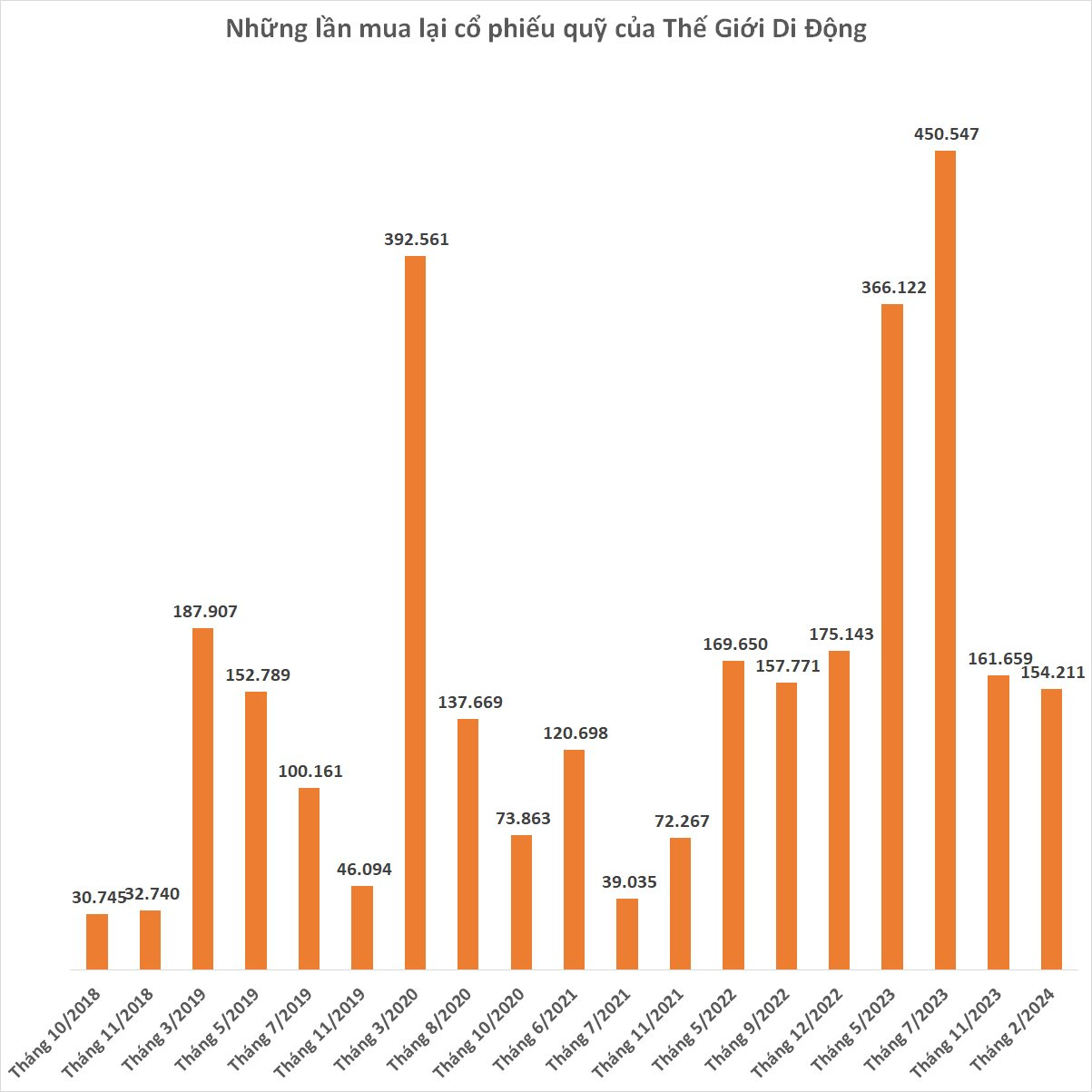

The World Mobile Investment Joint Stock Company has just announced the first stock buyback of 2024. Normally, World Mobile will have 3-4 buyback sessions each year.

Compared to previous years, this year’s first buyback session is earlier. Specifically, in 2022 and 2023, the first buyback took place in May. Before that, in 2021 it was June, and in 2019 and 2020 it was March.

In the first session of 2024, World Mobile plans to repurchase 154,211 treasury shares. If the transaction is successful, the company’s treasury stock will increase to 1.13 million units.

These are shares recovered under the Employee Stock Ownership Plan (ESOP) program of employees who have resigned under ESOP issuance regulations.

The repurchase price is VND 10,000 per share, equivalent to a total amount of VND 1.54 billion that the company needs to spend. This is also the price that World Mobile issued to employees. The transaction is expected to be conducted in February and March, and will be carried out through the Vietnam Securities Depository (VSD).

According to observations, the amount of treasury shares the company repurchased in this session is equivalent to the average level of the 2019-2022 period, and significantly lower compared to the first two sessions of 2023.

