño phenomenon in Southeast Asia. As previously mentioned, the domestic price of rice in Vietnam has increased along with global rice prices, leading to an increase in rice inflation. Although rice accounts for a small proportion of Vietnam’s Consumer Price Index (CPI) basket (less than 3.7%), and pork prices continue to help control food inflation, essential food items are still crucial for inflation forecasts.

“Overall, January truly marked a ‘promising’ start to Vietnam’s economic recovery despite the related risks,” said the HSBC experts.

Celebrating the new year of Giap Thin

After a challenging Year of the Cat, the outlook for Vietnam is projected to improve in the year of Giap Thin. HSBC believes Vietnam – the land of a thousand years of civilization – has started 2024 with strong signs of economic recovery. Even after factoring in the base effect, exports have returned at a staggering rate, showing stable trade performance.

“However, we need to be cautious about the general level of recovery as the export engine needs additional support from the growth in major economies worldwide. Meanwhile, inflation remains generally under control, but there are still risks of price increases, from the potential increase in electricity prices to rising rice prices,” noted the HSBC experts.

The experts also analyzed that while attention must still be paid to important export cycles, it is equally important to evaluate domestic demand. Currently, domestic demand is under pressure but is expected to improve. The initial signs include the recovery of some consumer stocks.

In fact, Vietnam has a large consumer proportion, accounting for over 50% of GDP. With an average annual growth rate of 7.5% before the pandemic, personal consumption has declined significantly since the outbreak, except for the period of reopening in 2022. Specifically, personal consumption growth has halved in 2023, reflecting the significant impact of the economic slowdown on households.

Part of the reason lies in the effect of asset value volatility due to the cyclical real estate sector, while another part is due to significant changes in consumer behavior since the pandemic. Consumers tend to be cautious about economic fluctuations, leading to an increase in savings.

This is further observed in Vietnam’s labor market. While the unemployment rate remains low at 2.3%, employment growth slowed down in 2023 and has not fully recovered.

International tourists visiting Vietnam. (Photo: PV/Vietnam+)

|

“Clearly, Vietnam is eagerly anticipating the cyclical recovery in global trade, which is the main hope for the job market. Fortunately, the electronics industry has recently shown positive signs, indicating that the darkest period for the trade sector is behind us. However, each industry is different as the recovery is not uniform. Sectors that provide significant employment, such as textiles and footwear, have not fully emerged from the difficult times. Asia is still in the early stages of trade recovery as we need more evidence to see stable and sustainable recovery supported by major economies worldwide,” analyzed the HSBC expert.

Good news for Vietnam, the complete recovery in the tourism industry is equally important for the labor market, supporting workers in the service sector. Thanks to favorable policies for visa extension and e-visas for tourists from several countries since mid-August, Vietnam welcomed around 12.6 million international tourists, significantly surpassing the initial target of 8 million visitors.

The auspicious prospects even prompted the Vietnam National Administration of Tourism to set ambitious targets for 2024, aiming for 17-18 million foreign visitors, nearly reaching the record high of 2019, and targeting a total revenue of VND 840,000 billion (8% of GDP), surpassing the pre-pandemic level of 2019. Based on previous trends, this implies that international tourism in 2024 is likely to contribute to about 4% of GDP, equivalent to the pre-pandemic average for Asia./.

Thuy Ha