According to information from FCN, the cash dividend rate in 2022 is 5% (equivalent to 500 VND per share), with the last registration date being 27/02/2024. With over 157.4 million outstanding shares, FCN needs to allocate nearly 7.9 billion VND for this dividend payout.

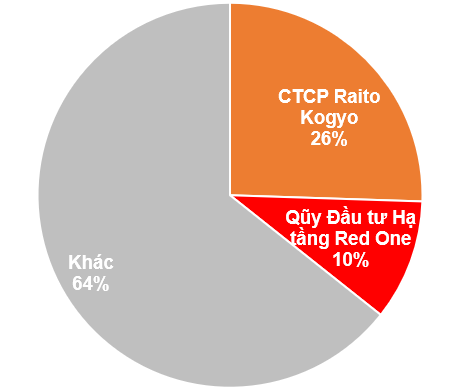

In the shareholder structure, Raito Kogyo JSC and Red One Infrastructure Investment Fund are the two largest shareholders, holding 25.51% and 10.16% of the capital in FCN respectively. They are estimated to receive over 2 billion VND and 800 million VND from FCN’s dividends.

|

The current shareholder structure of FCN

As of 31/12/2023. Source: VietstockFinance

|

However, FCN will not pay the dividends in a single installment. Instead, they will distribute it in 2 phases: 1% on 29/03/2024 and the remaining 4% in December 2024 (expected). Therefore, based on the information provided by FCN, shareholders still have the possibility of not receiving the majority of the dividends, as the remaining 4% is still in the expected status.

This is not the first time FCN shareholders have had to wait for this dividend payout. Previously, in October 2023, FCN announced that the dividends for 2022 would be paid in the first quarter of 2024.

This delay is due to unfavorable market conditions, which have affected FCN’s business operations and financial balance in 2023. Specifically, the progress of implementing some major projects in early 2023 was slower than expected, which impacted the bidding process, contract signing, and construction volume. As a result, the cash inflow was also affected.

In addition, the increase in interest rates at the end of 2022 led to higher borrowing costs. The ability to mobilize capital for real estate and construction enterprises was also constrained by regulatory controls and tighter credit access, making cash inflow more difficult.

If we go back exactly 1 year ago, a similar story occurred when FCN postponed the dividend payment for 2021 in cash from 28/10/2022 to 16/01/2023. The reasons remained the same: unfavorable market conditions, delayed progress on expected contracts, increased borrowing costs, and difficulties in accessing credit sources.

In reality, FCN just ended 2023 with net revenue of nearly 2.88 trillion VND, a 5% decrease compared to the previous year. After deducting costs, FCN incurred a net loss of over 3.2 billion VND, compared to a profit of nearly 4 billion VND in the previous year.

Business difficulties and bond maturity lead FCN to extend the dividend payment for 2022 until 2024.

| FCN’s net profit has been consistently decreasing in recent years |