Illustrative image

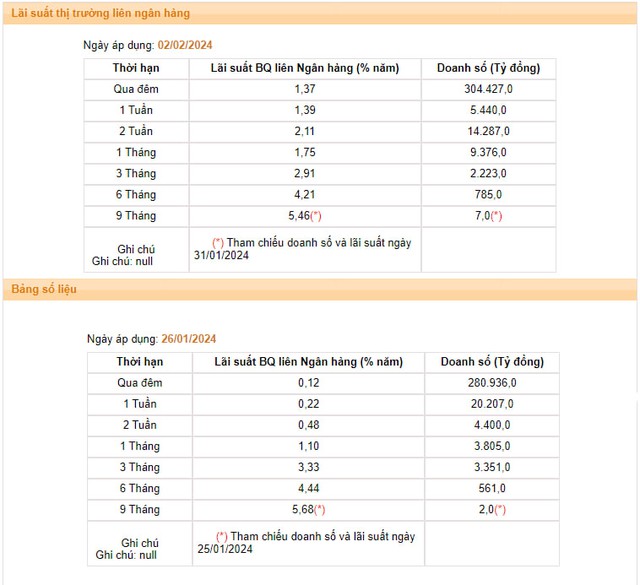

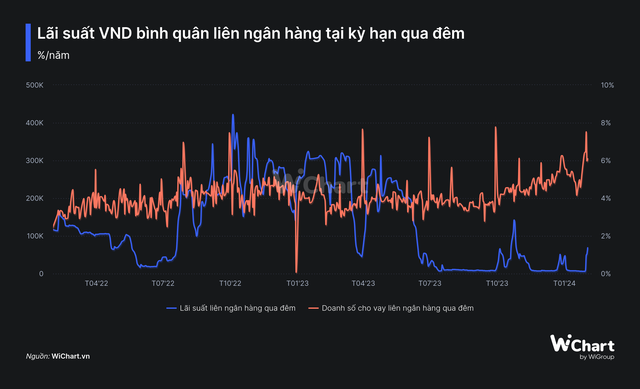

New data released by the State Bank of Vietnam (SBV) shows that the average interbank VND interest rate surged at the end of last week. Specifically, the overnight interest rate (the main term, accounting for about 90% of the transaction value) in the session on February 2 increased to 1.37%, marking three consecutive days of sharp increases. Compared to the previous week’s level (the January 26 session was 0.12%), the interbank overnight interest rate has increased more than 10 times.

Together with the overnight term, interest rates at other key terms (1 month and below) also increased sharply last week: the 1-week term increased from 0.32% to 1.39%; the 2-week term increased from 0.7% to 2.11%; the 1-month term increased from 1.1% to 1.75%.

In contrast, the 3-month term interest rate decreased from 3.77% to 2.91%, showing market expectations that interbank interest rates will decrease in the near future.

Source: SBV

Previously, the interbank overnight interest rate had continuously maintained at historically low levels in the context of excess liquidity in the banking system. According to analysts, the strong increase in interbank interest rates in the short term is mainly due to seasonal factors when payment and spending needs increase during the Lunar New Year holiday.

In fact, the trading volume in the interbank market has increased sharply in recent days, continuously maintained at over 320,000 billion VND/session, even reaching nearly 400,000 billion VND on January 31. To support banks with liquidity needs, the SBV continues to maintain the channel for lending against valuable papers (OMO), while adjusting the tender term up to 14 days. However, there are no market members in need of support from the central bank.

Analysts expect that interbank interest rates will soon cool down and remain low in the first months of 2024 in the context of abundant system liquidity and typically low credit demand after the Lunar New Year holiday.

“Interbank interest rates may increase due to seasonal factors around the Lunar New Year, but the increase is not significant and will end after the holiday,” assessed Vietcombank Securities.

In the context of the high possibility that the Fed will maintain high interest rates until May 2024, the USD-VND interest rate difference in the interbank market is forecasted to still be at a high record level (above 5%). This will somewhat put pressure on the USD/VND exchange rate when the market experiences fluctuations.

In a newly published report, Rong Viet Securities (VDSC) stated that the current devaluation of the dong is due to the fact that the USD-VND interest rate differential is still very large. In addition, this development is also associated with the recovery of the DXY in the context of the market lowering expectations about the timing and number of interest rate cuts in 2024 by the Fed.

According to CME Group data, the market is currently betting about a 48% chance that the Fed will cut interest rates in the March 2024 meeting, down from about 70% at the beginning of January 2024. These factors have supported the USD index (DXY) to increase by 2.2% in January to 103.6 points – the highest level since the beginning of December 2023. The rebound in the DXY index has put downward pressure on the prices of other currencies, including Vietnam’s currency.

Vietcombank Securities (VCBS) also believes that the pressure on the USD/VND exchange rate in 2024 continues to come from the VND – USD interest rate differential in the interbank market, and the interest rate for USD deposits both onshore and offshore.

However, VCBS forecasts that the positive factors helping the central bank have an advantage in guiding the market are: (i) FDI capital inflows into Vietnam have finished growing as the investment environment is maintained, and challenges related to the global minimum tax are handled adequately; (ii) The pattern of stable growth recovery. (iii) Trade surplus reaches 1-5 billion USD, not reaching an abnormal surplus level when import demand for production materials begins to recover. The strength of the USD is still an underlying factor putting pressure on the exchange rate.

VCBS assessed that under favorable conditions of the DXY not rising significantly and the flexible management policy of the SBV, the VND can maintain a reasonable depreciation rate of less than 3% against the USD in 2024.