In 2022, Vietnam ranked 2nd in Southeast Asia and 3rd in Asia in terms of average alcohol consumption per person. The per capita consumption of alcohol in terms of pure alcohol liters is 8.3 liters, equivalent to about 170 liters of beer per person per year. Clearly, Vietnam is a “fertile” market for beer brands.

However, the competition is becoming more fierce and there are many challenges that make beer businesses struggle in their operations. Beer consumption in 2023 is no longer as lively and vibrant as previous years. The main reasons are the difficult economy, decreased purchasing power, and tightened regulations on alcohol content for traffic participants.

The rapid decline in beer consumption has quickly affected the business performance of beer enterprises. According to statistics, the beer industry’s revenue on the stock market in the fourth quarter of 2023 continued to decline by 13% compared to the same period last year to a level of over 12.8 trillion VND. All four quarters of 2023 witnessed a decline in revenue compared to the same period. Even the beer industry’s profit in the last quarter has declined for the second consecutive quarter, decreasing by 6% compared to the same period in 2022, to over 1.1 trillion VND.

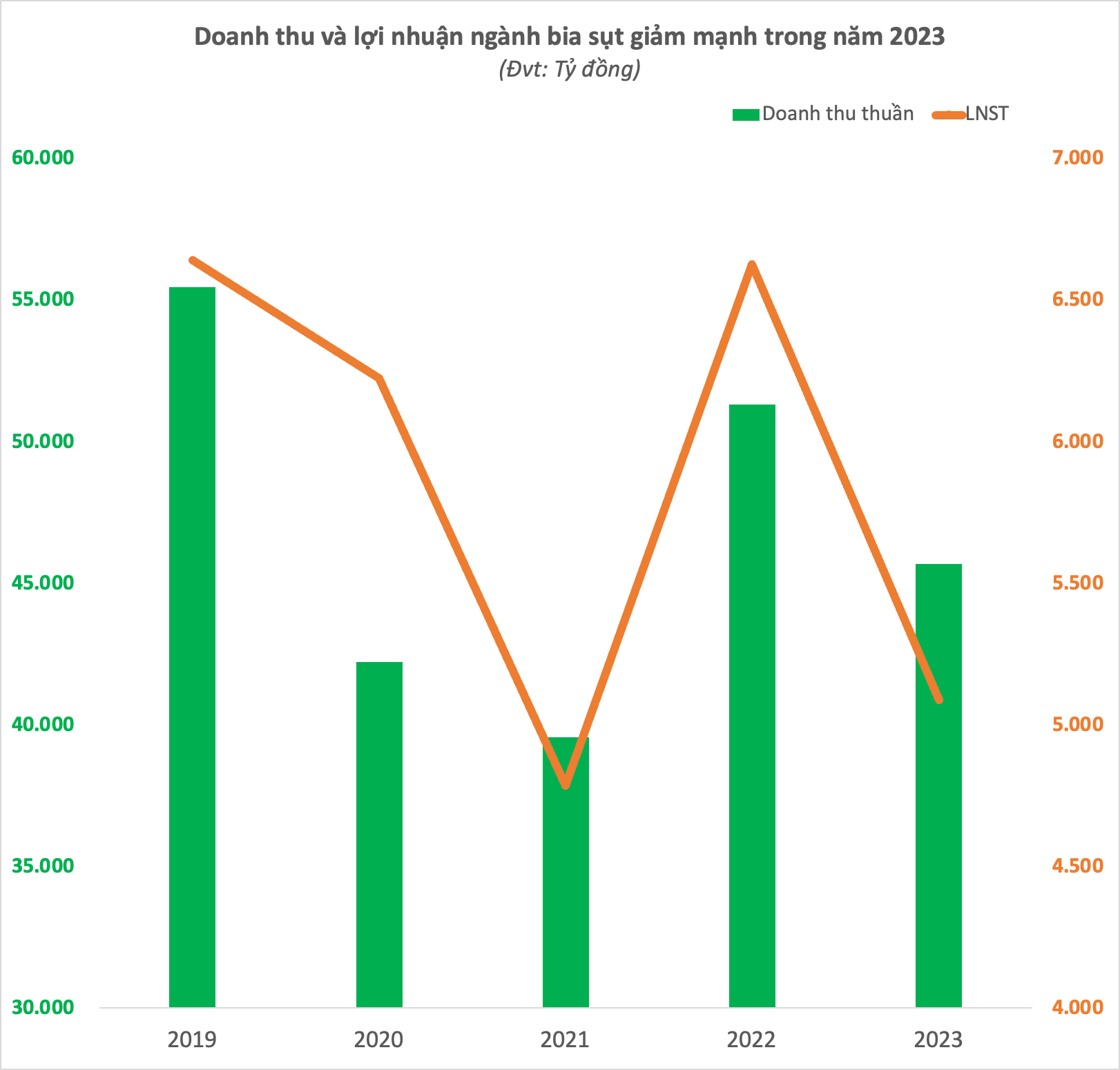

The continuous decline in consumption has had a significant impact on the full-year 2023 revenue of beer enterprises, which decreased by 11% to nearly 45.7 trillion VND. After-tax profit declined even more sharply, with a decrease of over 23%, reaching less than 5.1 trillion VND.

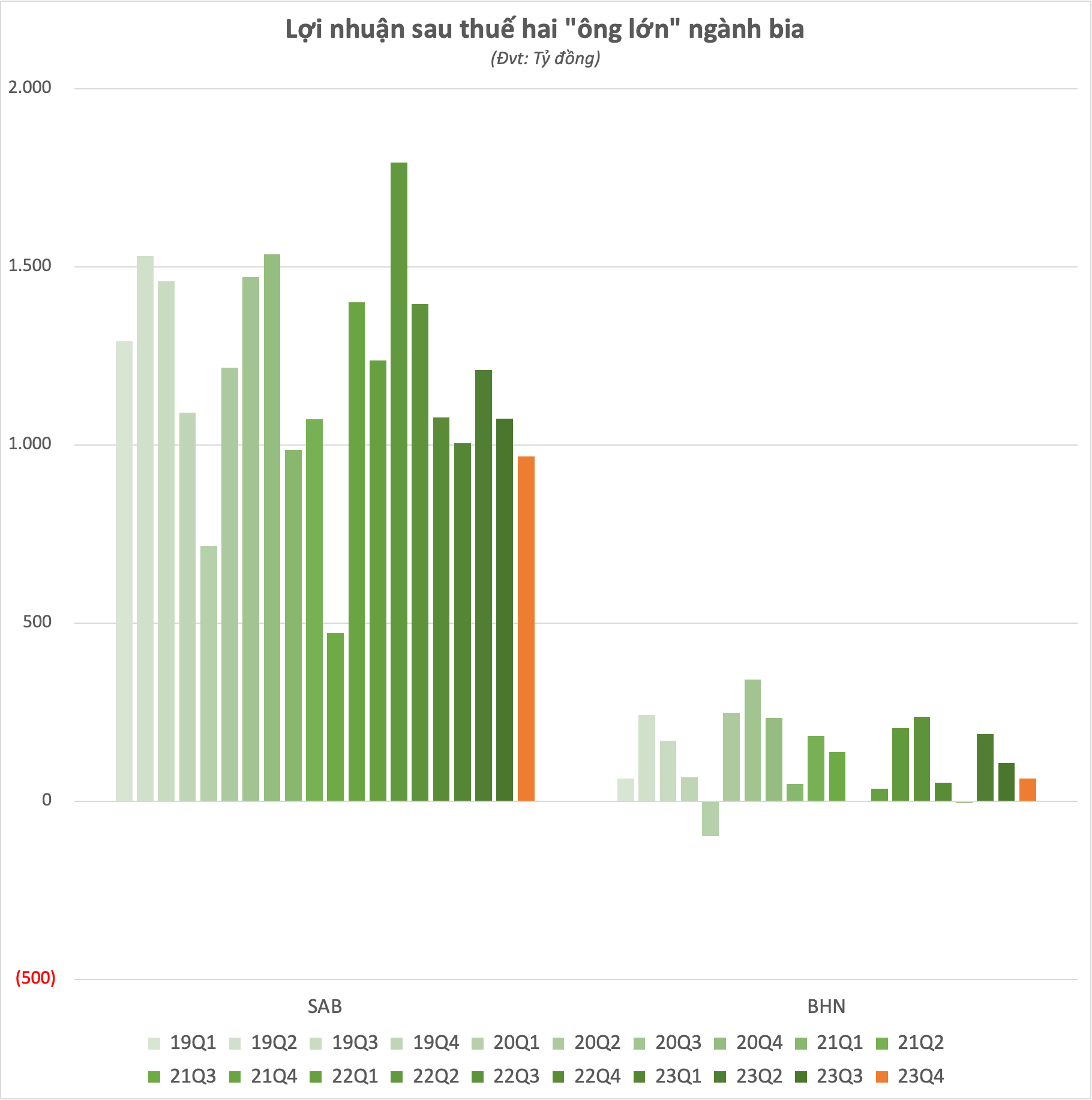

Looking at individual companies, Sabeco recorded a net revenue of 8.52 trillion VND in the fourth quarter of 2023, a 15% decrease compared to the same period. The high costs and the decrease in profit in joint venture companies contributed to Sabeco’s net profit of 967 billion VND, a 10% decrease compared to the same period, with a net profit of 947 billion VND. This is also the lowest quarterly profit of the Vietnamese beer giant in the past two years.

