As we look towards the final quarter of 2024, the financial picture for the enterprise remains positive with revenue reaching nearly VND 26,830 billion, an 11.5% increase year-on-year. By effectively managing cost prices, the national carrier recognized a gross profit of VND 4,377 billion, a significant leap from the modest VND 189 billion in Q4 2023.

Vietnam Airlines recorded a net profit of over VND 920 billion in Q4, marking a consecutive four-quarter profitable streak for the national carrier.

For the full year 2024, Vietnam Airlines’ revenue hit a record VND 106,750 billion, a 16.5% increase from the previous year, setting a new milestone in its operational history.

The impressive revenue growth in 2024 was backed by two main factors: the full recovery of international flight networks along with the expansion of new routes, and the upward trend in domestic airfare prices, increasing by 15-20% compared to the first half of the year.

**Significantly Reduced Debt**

In addition to the promising business results, Vietnam Airlines also demonstrated positive shifts in its financial restructuring. As of the end of 2024, the company’s total debt had decreased considerably by 25% to VND 20,483 billion, accounting for 35% of the total capital of VND 58,064 billion. Of this, long-term debt stood at VND 6,172 billion.

While significant progress has been made, Vietnam Airlines still faces challenges due to accumulated losses. As of the end of 2024, this figure remained at VND 34,307 billion, far exceeding the chartered capital of VND 22,144 billion, resulting in negative equity of VND 10,045 billion. Regarding liquidity, the airline maintained VND 5,635 billion in cash and bank deposits, earning VND 56 billion in interest income for the year.

**Addressing Negative Equity**

To tackle the negative equity situation, Vietnam Airlines received crucial support when the National Assembly approved the comprehensive solution proposal in November 2024.

The approved plan allows the airline to offer additional share sales to existing shareholders, with a maximum scale of VND 22,000 billion, to be carried out in two phases.

In the initial phase, the State Capital Investment Corporation (SCIC) will invest VND 9,000 billion on behalf of the government. Subsequently, the second phase will involve a maximum issuance of VND 13,000 billion. This strategy is expected to help the airline not only eliminate negative equity but also reduce loan interest pressure and strengthen its fleet in the future.

Thiên Vân

– 10:53 30/01/2025

Coteccons Profits Soar to $85 Million in H1 of 2025 Fiscal Year

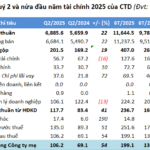

The first half of the 2025 financial year (July 1st to December 31st, 2024) saw the Construction Joint Stock Company Coteccons (HOSE: CTD) achieve impressive financial results. The company recorded a net profit of nearly VND 200 billion, a remarkable 47% increase compared to the same period last year, and successfully fulfilled 46% of its annual plan. Additionally, new contract wins amounted to VND 16.8 trillion, showcasing the company’s strong performance and promising future prospects.

The Captivating Craft of Words:

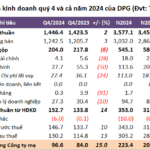

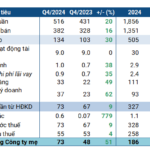

“Dat Phuong’s Profitable Prowess: A Stellar Fourth Quarter with nearly 100 Billion VND in Profit.”

The Joint Stock Commercial Bank for Foreign Trade of Vietnam, or Vietcombank, has announced its fourth-quarter 2024 financial statements, reporting a net profit of VND 97 billion, the highest in the past seven quarters. This figure represents a 15% increase compared to the same period last year, yet Vietcombank has only achieved 88% of its annual profit plan.

The Power of Words: Unlocking Online Success with Captivating Copy

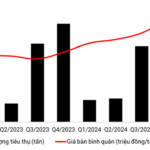

Unleash the Potential: Discover the Secrets to Writing Compelling Content that Boosts Revenue for Cao Su Dong Phu with Soaring Rubber Prices

In 2024, the continuous rise in rubber prices propelled Dong Phu Rubber Joint Stock Company (HOSE: DPR) to record peak revenue in a decade.