According to the data released by the State Bank, the amount of money deposited into the banking system by citizens and economic organizations by the end of 2023 reached over 13.5 million trillion dong (an increase of 13.2% compared to the end of 2022), the highest in the history of the banking industry.

Accordingly, in 2023, deposits from citizens and economic organizations increased by an additional 1.68 million trillion dong – the highest increase ever. Compared to 2022, the amount of deposits in 2023 nearly doubled.

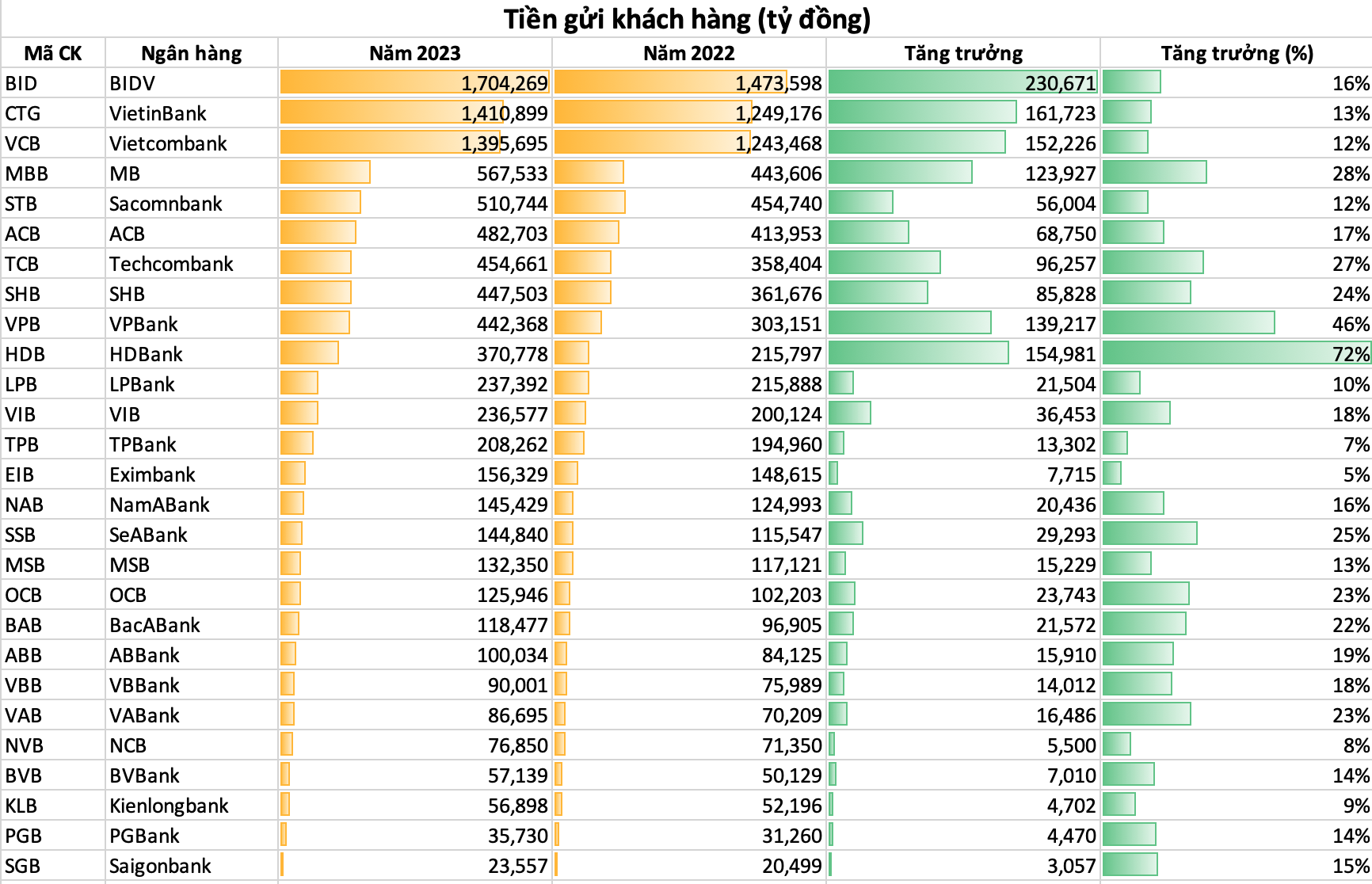

Financial reports show that many banks have recorded the highest deposit growth in recent years. At the same time, no bank saw a decrease in deposits in 2023.

In terms of growth rate %, HDBank attracted the most customer deposits with a growth rate of 72% in 2023. The deposit balance of customers at this bank reached 370,778 trillion dong by the end of 2023, ranking 10th among listed banks. HDBank’s deposits increased by nearly 155 trillion dong, on par with other major banks such as VietinBank (with an increase of over 161 trillion dong) and Vietcombank (with an increase of over 152 trillion dong).

In terms of additional balance, BIDV ranked first with an increase of over 230 trillion dong, equivalent to a growth rate of 16%.

The top 10 listed banks (excluding Agribank) with the highest deposits are currently BIDV, VietinBank, Vietcombank, MB, Sacombank, ACB, Techcombank, SHB, VPBank, HDBank.

There have been some changes in rankings compared to 2022. MB grew by 28% and surpassed Sacombank to become the 4th largest bank in terms of deposits among listed banks. Techcombank grew by 27% and surpassed SHB to rank 7th.