Right from the beginning of the year, the 2023 Annual General Meeting of Shareholders of Binh Duong Water – Environment JSC (Biwase, code BWE, HoSE listed) approved the plan to acquire shares of certain companies operating in the water sector, thereby making these companies become subsidiaries or affiliated companies. It can be seen that M&A activities are part of the business plan for 2023 of this water company in Binh Duong province.

Series of M&A deals with DNP Water partner

The first deal in the past year was conducted in March 2023 when Biwase acquired shares of Long An Water Supply and Sewerage Joint Stock Company (code LAW, UPCoM listed) owned by DNP Water Investment Joint Stock Company (DNP Water). Accordingly, Biwase acquired 2,989,000 shares from DNP Water, equivalent to 24.50% of the charter capital of LAW, with a total transfer value of VND 59,780,000,000. LAW officially became an affiliated company of BWE from March 15, 2023.

Just 2 months later, BWE continued to increase its ownership in LAW by purchasing an additional 1,654,740 shares. The transaction was conducted through an agreed trading method with a total fee of VND 33,127,894,800. The transactions were carried out and completed on May 31, 2023. After these transactions, up until the end of 2023, Biwase held over 38.06% of the charter capital, equivalent to over 4.6 million shares in Long An Water Supply and Sewerage Company. The total fee for the investment in LAW was VND 92,967,674,800.

Also in March 2023, Biwase carried out another acquisition of shares in Quang Binh Water Supply Joint Stock Company (code NQB, UPCoM listed), also owned by DNP Water. Specifically, on March 21, 2023, Biwase acquired 4,307,000 shares of NQB, equivalent to 25% of the charter capital of NQB, with a total transfer value of VND 57,713,800,000. The transaction was conducted through an agreed trading method. From March 21, 2023, NQB officially became an affiliated company of Biwase.

One month later, BWE continued to purchase an additional 2,758,000 shares to increase its ownership ratio in NQB. The transaction was carried out through an agreed trading method with a total value of VND 36,994,157,200. The transaction was carried out and completed on June 5, 2023. As of the end of 2023, BWE owned 7,065,000 shares in NQB, equivalent to a voting rights ownership ratio of 41%; the investment value recorded in the consolidated financial statements for the 4th quarter of 2023 was VND 94,765,671,000.

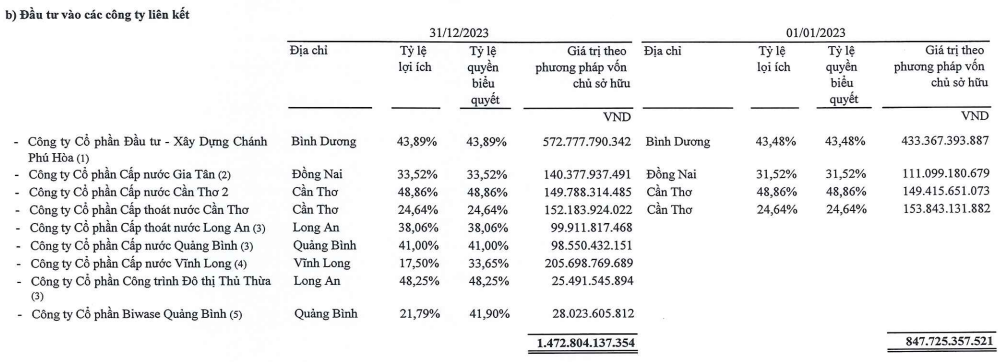

List of Biwase’s affiliated companies in the consolidated financial statements for the 4th quarter of 2023. Source: BWE

The third deal that Biwase conducted with DNP Water in the past year was the repurchase of 437,247 shares in Thua Thua Urban Development Joint Stock Company, owned by DNP Water. The number of shares is equivalent to 48.25% of the charter capital of Thua Thua, with a total transfer value of VND 20,651,175,810. This transaction was completed on August 30, 2023, making Thua Thua officially become an affiliated company of BWE.

On September 6, 2023, BWE issued Resolution No. 50B/BB-BOD on the unanimous decision to exercise the right to purchase shares under the plan to increase the charter capital of Thua Thua. Accordingly, BWE paid to purchase an additional 437,247 shares with a total value of VND 4,372,470,000.

As of December 31, 2023, BWE owned 874,494 shares, with a total investment value of VND 25,023,645,810. The voting rights ownership ratio of the company in Thua Thua is 48.25%.

M&A through subsidiaries

Furthermore, in 2023, BWE continued its M&A activities with Vinh Long Water Supply Joint Stock Company (Vwaco, code: VLW, UPCoM listed) through its subsidiary, Biwase Construction – Electricity Joint Stock Company (Biwelco). Specifically, last year, BWE received 9,725,862 shares of VLW transferred by Danang – Central Investment Joint Stock Company, equivalent to 33.65% of the charter capital of VLW, with a total fee of VND 190,494,838,534.

The transaction was conducted through an agreed trading method and completed on June 26, 2023. Among which, 7,124,962 shares, equivalent to 24.65% of the charter capital of VLW, were successfully transferred on April 5, 2023. From this date, Vinh Long Water Supply officially became an affiliated company of Biwelco.

The consolidated financial statements for the 4th quarter of 2023 reflected that as of December 31, 2023, BWE owns 33.65% of the voting rights and 17.5% of the beneficial ownership in VLW.

Another deal carried out by BWE through its subsidiary Biwelco was the investment in DNP Quang Binh Infrastructure Investment Joint Stock Company (DNP Quang Binh) – currently Biwase Quang Binh JSC (Biwase Quang Binh).

On October 14, 2023, Biwelco bought 2,427,300 shares of DNP Quang Binh owned by DNP Water, equivalent to 40.46% of the charter capital. The total transfer value was VND 24,811,860,600, making DNP Quang Binh an affiliated company of BWE.

In November 2023, based on the resolution of the Extraordinary General Meeting of Shareholders No. 06.11/NQ-GMS dated November 6, 2023 of Biwase Quang Binh regarding the issuance of additional shares of the charter capital to existing shareholders (with a ratio of 2:1; share issuance price of VND 10,000), Biwelco paid to purchase an additional 606,825 shares. The transaction value was VND 6,068,250,000.

As of December 31, 2023, Biwelco owns 3,034,125 shares, with a total investment value of VND 30,880,110,600. The voting rights ownership ratio of Biwelco in Biwase Quang Binh is 41.9%. Therefore, BWE also holds 41.9% of the voting rights and 21.79% of the beneficial ownership in Biwase Quang Binh.

In addition to the above-mentioned affiliated companies, Biwase also increased its ownership ratio in Dong Nai Water Company (code DNW). Specifically, in the trading session on May 12, 2023, Biwase bought 360,000 DNW shares. The total transaction value was VND 9,421,251,840.

The consolidated financial statements for the 4th quarter of 2023 recorded that BWE owns 22.6 million DNW shares, with a voting rights ownership ratio of 18.83%. The investment value recorded was VND 361,358,837,840.

In an updated report in mid-January 2024, BIDV Securities Company (BSC) assessed that the growth potential of BWE from 2025 onwards will come from its affiliated companies. However, in the short term, BWE will temporarily cease M&A activities as it needs to focus on restructuring the recently acquired companies, which have exceeded the planned budget (about VND 1,000 billion). Moreover, BWE has not had a divestment policy from State-owned capital in its affiliated companies.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)