Tet is an ideal time for many people to send savings. It is a milestone that marks a new start for the journey of accumulation and saving. It is also a way to increase luck and double fortune throughout the year.

Savings interest rates at many banks have decreased significantly, both online and at counters. However, some banks still offer special policies with higher interest rates for customers.

For example, at Wooribank, an attractive interest rate package called Won Challenge is deployed with the highest interest rate of 11% per year for a 12-month term, 10% for a 12-month term, and 6% per year for a 9-month term. However, this interest rate package sets conditions, customers can only deposit a maximum of 5 million VND and a minimum of 1 million VND/month. In addition, this bank also has an accumulated savings package with an interest rate of up to 7.5% for a 36-month term. As for the usual online savings interest rate, the interest rate is only about 5% per year.

At Cake by VPBank, the preferential interest rate is up to 5.5% per year for terms from 13-36 months. Meanwhile, the savings interest rate for a 6-month term is 5.2% per year.

Techcombank also has an online Lucky deposit interest rate package with the highest interest rate of 5% per year for terms from 12-36 months. For a 6-month term, the interest rate is 4% per year.

At NCB, the deposit interest rate is posted by the bank at 5.15% per year for a 12-month term; 5.25% per year for a 13-month term, and 5.45% per year for a 15-month term. In addition, this bank also has the An Phu savings package, with the highest interest rate of 5.7% per year for deposits from 18 months to 60 months.

For a 24-month term, OCB bank currently applies a quite attractive online savings interest rate, up to 5.8% per year.

Some e-wallets also promote cash withdrawal services with preferential interest rates. For example, the savings interest rate on ZaloPay wallet for a term can be up to 6.1% per year (Minimum deposit amount of 500,000 VND and a maximum of 50 million VND).

Viettel Pay also launched a savings package with an interest rate of 3.5% per year. Although the interest rate is low, customers will receive daily profits.

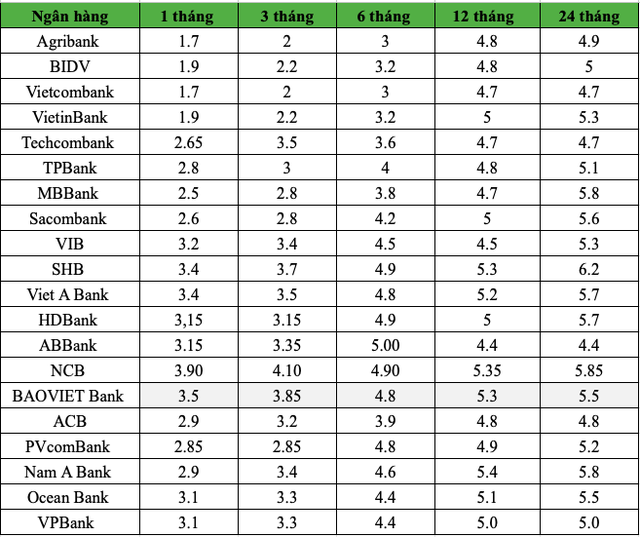

Below is a table of the usual online savings interest rates at 21 banks.

The usual online savings interest rates at some banks on the 1st day of Tet