Profitable stock investment through interest income

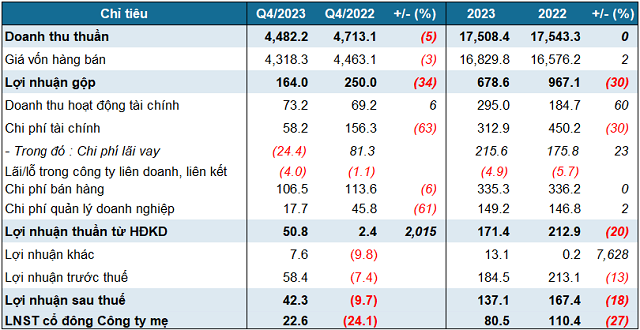

According to Petrosetco’s consolidated financial statements for the fourth quarter of 2023, the company’s net revenue was over 4.482 trillion VND, a 5% decrease compared to the same period. Petrosetco explained that the difficult economic situation led to a decrease in demand for electronic products compared to the same period.

After deducting the cost of goods sold, Petrosetco’s gross profit was 164 billion VND, a 34% decrease; the gross profit margin decreased by 1.6 percentage points to 3.7%.

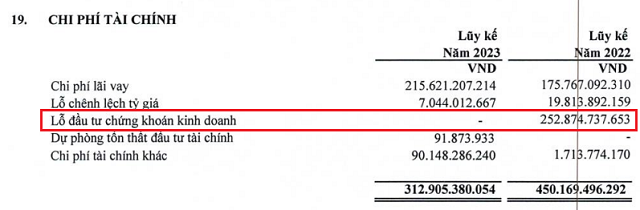

Amidst the lackluster core business performance, financial activities became a bright spot as they generated a profit of 15 billion VND, significantly better than the 87 billion VND loss in the same period. According to Petrosetco, the main reason for this improvement is that in 2022, the company had a loss due to financial investments of about 50 billion VND, while in 2023, no such financial investment was made.

Source: Petrosetco’s Q4 2023 consolidated financial statements

|

Other positive points came from the reduction in selling and business management expenses by 6% and 61%, to 107 and 18 billion VND, respectively. The SG&A expense ratio decreased by 0.6 percentage points to 2.8%.

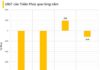

With these factors, Petrosetco achieved a profit of nearly 23 billion VND in the final quarter of the year, instead of a loss of over 24 billion VND in the same period.

However, after facing accumulated difficulties in the first 9 months of the year, Petrosetco was unable to end 2023 with growth. Specifically, the total revenue for the whole of 2023 was over 17.508 trillion VND, remaining relatively unchanged compared to the previous year, and the net profit was nearly 81 billion VND, a 27% decrease.

In 2023, Petrosetco set a target of 18 trillion VND in net revenue and 240 billion VND in net profit after tax. Therefore, the company has nearly achieved its revenue target with a 97% ratio, but has only achieved 57% of its profit target.

|

Petrosetco’s Q4 business results and 2023 overall performance

Unit: Billion VND

Source: VietstockFinance

|

During Petrosetco’s annual business review in December 2023, CEO Vu Tien Duong mentioned that the company’s core business sectors faced many challenges.

In terms of revenue, Petrosetco’s distribution services segment in 2023 is expected to reach 15.198 trillion VND, approximately the same as the previous year and close to the 2023 plan; the lifestyle services segment is expected to reach 1.017 trillion VND, achieving 101% of the annual plan and 109% compared to the same period; the real estate management services segment is expected to reach 759 billion VND, achieving 125% of the annual plan and 150% compared to the same period; the remaining supplies and petroleum support services segment did not meet expectations.

Although not meeting profit expectations, the company’s after-tax profit margin on equity of approximately 15% is a noteworthy result.

Story of personnel changes, ownership structure, and underwhelming business results at Petrosetco

Asset structure fluctuated, increased borrowing

As of December 31, 2023, Petrosetco’s total assets were over 10.088 trillion VND, a 12% increase compared to the beginning of the year. Among them, short-term receivables were over 2.986 trillion VND, a 47% increase, accounting for 30% of total assets. The company also increased the value of short-term financial investments by 44%, to 2.640 trillion VND, accounting for 26% of total assets.

In contrast, inventory and cash equivalents decreased by 22% and 6%, to 1.897 trillion VND (19% of total assets) and 1.029 trillion VND (10% of total assets), respectively.

On the liabilities side, Petrosetco had total borrowings of nearly 4.527 trillion VND, a 22% increase compared to the beginning of the year, accounting for 45% of total capital, mostly short-term loans from BIDV, VCB, and other banks.

In addition to the high proportion of borrowings, short-term payable to suppliers also accounted for a significant proportion at 16%, or 1.577 trillion VND.

Huy Khai