Liquidity remained lower than yesterday’s session, averaging nearly 12.840 trillion VND compared to 16.975 trillion VND yesterday.

At the closing session, securities such as VIX, VCI, and SSI successfully maintained their gains, while MBS, particularly SHS, were in the red with respective decreases of 1.48% and 3.31%.

In the banking sector, VCB stocks continued to decline throughout the session, closing with a 0.56% drop, followed by TPB and SHB stocks. On the other hand, ACB, CTG, and MBB stocks saw increases.

In the production group, DGC stocks showed an impressive increase of over 5%; followed by DBC stocks with a similarly strong rise of 2.46%.

The mining group also drew attention with PVS stocks (+2.45%) and PVD stocks (+1.77%).

NVL (+1.47%) and CTD (+2.62%) shone the brightest in the construction and real estate group on February 6th.

In terms of stocks affecting the VN-Index, CTG and DGC successfully led the effort to counter the selling pressure from the negative impact group to the index. The leading stock throughout today’s session was VCB.

It can be seen that the top stocks that positively affected the VN-Index contributed to an increase of 2.73 points, while the negative impact group contributed to a decrease of 1.8 points.

|

Top stocks strongly affecting the VN-Index on February 6th Measured in points |

Foreign investors continued to maintain their net selling position until the end of the session, with a net selling value of nearly 480 billion VND. Among them, the most sold stocks were SHS, followed by VHM, GEX, HPG, and VCB, which was also the 5th most sold stock. Conversely, VIX stocks were the most bought.

14:10: “Heartbreaking” drop appears

The market in the afternoon session of the Lunar New Year is making many investors worried, as there was a time when the VN-Index fell into a price decline, reaching 1,185.84 (-0.22 points) before bouncing back into the price increase zone.

As of 14:05, the VN-Index was trading around 1,186.54 (+0.48 points). Many banking and securities stocks were losing momentum, with narrowing increases or decreases in prices. Typical securities stocks included VCI (+2.51%), VIX (+1.97%), VND (+0.45%), and SSI (+0.43%); in contrast, SHS (-2.21%) and MBS (-0.74%) stocks were in the red.

Similarly, banking stocks like ACB (-0.18%), EIB (-0.27%), SHB (-1.28%), and VCB (-0.89%) were on the decline.

In the real estate and construction group, NVL and PDR stocks saw a decrease in momentum compared to the morning session; on the bright side, there was an emergence of CTD stocks, with an increase of over 3%.

In the manufacturing group, DGC stocks maintained an impressive performance (+3.63%), and HAH stocks in the warehouse transportation group were also the brightest spot in the industry.

In the top stocks affecting the index, VCB and BID were the strongest ones pushing the index down, while the other Big 4, CTG and TCB, were on the opposite side, trying to bring the VN-Index back on track, but it seems they have not fully fulfilled this role.

It can be seen that the negative impact group mainly focused on 2 banking stocks, while the stocks with positive impact shared the workload more evenly.

In terms of foreign investors, this group net sold nearly 409 billion VND.

Morning session: VN-Index “recovers”, showing a tug-of-war

After a few minutes of slight weakness, the VN-Index has regained strength and continued its upward trend since the beginning of the session. The tug-of-war has also become more intense, but the dominating buying side helped the index remain relatively stable and in the green zone.

At the end of the morning session, the index stopped at 1,188.85 points, an increase of nearly 3 points; among them, 14 stocks reached the ceiling price, 336 stocks increased, 1,028 stocks remained unchanged, 219 stocks decreased, and 8 stocks hit the floor price.

Liquidity is still lower than the average of the previous trading session. The end of the morning session recorded over 6.200 trillion VND in trading value, compared to over 8.500 trillion VND at the same time the previous session.

Stocks in the securities group like VIX, VCI, and HCM showed good performance from the beginning of the session, maintaining an increase of around 2%; while stocks like SSI, VND, and SHS also had positive developments.

Many banking stocks such as VIB, CTG, MBB, HDB, TCB, VPB remained the center of price increases in the banking sector, helping to balance the weakening of some stocks in the same sector such as EIB, ACB, VCB, BID, LPB, SHB.

In the real estate and construction group, stocks such as NVL and PDR have narrowed their gains compared to the morning session; worth noting are stocks such as NLG with an increase of nearly 2%, and DIG with an increase of nearly 1%.

In the production group, DGC stocks led with a 3% increase, followed by DBC and HPG.

Notably, FRT stocks led the retail group with a remarkable increase of nearly 4%, while MWG stocks decreased by nearly 1%.

