Oil rises 3% on the decision to reject the ceasefire in Gaza and US fuel reserves

Oil prices rose more than 3% due to concerns about the widespread conflict in the Middle East after Israel rejected Hamas’ proposal for a ceasefire.

At the close on February 8th, Brent crude oil rose $2.42/barrel or 3% to $81.36/barrel, while WTI crude oil rose $2.36 or 3.2% to $76.22/barrel. Brent crude surpassed $80/barrel and WTI rose above $75/barrel for the first time in February.

In the US, gasoline and distillate inventories fell more than expected, which also boosted the oil market. The decline in fuel inventories combined with an increase in crude oil inventories is a sign of maintenance in US refineries.

Demand growth remains strong in major oil-consuming countries, including India and the US.

Gold falls due to strong USD

Gold prices fell as the USD strengthened and silver bond yields increased due to the hope that the Fed will gradually cut interest rates, while palladium continues to decline due to expectations of long-term declining demand.

Spot gold fell 0.13% to $2,031.58/ounce. US gold for April delivery closed down 0.2% at $2,047.9/ounce.

The USD index rose 0.1%, making gold more expensive for holders of other currencies.

Currently, traders see a 61% chance that the Fed will cut interest rates from May.

Zinc reaches lowest level in 5 months

Zinc prices fell to the lowest level in over 5 months, affected by increasing inventories and concerns about the impact of the real estate sector, while copper touched its lowest level in nearly 3 months.

LME zinc for 3 months fell 2.8% to $2,333/tonne, reaching a low of $2,322, the lowest since August 22nd.

LME zinc has fallen 7.2% in the past month and 4.3% this week.

The weakness in the zinc market is also indicated by the increase in zinc inventories on the LME, which have risen 14% in the past 10 days to their highest level in a month.

LME copper fell 1.3% to $8,203/tonne, the lowest since October 17th due to the strong USD and investor concerns about China’s economy.

Dalian iron ore nears one-week high

Chinese iron ore prices rose to nearly a one-week high on hopes of increased demand from the real estate sector as China signals some support for this struggling sector.

Iron ore for May delivery on the Dalian Commodity Exchange closed up 2.4% at 963.5 CNY ($133.9)/tonne. Earlier in the session, prices reached 967.5 CNY, the highest since February 2nd.

In Singapore, iron ore for March delivery rose 2.4% to $128/tonne.

China aims to strengthen finance for housing projects in the coming days as part of their support measures. Construction accounts for a significant portion of steel and iron ore demand.

However, banks’ reluctance to lend to this struggling sector will still be a major obstacle for developers in need of new capital.

Japan rubber stabilizes

Japanese rubber prices stabilized in a weak trading session as investors held back from making large bets ahead of the long Lunar New Year holiday in China.

Rubber contracts for July delivery on the Osaka Exchange remained unchanged at 277.6 JPY ($1.87)/kg.

In Shanghai, the May contract rose 90 CNY to 13,365 CNY ($1,857.69)/tonne.

The market is quieter ahead of the Lunar New Year holiday and most tire factories in China will be closed.

Soybean rises, corn and rice fall

Soybeans on the Chicago Board of Trade closed higher due to late-session buying, as the market has difficulty determining the scale of Brazil’s harvest.

Both the US Department of Agriculture and Brazil’s Conab reduced their forecasts for Brazil’s soybean output after dry and hot weather.

Corn briefly turned positive before reversing lower on news of fewer-than-expected corn crops in Brazil.

Rice continues to face pressure from signs of declining prices in Russia, which have increased concerns about increased competition in exports.

CBOT soybean futures were most traded, closing up 4⅛ US cents at $11.93½/bushel.

CBOT corn fell 1 US cent to $4.33¼/bushel, while CBOT rice closed down 13½ US cents at $5.88½/bushel.

Cocoa price reaches record high due to traders competing for supply

Global cocoa prices reached a new record high as traders continued to compete for supply, predicting an ever-increasing deficit this season and increasing concerns in the coming crop year.

Cocoa contracts on the London market reached a new record at £4,670/tonne in this session, before closing at £4,660, up £7.35 on the day. Prices have nearly doubled since the beginning of last year.

In New York, cocoa reached a new high of $5,874/tonne, closing up 7.3% at $5,805, up about 90% since the beginning of last year.

Raw sugar closed up 0.4% at 23.98 US cents/lb, while white sugar rose 1.4% to $665.7/tonne.

Arabica coffee fell 1.1% to $1.8585/lb, while robusta coffee fell 0.2% to $3,109/tonne.

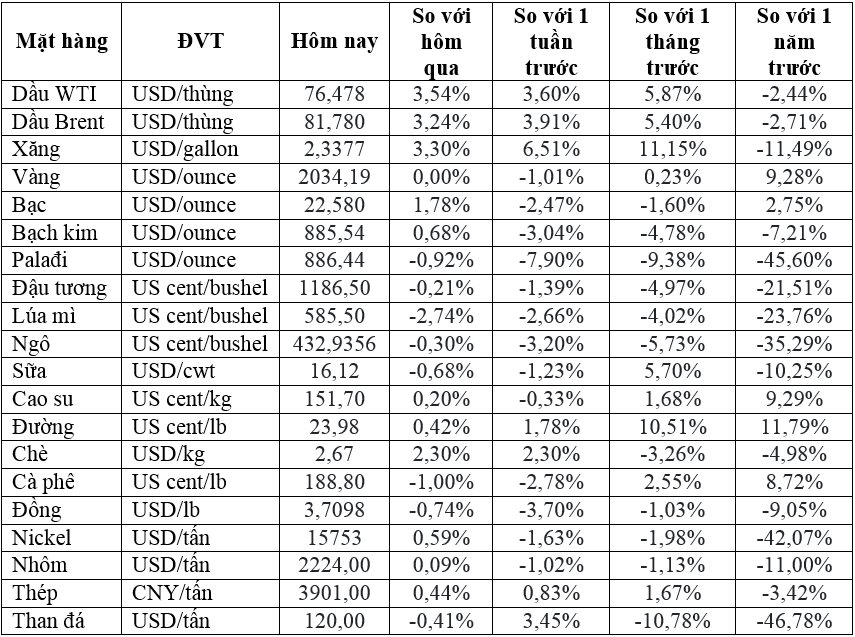

Key commodity prices as of February 9th