For the whole year 2023, Sabeco’s net revenue reached 30.461 trillion VND, a 13% decrease compared to the previous year. Beer is still Sabeco’s main product, accounting for 88% of revenue and 98% of gross profit. As a result, Sabeco’s net profit in 2023 reached 4.118 trillion VND, a 21% decrease. Sabeco attributed the competition, decreasing consumer demand, the country’s economic recession, and the strict implementation of Decree 100 as reasons for the decrease in revenue, which affected the profit. Compared to the set plans, Sabeco only achieved 76% of the revenue targets and 74% of the profit targets for the year.

Another long-standing name, Tổng CTCP Bia – Rượu – Nước giải khát Hà Nội (Habeco, code BHN), also complained about the increasing competition in the beer market, decreasing consumer trends, and the tightened control of alcohol concentration in the last months of 2023 that affected the profit results.

In the fourth quarter of 2023 alone, Habeco achieved a net revenue of 2.246 trillion VND, a 9% decrease compared to the same period. The increased cost of goods sold narrowed the gross profit margin to 24%. However, the reduced other costs helped Habeco’s net profit after tax reach 64 billion VND, a 24% increase compared to the same period last year.

For the whole year 2023, the leading Hanoi Beer Company achieved a net revenue of 7.757 trillion VND and a net profit of 356 billion VND, decreasing by 8% and 30% respectively. Although experiencing a decline in profit, Habeco still exceeded 5% of the revenue target and exceeded 60% of the profit target for the year thanks to a cautious plan.

Notably, in 2023, Habeco increased trade discounts by 13% to 143 billion VND despite the decrease in revenue. This is usually a preferential discounted commission for customers who make large purchases to encourage them to buy more goods.

Công ty cổ phần Bia Hà Nội – Hải Dương (Hanoi Beer Joint Stock Company – Hải Dương Brewery JSC), code HAD, also faced difficulties in their business performance with a net revenue of nearly 27 billion VND in the fourth quarter, an increase of 16% compared to the same period last year. However, the cost of goods sold increased, resulting in a gross profit of nearly 2 billion VND, a 47% decrease. As a result, HAD reported a loss of over 1 billion VND in the fourth quarter, while still making a profit in the same period of the previous year. Accumulated for the whole year 2023, the company made a profit after tax of 6 billion VND, a decrease of nearly 43% compared to 2022.

