Record nearly 66 trillion dong of corporate bonds issued in December

Although the total value of individual corporate bond issuances in January 2024 is quite modest, it is 15 times higher than the same period last year when only Phan Vu Investment Corporation successfully issued 110 billion dong worth of bonds.

Looking back at the same period in 2021 and 2022, which achieved a total issuance value of 2,942 billion dong and 39,516 billion dong respectively, the total issuance value in January 2024 has decreased significantly.

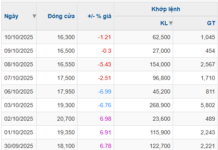

The commercial bank group has not had any issuances in January 2024, in stark contrast to December 2023 when a record-breaking 62 issuances with a value of nearly 55,000 billion dong were made.

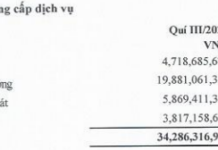

Meanwhile, two issuances with a total value of 1,650 billion dong in January 2024 came from two enterprises, Investment and Development of Transport Corporation, and Ninh Thuan BOT Company Limited.

|

Companies successfully announced private bond issuances in January 2024 (Unit: Billion dong)

Source: HNX, compiled by the author

|

In particular, on January 26, Investment and Development of Transport Corporation issued a batch of TRACH2427001 bonds with a value of 450 billion dong – more than 4 times the company’s charter capital. The bonds have a term of 3 years, a fixed interest rate of 6.5% per year, are non-convertible, include warrants, and have no collateral.

Investment and Development of Transport Corporation was established on June 30, 2006, with a charter capital of over 112.6 billion dong and its main business activity is road freight transport. The company is headquartered at 65 Cảm Hội Street, Đống Mác Ward, Hai Bà Trưng District, Hanoi.

The CEO and Legal Representative of the company is Ms. Nguyễn Hương Giang. In addition, Ms. Giang is also the Legal Representative of companies such as A+ Electronic Wallet Joint Stock Company, Ataka Vietnam Joint Stock Company, and the Representative Office of Ataka Vietnam Joint Stock Company.

It is known that before Ms. Giang, Mr. Nguyễn Quý Lâm held positions at Investment and Development of Transport Corporation. Both individuals, along with Ataka Vietnam, are related to a group of companies with a strong Japanese presence. At the end of December 2023, this group liquidated all 25,000 billion dong worth of bonds issued during the period 2017-2019, with Hakuba Joint Stock Company liquidating 30 batches, Yamagata Joint Stock Company liquidating 36 batches, Azura Joint Stock Company liquidating 54 batches, and Ataka liquidating 50 batches.

Group of companies with a strong Japanese presence actively repurchasing bonds before maturity

The majority of capital raised from individual corporate bond issuances in January 2024 is from BOT Ninh Thuận Company Limited (BOT Ninh Thuận) with a value of 1,200 billion dong, a term of 9.75 years, and an interest rate of 10.5% per year.

This is a “triple zero” bond consisting of no collateral, no conversion, and no warrants, issued and completed on the same day, January 29, 2024. This is also the only bond currently issued by BOT Ninh Thuận.

BOT Ninh Thuận was established on July 25, 2014, with an initial charter capital of over 422 billion dong and its main activity is the construction of various civil engineering projects. In July 2020, the company increased its capital to over 599 billion dong and has maintained this level since then. The company’s headquarters is located at 477-479 An Dương Vương Street, Ward 11, District 6, Ho Chi Minh City.

The CEO and Legal Representative of the company is Mr. Huỳnh Thái Hoàng (born in 1972). Mr. Hoàng is also the Legal Representative of Ninh Thuan Investment and Development Construction Joint Stock Company.

BOT Ninh Thuận is a subsidiary of CII Investment Corporation (HOSE: LGC), which owns 100% of the capital, making it an indirect subsidiary of Ho Chi Minh City Infrastructure Investment Joint Stock Company (HOSE: CII). Ninh Thuận BOT was established to implement the project to expand the bypass of National Highway 1A through Phan Rang City (Ninh Thuận).

BOT Ninh Thuận raises 1,200 billion dong in bonds, purchased by parent company CII

In other developments, data from the State Securities Commission (SSC) shows that the public offering of CII42301 convertible bonds by CII has ended on January 25.

Accordingly, 4,033 domestic individual investors bought 22.8 million bonds (a rate of 80.14%), 73 foreign individual investors bought 70,734 bonds (a rate of 0.25%), and 24 foreign institutional investors bought 5.3 million bonds (a rate of 18.66%).

A total of 28.13 million bonds were successfully sold, accounting for 99.05% of the total offering of 28.4 million bonds. After deducting expenses, CII received 2,812 billion dong.

This amount will be invested in bonds issued by BOT Ninh Thuận (1,200 billion dong), bonds issued by Hanoi Expressway Company (523 billion dong), and the remaining amount will be used to pay for two CIIB2024009 (500 billion dong) and CIIB2124001 (590 billion dong) bond tranches.

Thus, the investors who purchased the bonds issued by BOT Ninh Thuận are also the parent company CII.

In January 2024, Vingroup – VIC Joint Stock Company (HOSE: VIC) also completed the public offering of VHC2326002 bonds with a value of 2,000 billion dong, a term of 3 years, a fixed interest rate of 15% per year for the first year, and a floating rate of 4.5% higher than the reference interest rate for the following years. Purchasers included 2 domestic institutions (with a purchase quantity of 99.7%) and 9 domestic individuals (0.3%). This is the second offering in a total of three, with a total capital need of 60 trillion dong of VIC.

In the near future, some enterprises, mainly commercial banks such as HDBank, VietBank, and two real estate companies Vingroup and DIC Corporation (HOSE: DIG), are planning to issue bonds with a total expected issuance value of over 10,000 billion dong.

In the latest bond market analysis report, MB Securities Joint Stock Company (HNX: MBS) expects the bond market to outperform in 2024 in the context of recovering business activities. The real estate market has gone through the most difficult period, low interest rate environment, as well as clear legal regulations, will boost the confidence of issuers and investors.