Illustrative photo

Crude oil climbs on supply outlook

Crude oil Brent and WTI initially rose more than $1/barrel after the US Energy Department said crude production would increase less than expected, but later trimmed gains amid the possibility of an extended ceasefire in the Gaza Strip conflict.

At the close on February 6, Brent crude rose $0.6 or 0.77% to $78.59/barrel, while WTI rose $0.53 or 0.73% to $73.51/barrel.

In the Short-Term Energy Outlook, the Energy Department said US production will increase by 170,000 barrels per day this year, down from the previously forecasted 290,000 barrels per day.

US Secretary of State Antony Blinken, during his Middle East trip to seek a way to end the Gaza Conflict, said Hamas’ response to the ceasefire proposal is being considered.

Some analysts noted the volatility of prices due to events in the Middle East.

Inventory data released on February 6 and 7 is expected to remain strong for gasoline and diesel, but future inventory is expected to decrease. Five analysts surveyed by Reuters estimated on average crude oil inventories increased by about 2.1 million barrels in the week through February 2.

Refineries are undergoing maintenance in refineries across the United States and the shutdown of BP’s Whiting refinery in Indiana last week will curb output.

Gold strengthens

Gold prices strengthened as the US dollar and silver bond yields fell, while traders prepared to receive comments from some Federal Reserve officials this week to assess the pace of interest rate cuts this year.

Spot gold rose 0.6% to $2,035.89/ounce, after hitting its lowest level since January 25 in the previous session. US gold for April delivery closed up 0.4% at $2,051.4/ounce.

Gold support is a 0.3% drop in the US dollar and a decline in 10-year silver bond yields.

Copper rises as China’s measures and LME stocks decline

Copper prices rose for the first time in 5 sessions in London, supported by China’s efforts, the world’s leading metal consumer, to stabilize their markets and a weaker US dollar, while LME stocks declined.

The 3-month copper contract on the London Metal Exchange (LME) rose 0.5% to $8,405/tonne.

This marketplace is supported by a series of signs that the Chinese government is intensifying its efforts to support plummeting markets, pushing Chinese stocks to have their strongest day in two years. From a technical point of view, copper is also supported by the 200-day moving average at $8,348.5. Meanwhile, LME copper stocks dropped to a 5-month low.

Short-term demand in China is limited by the upcoming Lunar New Year holiday. It also shows that current demand is weaker as spot copper prices are lower than the 3-month copper contract at an all-time high of $112.

Iron ore declines on China’s demand concerns

Iron ore prices fell as pre-holiday de-stocking continued with steel producers’ capacity cuts and dampened demand prospects in China, which is grappling with a real estate crisis and falling stock market.

Iron ore for May delivery on the Dalian Commodity Exchange in China closed 0.63% lower at 939 CNY ($130.57)/tonne.

In Singapore, iron ore for March delivery fell 0.75% to $125.15/tonne, the lowest since January 18.

Analysts at Everbright Futures said there had been no significant change in the supply-demand factor and that the market was affected more by macro market sentiment.

Further price pressure on iron ore markets are limited steel demand as harsh weather and weak pre-holiday operations lasting a week starting February 10.

Persistent weakness is taking place regardless of many developers and the hardships China’s property market is facing as local governments have been adding projects to their whitelist, reflecting the rapid expansion of the government’s liquidity pumping into the crisis-affected areas. But banks are reluctant to lend to this sector, a major obstacle for developers in need of capital.

Steel components remained largely unchanged, hot-rolled coils dropped 0.18%, stainless steel dropped 0.29%, while steel wire increased 0.69%.

Rubber declines

Japanese rubber prices decline as passenger car and tire production slows down, and concerns about automobile demand affecting market sentiment despite limited supplies from Thailand’s top rubber producer.

Rubber contracts for July delivery on the Osaka Exchange fell 5.1 JPY or 1.76% to 284 JPY ($1.91)/kg.

In Shanghai, rubber for May delivery fell 15 CNY to 13,355 CNY ($1,857)/tonne.

China’s tire manufacturers’ output declines from last week starting February 1. Both domestic and international tire sales have slowed down.

Coffee mixed

Robusta coffee for May delivery ended unchanged at $3,096/tonne, supported by scarce supplies in Europe.

Vietnamese farmers are refusing to deliver their previously sold robusta coffee since contracts were re-negotiated after global prices surged to their highest in 28 years.

Arabica coffee for March delivery fell 0.7% to $1.882/lb.

Agents said the attack on boats on the Red Sea continues to make Ethiopia’s coffee exports through Djibouti more difficult, leading to slow transport.

They also noted that ICE-certified Arabica coffee stocks increased again, rising 10% over the past 20 days, although the current level is low in history.

White sugar rises

Raw sugar for March delivery closed little changed at 23.56 US cents/lb.

A global sugar shortage is expected to reach 788,000 tonnes in the 2024/25 season, meaning supplies will remain scarce and prices high.

White sugar for March delivery rose 0.8% to $651.7/tonne.

Soybeans, corn rise; wheat falls

US soybeans rose for a 2nd consecutive session on short covering and technical buying activity that boosted prices from multi-year lows a day earlier, despite limited concerns about weak demand.

Corn also rose, while wheat fell on rain forecasts in Argentina, where hot and dry conditions have put pressure on crops.

Soybeans for March delivery rose 3-1/4 US cents to $11.99-1/2/bushel after hitting its lowest level for the most-traded contract since December 2020 on February 5.

Corn for March delivery dropped 4 US cents to $4.38-3/4/bushel, while wheat for March delivery rose 4-3/4 US cents to $5.95/bushel.

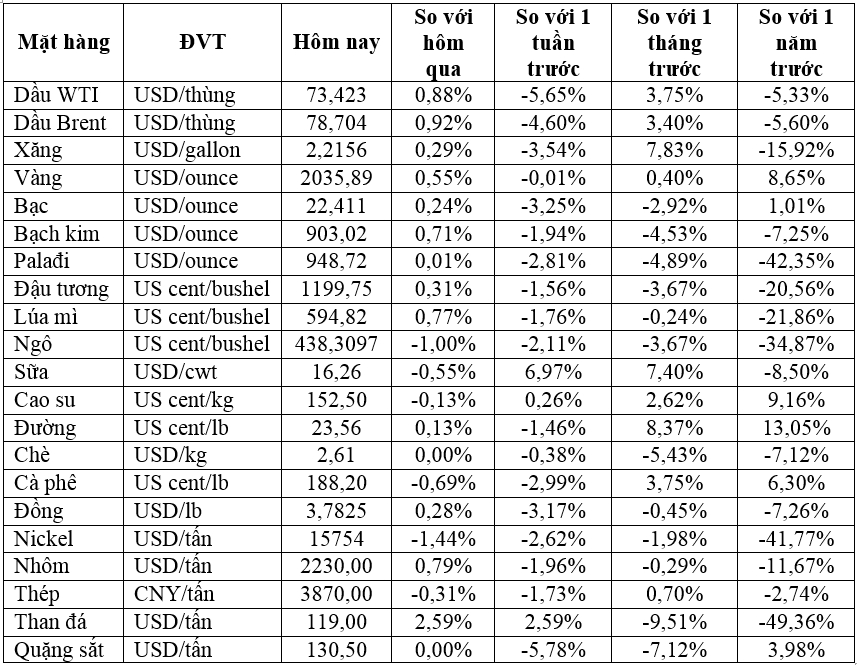

Key commodities prices on the morning of February 7

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)