Mr. Ho Xuan Nang was born in 1964, in the Year of the Wood Rooster. He is currently the Chairman of the Board of Directors of Vicostone JSC (stock code: VCS), Chairman of the Board of Directors of Phenikaa Group, Chairman of the Board of Directors of Phenikaa-X JSC, Chairman of the Board of Directors of AQP Research and Drug Testing JSC, Chairman of the Board of Directors of Vinh Thien Medical JSC, and Chairman of the School Board – Phenikaa University.

Mr. Nang currently owns assets worth nearly 8,700 billion VND, both directly and indirectly through Phenikaa Group’s ownership of VCS shares, making him one of the top 20 richest people on the Vietnamese stock market. In fact, in 2018, at the peak of VCS stock (Vicostone’s stock code) when it reached its highest level in history, Mr. Ho Xuan Nang was among the top 5 wealthiest individuals.

Starting off as the Deputy Secretary of the Chairman

Mr. Ho Xuan Nang is originally from Nam Dinh province and pursued higher education, earning a doctorate in engineering from the Hanoi University of Technology. After obtaining his doctorate, Mr. Ho Xuan Nang worked as a scientific researcher at the Agricultural and Food Processing Electro-Mechanics Institute under the Ministry of Agriculture and Rural Development. However, he later ventured into business and became the Production Director of Ford Vietnam.

In 1999, Mr. Nang joined the Vietnam Construction Import-Export Corporation (Vinaconex) as the Deputy Secretary of the Board of Directors, and later as the Deputy Chief of the Vinaconex General Office. At the end of 2002, the High-end Vinaconex Marble Factory was established based on a decision by the Vinaconex Board of Directors to invest in a production line for high-end artificial marble using organic adhesive material (Bretonstone) and a production line for high-end artificial marble using cementitious binder (Terastone).

From 2003 to July 2004 was a period of stagnation for the factory, with poor product quality, high rejection rate, sluggish domestic sales, and unsold products. Despite three changes in factory directors, the aforementioned issues remained unresolved, and the possibility of bankruptcy was imminent.

In July 2004, Mr. Ho Xuan Nang was appointed to replace the former director and began a comprehensive restructuring process, a turning point in the operational model and business strategy.

One of the changes in the operational model was the conversion of the factory into a joint-stock company. In December 2004, the Minister of Construction signed a decision to transform the High-end Vinaconex Marble Factory into Vinaconex High-end Marble Joint Stock Company, and in 2005, the company officially started operating as a joint-stock company with a charter capital of 30 billion VND, 60% of which was held by Vinaconex.

Immediately after the transition to a joint-stock company, in the last 6 months of the 2005 financial year, the company achieved a profit. 2006 was the first financial year with a post-tax profit of 5.6 billion VND, a significant amount compared to other member companies of the Vinaconex Parent Company at the time, demonstrating the effectiveness of the initial restructuring.

Since 2007, VCS has been listed on the stock market, and Vinaconex was still the parent company holding 51% of the shares, alongside shareholders such as Vietnam Holding (5%) and IPA Investment Joint Stock Company (5%). Subsequently, Vinaconex gradually divested, and by 2013 it had fully divested. In addition, Vicostone’s shareholder structure includes investment funds such as Red River Holding Limited and Beira Limited. However, during this period, VCS also caused a stir in the market due to the strained relationship between the management board and the foreign shareholder Red River Holding.

The acquisition deal that increased Mr. Ho Xuan Nang’s assets to billions of VND

The “shareholder war” ended when Mr. Ho Xuan carried out an M&A deal with Phenikaa Green Phoenix Corporation. Red River Holding left Vicostone, and the company unexpectedly witnessed impressive business results and stock price growth, causing the assets of the Chairman to skyrocket.

In August 2014, Vicostone Joint Stock Company (VCS) held an extraordinary general meeting of shareholders which approved the restructuring of the company, with the important content being the approval of Vicostone becoming a subsidiary of Phenikaa Group. Accordingly, Vicostone approved Phenikaa Group’s acquisition of 58% of Vicostone’s shares without a public tender offer.

Right in that month, Phenikaa completed the purchase of 58% of shares and became the parent company with controlling rights of Vicostone. By the end of September 2014, Vicostone repurchased 20% of the outstanding shares as treasury shares, increasing Phenikaa’s voting rights to 72.5%. Subsequently, Phenikaa continued to acquire more shares, and the current ownership stake is 84.15%.

Explaining why Vicostone accepted to become a subsidiary of Phenikaa, Vicostone stated that at that time, the company faced difficulties as it was threatened in terms of market share, operating results, and stagnating growth due to fierce competition from large competitors continuously investing in expanding production scale.