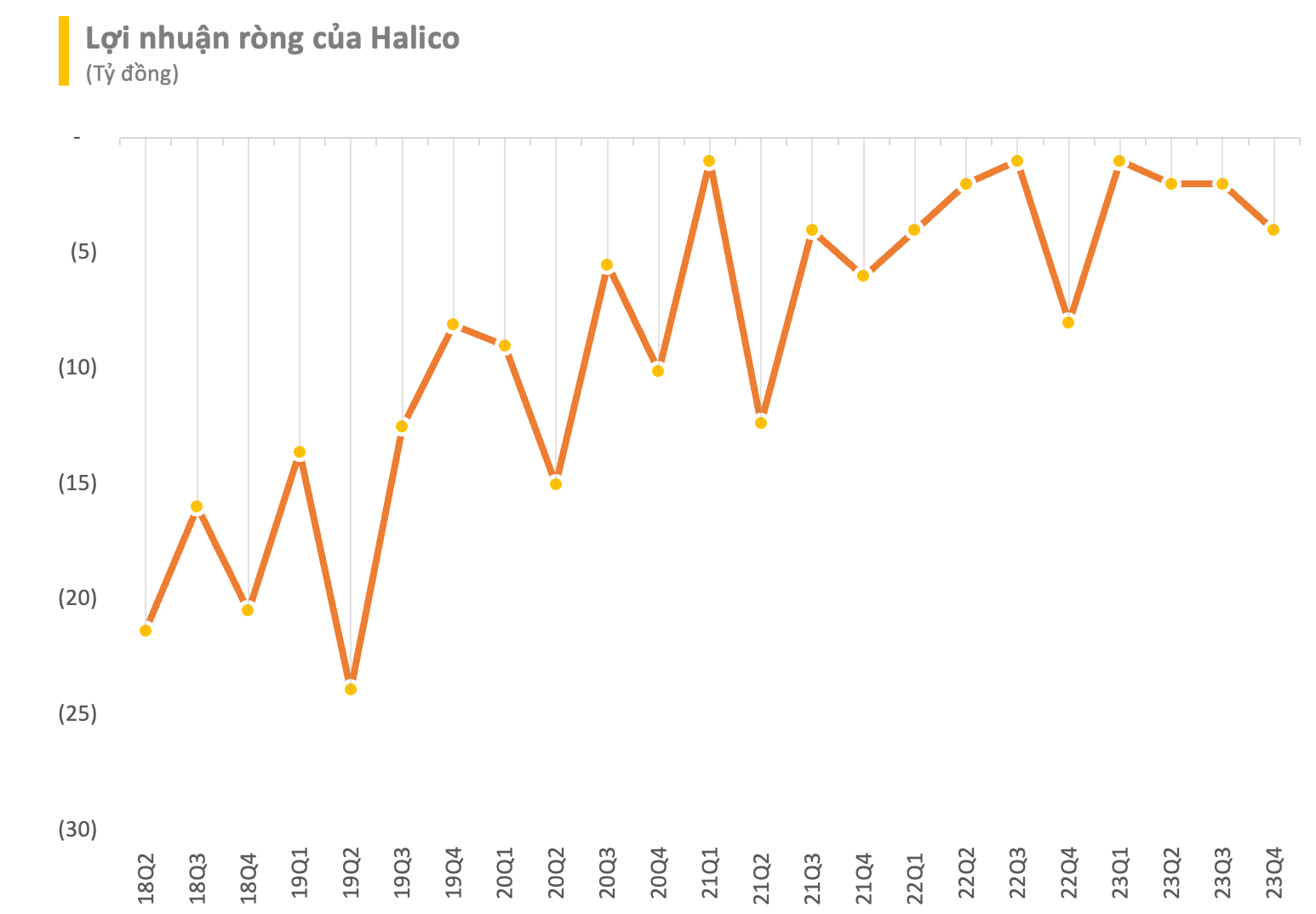

Belonging to the group of alcoholic beverage businesses, Công ty cổ phần Rượu và Nước giải khát Hà Nội (Halico, code HNR) – the owner of Hanoi Vodka brand, faced an even worse business year with continuous quarterly losses for 27 quarters.

According to the financial report for the fourth quarter of 2023, Halico recorded a loss of over 4 billion VND after tax. The accumulated loss for the whole year 2023 reached nearly 10 billion VND. The company has been continuously losing for 8 years without any profit, bringing the accumulated loss to over 457 billion VND.

CTCP Bia Sài Gòn – Hà Nội (BSH) recorded a net revenue of 150.5 billion VND in the fourth quarter, a 3% decrease compared to the same period in 2022. The net profit after tax was over 7 billion VND, a 32% decrease. For the whole of 2023, the beer company achieved a net profit after tax of over 43 billion VND, a 25% decrease.

Similarly, Công ty CP Bia Hà Nội – Thanh Hóa (THB) also witnessed a year of sluggish business with a 11% decline in net revenue in the fourth quarter compared to the same period, reaching 470 billion VND. Thus, the net revenue for the whole year 2023 reached 1.506 trillion VND, a 6% decrease.

According to the leaders of these businesses, there are many reasons for the sharp decline in beer consumption such as difficult business conditions and the impact of Decree 100. In addition, the surge in imported beer brands in the premium segment has also affected the market share of domestic beer businesses that have strong positions in the mid-range segment.

In another aspect, besides the output, the beer industry is also facing difficulties with the significant increase in input raw material prices. In the near future, if the amended Special Consumption Tax Law is implemented, including changes in the calculation method and adjustment of tax rates for alcohol and beer, the situation of these businesses will become more challenging.

In a recent report, Funan Securities stated that an important risk for the beer industry is the lack of demand improvement signals because people tend to tighten their spending, especially on non-essential items such as beer and alcohol. In particular, the decrease in spending on beer and alcohol is not only a story of economic difficulties but also an inevitable future trend when the consumption of unhealthy drinks will gradually decrease due to policies and regulations that restrict people from consuming alcoholic beverages.