The stock market closed the Year of the Cat with a bullish session led by the banking group. CTG shares of VietinBank were one of the most notable names, soaring 3.2% to VND 35,500 per share, nearing the historical peak reached in mid-2021.

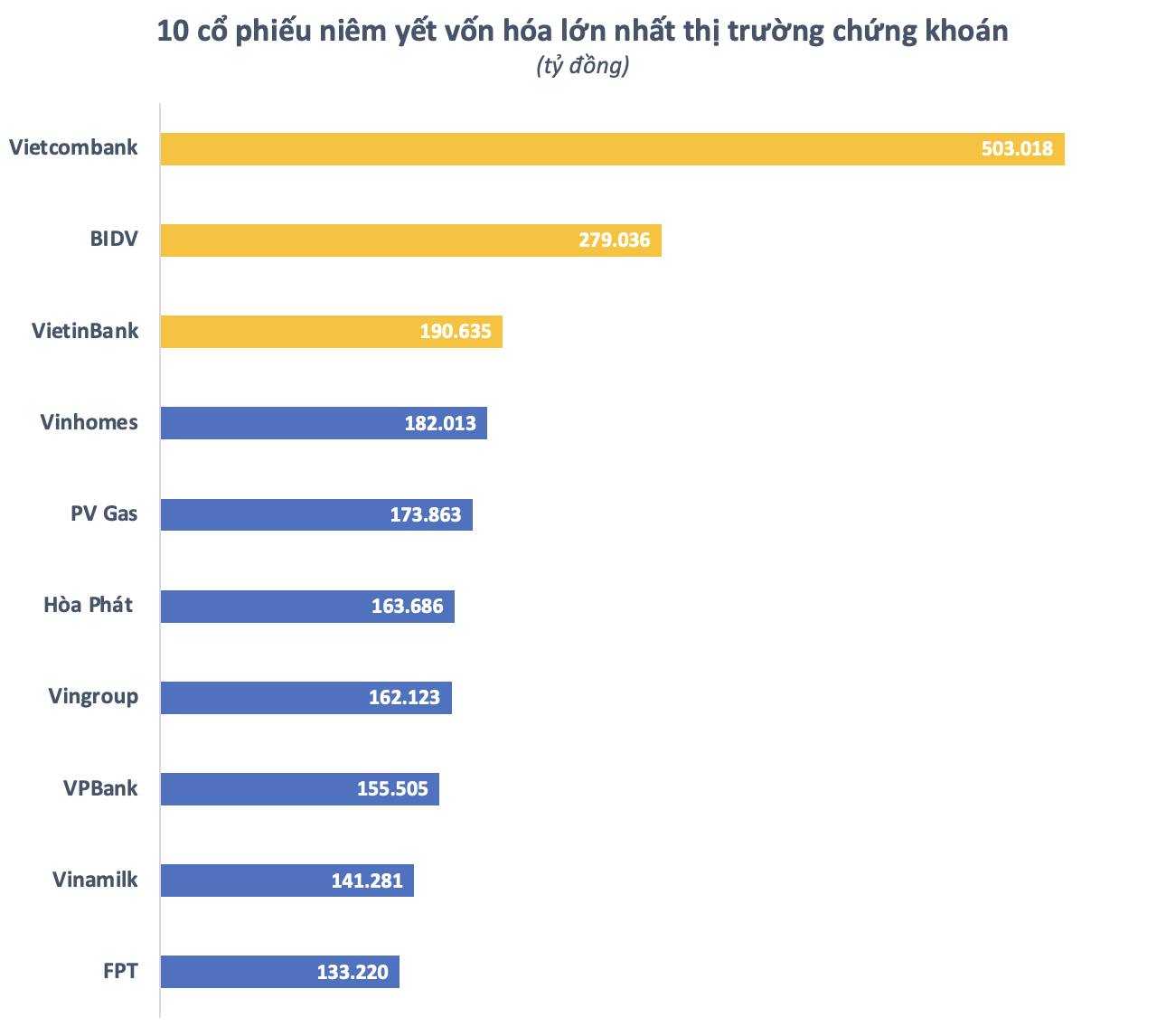

Since the beginning of 2024, the CTG stock price has increased nearly 31%, pushing the market capitalization to VND 190,635 billion, surpassing famous names such as Hoa Phat, Vingroup, PV Gas, and most recently Vinhomes. As a result, the three state-owned banks Vietcombank, BIDV, and VietinBank are all at the top of the list of the most valuable stocks on the stock market.

Prior to VietinBank, the stocks of the two banking giants, Vietcombank and BIDV, had already surpassed their historical peaks. Vietcombank even became the first name in the history of the Vietnam stock market to reach a half a billion VND market capitalization. Meanwhile, the BIDV stocks of BIDV are among the strongest gainers among the top stocks on the stock market in the past three months.

Regarding VietinBank, the bank was established on March 26, 1988, based on the separation from the State Bank of Vietnam according to Decree No. 53 / HDND of the Council of Ministers. VietinBank was approved for equitization in September 2008 and successfully conducted its IPO at the end of the year. The bank was officially listed in July 2009 with the stock code CTG.