Meanwhile, Phenikaa signed an exclusive contract to import the largest quartz stone production line using the most advanced technology from Breton and held exclusive rights for 6 years, which meant that Vicostone no longer had the right to invest in equipment for the next 6 years. Furthermore, Phenikaa also established a factory in the Hoa Lac Hi-Tech Park, creating significant competitive pressure on Vicostone, and if Vicostone did not have a suitable strategy, it might not have the capacity to compete and develop.

According to the proposal of the Phenikaa shareholder group, which was also approved by the Vicostone Board of Directors, Mr. Ho Xuan Nang – the Chairman and CEO of Vicostone – repurchased the capital contribution stake in Phenikaa. As of December 31, 2014, Mr. Ho Xuan Nang announced his ownership of 90% of the charter capital of Phenikaa.

As a result, the leader of the acquired company “acquired” the acquiring company. This is a rare occurrence in M&A deals in Vietnam. With this move, Mr. Nang became the person with controlling rights over both Phenikaa and Vicostone.

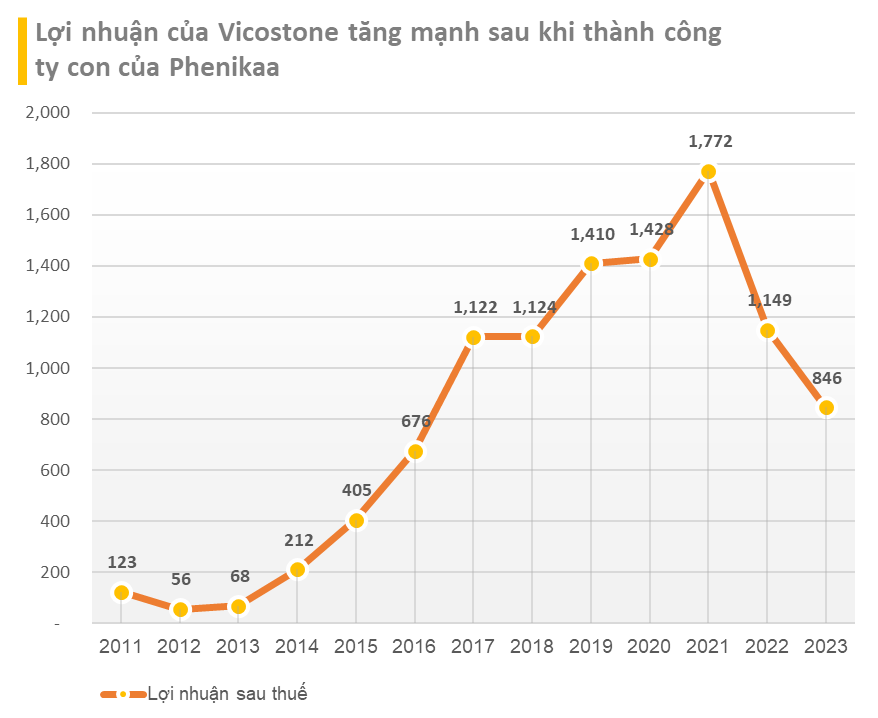

After this M&A deal, both the business results and the VCS stock price saw a sharp increase, leading to a rapid increase in the assets of Mr. Ho Xuan Nang. However, in the past 2 years, both the revenue and profit of VCS have sharply declined. In 2023, VCS achieved net revenue of 4,354 billion VND, a decrease of 23%, and a net profit of 846 billion VND, a decrease of 26% compared to the same period.

From 2008-2009, Chairman Ho Xuan Nang planned to invest in a university, but at that time, the global economic crisis occurred, and Vicostone was investing in the US market, so he had to put this plan on hold. In 2015-2016, Mr. Nang returned to pursue his dream, but he was only able to acquire a 35% stake in Phenikaa University. By the end of 2017, he finally gained full control of Phenikaa University.

Expanding into the education sector

After completing his doctorate, Mr. Ho Xuan Nang stayed at the Hanoi University of Technology as a lecturer. Due to encountering certain difficulties, in 1993, he left the university and began working at the Institute of Agricultural and Food Processing Electro-Mechanics under the Ministry of Agriculture and Rural Development.

From 2008-2009, Chairman Ho Xuan Nang planned to invest in a university, but at that time, the global economic crisis occurred, and Vicostone was investing in the US market, so he had to put this plan on hold. In 2015-2016, Mr. Nang returned to pursue his dream, but he was only able to acquire a 35% stake in Phenikaa University. By the end of 2017, he finally gained full control of Phenikaa University.