In 2023, World Mobile repurchased a total of 978,328 treasury shares, nearly double compared to 2022, more than 4 times compared to 2021, and even 1.5 times compared to 2020.

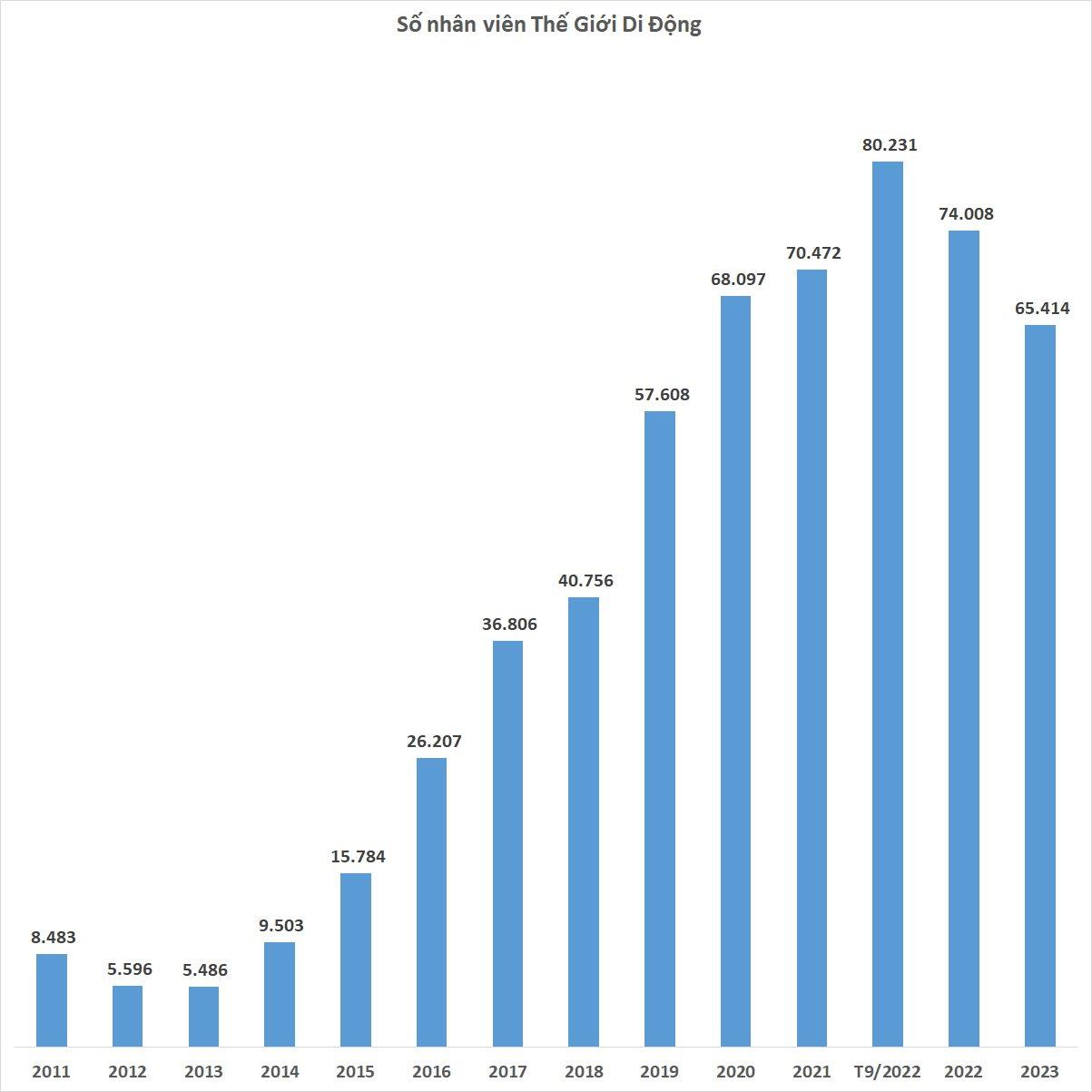

2023 was also the year when World Mobile reduced its workforce by 8,600 employees, marking the first year of a decline in personnel after 10 consecutive years of growth. In Q4/2023 alone, the company reduced nearly 3,000 employees as about 200 stores had to close due to unfavorable business conditions.

ESOP is a long-standing policy maintained by World Mobile and is an important strategy of the company to retain talents, regardless of the opinions of some shareholders who believe that the issuance ratio is too large and affects the rights of shareholders.

However, in 2023, World Mobile did not issue ESOP.

According to the newly announced business results, World Mobile ended 2023 with a revenue of VND 118.28 trillion, a decrease of 11% compared to the previous year, and achieved 88% of the target.

After-tax profit was VND 168 billion, a decrease of 96% compared to last year.