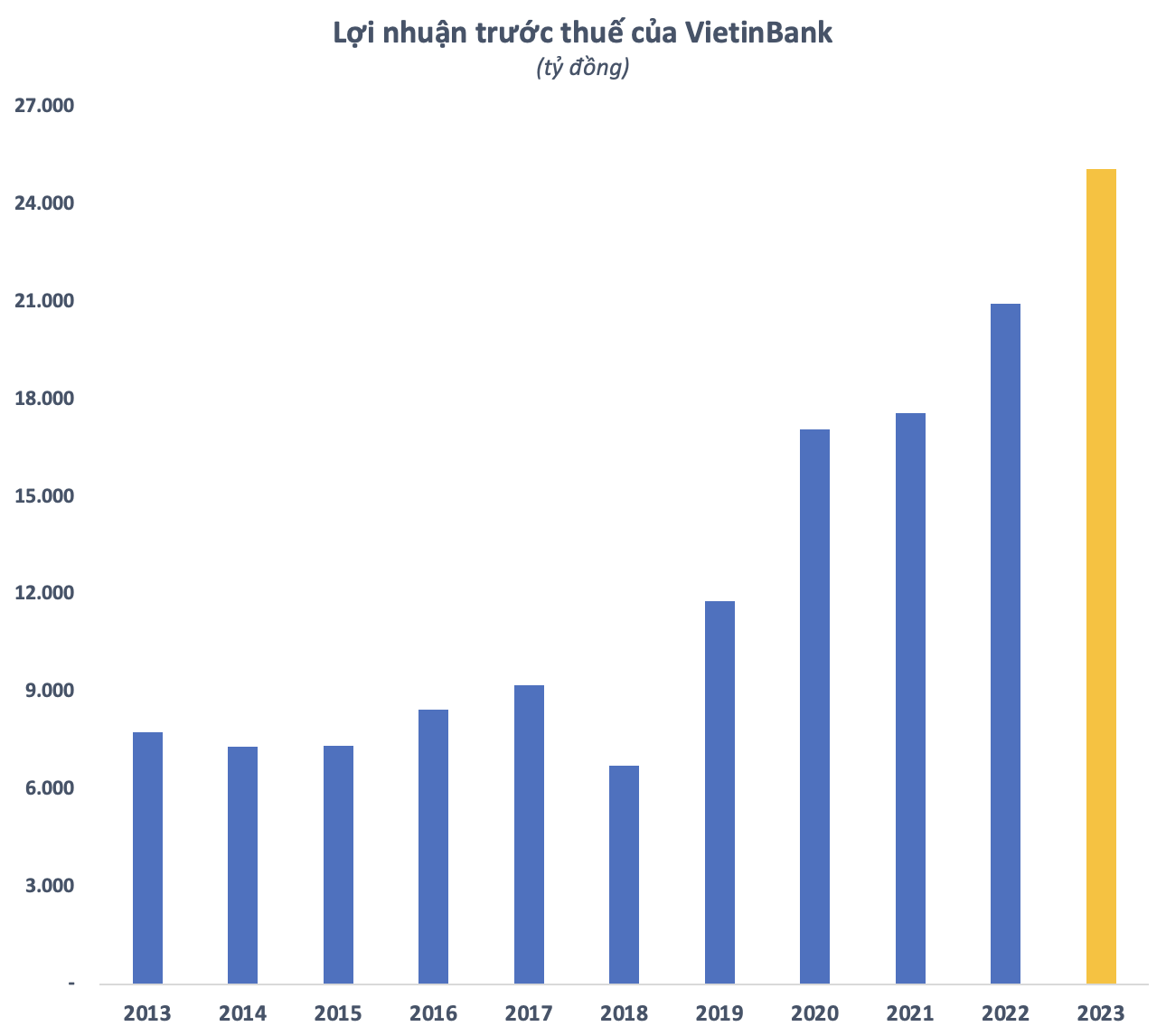

In the early stage before the equitization, the bank’s business situation went through many ups and downs. However, the results have improved significantly over the past decade following the strategic shareholder Mitsubishi UFJ Financial Group from Japan in 2013. The bank’s profits have been growing year by year, except for 2018 due to objective factors.

Specifically, the plan to restructure the bank’s operations associated with bad debt resolution in the period of 2016 – 2020 was approved by the State Bank on November 27, 2018. However, as the capital increase plan at that time had not been approved and the initial implementation of the restructuring plan made VietinBank adjust and reduce a series of indicators in the last quarter of the year.

After that, VietinBank’s pre-tax profit quickly returned to growth from 2019 and reached a record VND 25,100 billion in 2023, an increase of nearly 19% compared to 2022. This figure puts VietinBank in the 5th position in the ranking of last year’s profits in the whole industry. As of December 31, 2023, VietinBank’s total assets increased by 12.4% compared to the beginning of the year, surpassing VND 2 quadrillion, becoming the 3rd name after BIDV and Agribank to reach this milestone.

Vinhomes – the latest name that VietinBank has just surpassed in terms of market capitalization, is still the most valuable enterprise in the real estate industry on the stock market since its listing in May 2018. The first IPO in 2018 of this company till now is still the most successful IPO deal in the history of Vietnam’s stock market with a value of $1.35 billion.

Since being listed on the stock market, Vinhomes has regularly been among the top in terms of market capitalization, with a value reaching over $10 billion, second only to its parent company Vingroup. Although the stock is no longer at its peak, Vinhomes is the champion in terms of profit in 2023 with a pre-tax profit of up to VND 43,243 billion, an increase of 12% compared to 2022. This figure is still lower than the record profit of over VND 48,000 billion that this real estate company achieved in 2021.