Regarding the group of stocks affecting the index, BID and VCB continued to exert the most pressure on the index, while other stocks like CTG and TCB balanced the situation.

10:35: Showing signs of fatigue

Although the VN-Index is still in the green zone, the morning’s upward momentum has been somewhat restrained. As of 10:10, the VN-Index was only up 1.5 points, down to 1,187.55 points and showing signs of fatigue.

Market liquidity is still quite sluggish, with an average trading value on HOSE of over 3.480 trillion VND as of 10:10, lower than the 5.296 trillion VND in the previous session.

The financial sector still maintains a positive trend, providing the main driving force for the market. Some stocks in the securities sector, such as VIX, VCI, HCM, experienced impressive increases of around 2%, while ORS stocks even increased nearly 3%; and other stocks like SSI, VND, SHS also had positive developments.

Many banking stocks like VIB, CTG, MBB, HDB, TCB, VPB are still leading the market with positive developments, while VCB, SHB, and EIB stocks are in the red with decreases of less than 1%.

In the real estate and construction group, NVL and PDR stocks continue to show positive momentum, but the increase is narrower compared to the morning session; an encouraging point is the emergence of CTD stocks, with an increase of over 3%.

In the manufacturing group, DGC stocks maintained an impressive increase of 3% and HAH stocks in the warehouse transportation group were also the brightest spot in the industry.

In the group of stocks affecting the index, VCB and BID continue to bear the brunt of the index’s decline, while CTG and TCB are on the opposite side, trying to bring the VN-Index back on track, but it seems they have not fully fulfilled this role.

Opening: Banks continue to lead the way

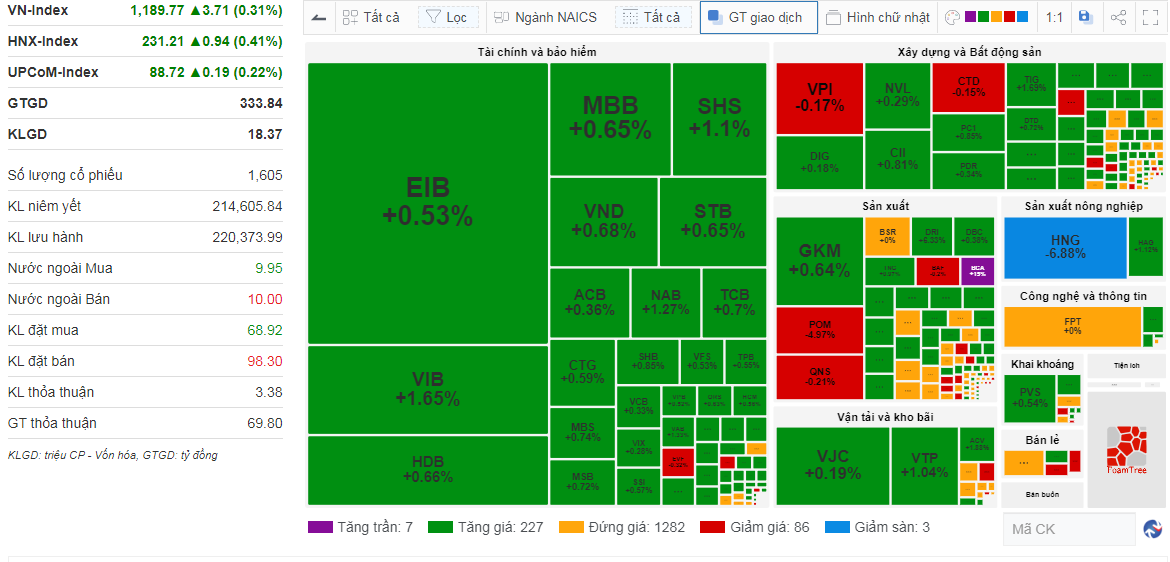

The VN-Index opened with an increase of nearly 4 points to 1,189.77 points, with 7 stocks reaching the ceiling price, 227 stocks increased, 1,282 stocks remained unchanged, 86 stocks decreased, and 3 stocks hit the floor price.

Market developments at 9:16 AM. Source: VietstockFinance

|

The Large Cap, Mid Cap, Small Cap, and Micro Cap groups also showed similar upward trends.

The banking group still played a leading role in driving the market up, with VCB, VIB, STB, and TPB being the stocks that had the most positive impact on the market, especially VCB. On the other hand, the stocks that had a negative impact on the market, such as MWG, EVF, HNG, had a weaker impact.

Kha Nguyen