The current P/E ratio of VN-Index is around 15.5 times, slightly higher than the average level in the past 2 years, according to Bloomberg data – this P/E ratio has eliminated the extraordinary profits of businesses so it differs from the calculation of other organizations.

In the updated market outlook report just released, KBSV Securities maintains the view that the market valuation is at an attractive level for investors to accumulate stocks for medium to long-term goals.

Regarding the market volatility in February, KBSV Securities maintains a scenario of fluctuation with a dominant recovery trend.

The announcement of the Q4 and full-year 2023 business results of many groups of companies being more positive than the same period (low base in 2022) will improve investor sentiment. However, the business results will vary between different stock groups, so the market is likely to be divided, leading to short-term fluctuations.

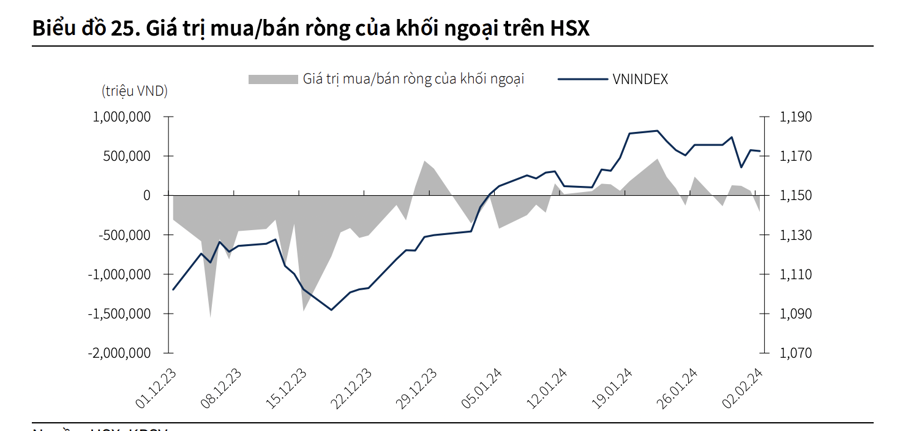

The return of foreign capital inflows is a factor that supports improving the liquidity of the market and supporting the overall index. Previously, foreign investors withdrew about $1 billion in 2023, which partly affected the recovery of VN-Index, including Thai investors selling to avoid personal income tax on foreign investment accounts effective from early 2024.

However, KBSV Securities believes that foreign investors still have many motivations to return given the expectation of economic recovery, reasonable valuation of the Vietnamese market, and beyond that, expectations of upgrading. In fact, foreign investors have started to balance trading since the beginning of January.

Furthermore, investment sentiment has improved thanks to information from some markets around the world. The main indices in the US have successively exceeded historical highs due to expectations of lower interest rates and optimism surrounding AI technology. Investors should pay attention to the upcoming policy meeting of the FED in March 2024.

There are risks that the FED may postpone interest rate reductions. Specifically, according to CME Group, the market currently expects only a 48% chance that the FED will have the first rate cut in March 2024 (compared to 72.8% a month ago).

On the other hand, in China, the CSI 300 index has fallen to a five-year low. Policy planners are considering a $278 billion package to stabilize the market. This is somewhat positive news that helps improve investor sentiment.

In addition to the above information, KBSV Securities notes risks related to the strength of the US dollar, unpredictable geopolitical volatility globally (escalating tensions in the Red Sea and the Middle East, the complex ongoing Russia-Ukraine war, etc.) that could negatively affect the market compared to the base scenario.

On the weekly chart, VN-Index has successfully broken through the resistance level around 1155, corresponding to the peak in October 2023 and the MA200 line on the weekly chart.

However, after a strong rally, the upward momentum of the index is showing signs of weakness as leading stock groups are approaching significant resistance levels and there have been signals of correction. On the daily chart, the short-term breakthrough sessions, in the third week of January, had relatively large ranges but were accompanied by low trading volume, indicating that the upward momentum is not yet convincing.

The ADX indicator – the average directional indicator, during the period when VN-Index recovered from the bottom around 1080 to the present time, fluctuated around the range of 24-27 (if ADX < 25 indicates a weak and unclear trend), also indicating that the recovery of VN-Index lacks firmness and this implies short-term reversal risks.

Combined with the role of the banking stock group as leaders in the upward moves in January slowing down, KBSV Securities leans towards a scenario (70% probability) where the index may face significant correction pressure at the resistance zone of 1185 – 1205 points and then move down to retest the support zone around 1145 (+-10) points, before entering a new recovery phase with improved liquidity expectation.

The remaining scenario (30% probability) is that VN-Index may maintain its upward momentum to break through the 1185 – 1205 zone, and then start a short-term correction phase. However, the probability for this scenario is not high as the upward momentum is showing signs of weakness.