Reducing reliance on lending activities and increasing income from non-lending services is one of the key tasks set by the Government in the strategy for the development of the banking sector by 2025 and the orientation to 2030.

Accordingly, in Decision No. 986/QD-TTg dated August 8, 2018, the Government set a target for the share of income from service fees to reach about 12-13% by the end of 2020 and increase to 16-17% by the end of 2025. However, after 5 years, the approved strategy is still far from the target.

STRONG DIFFERENTIATION IN PROFIT STRUCTURE TRANSFORMATION

The issue of reducing reliance on lending income and increasing income from non-lending activities of commercial banks has been raised by the Government since 2012 (under the plan “Restructuring the credit system in the period of 2011-2015”).

Experts believe that this transition helps diversify risks for banks. While lending activities carry many risks such as liquidity and bad debts, non-lending activities carry very little risk and provide a stable source of income for banks.

For the entire economy, the increased non-lending activities of banks contribute to the circulation of capital, contributing to economic growth. Banking services have an impact on various sectors of the economy, including industry, agriculture, trade, services, import-export, etc.

In addition, the development of non-lending services also contributes to the enhancement of financial transparency in the economy, actively contributing to the prevention of corruption, tax evasion, money laundering, etc.

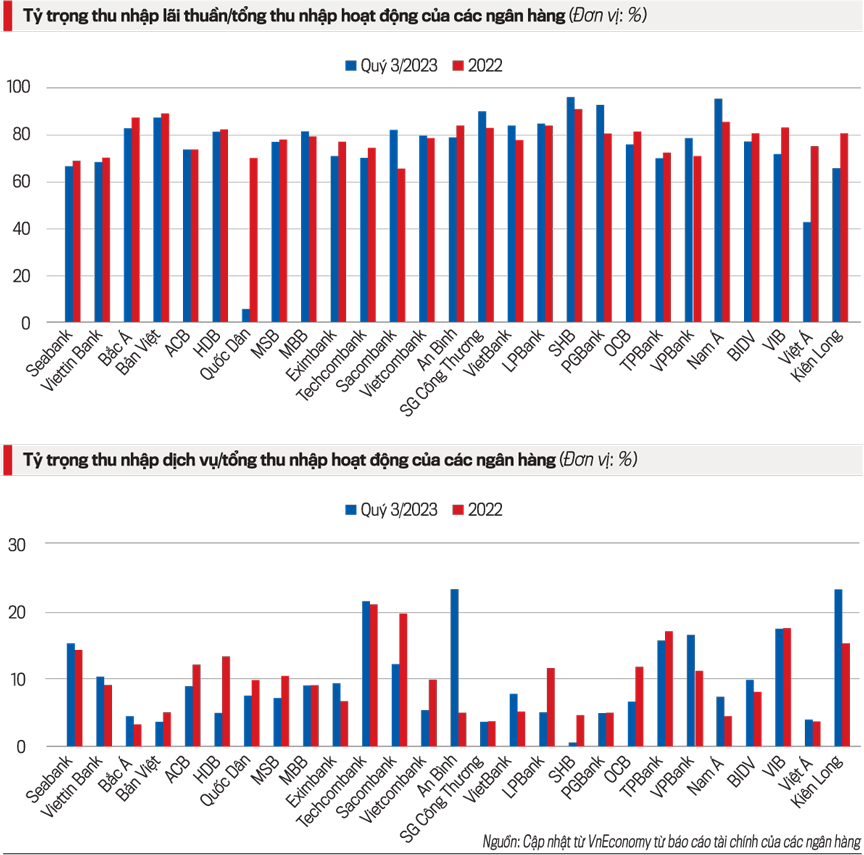

According to information on the State Bank of Vietnam’s website, during the period 2014-2019, interest income accounted for an average of 78%, while the proportion of fee income ranged from only 12% to 14% of the total operating income of commercial banks in Vietnam.

Thus, the share of income from non-lending activities of the entire banking system is currently narrower compared to the 2014-2019 period.

This decrease is largely due to the bancassurance channel crisis that occurred in early 2023. Prior to that, bancassurance in the period 2020-2022 was considered a “golden goose” for banks.

Statistics from the financial statements of banks show that most banks have reduced the proportion of net income from non-lending activities in Q3/2023 compared to the end of 2022, with a sharp decline in profits from insurance business.

There is a large differentiation in the race to transform profit structure among banks. By the end of Q3/2023, 5 out of 27 listed banks had a net interest income ratio of 90% to above 96%, 7 out of 27 banks maintained this ratio above 80%, and the remaining 15 banks had over 70% of their profits coming from lending activities.

Some banks have been able to maintain a high and stable net interest income ratio from non-lending activities in the system such as SeaBank, TechcomBank, VPBank, and VIB.

Notably, as of the end of Q3/2023, the proportion of income from non-lending activities of An Binh Bank increased sharply from 5.17% at the end of 2022 to 21.65% on September 30, 2023. It is even more remarkable that in April 2023, An Binh Bank became the first bank to terminate the bancassurance contract with FDW.

TECHNOLOGY BRINGS SUSTAINABLE TRANSFORMATION OPPORTUNITIES

Thus, the operating income structure of commercial banks in Vietnam is still weighted towards interest income, and the proportion of fee income is significantly lower than the set target in the development strategy for the banking sector and is still far behind other countries.

Looking at the positive side, the Vietnamese banking sector still has room to increase fee income, especially in the context of rapid technological advancements.

According to The Financial Brand, in the US market, the fee income ratio accounts for about 33-36% of the banks’ operating income; in the European market: 31-33%; in the Thai market: 26-28%; in the Japanese market: 32-36%, and in the Chinese market: 21-22%.

Over the past two decades, the rapid progress of science and technology, along with the explosion of the connected society, has quickly changed customer behavior, especially in the financial services industry. This context has opened up new trends and also clarified existing trends in banking operations. These include: open banking, digital banking, retail banking, green banking, financial investment services, and the rise of Fintech.

Worldwide, financial experts have introduced the concept of four generations of banks.

Banking 1.0: Traditional banking activities through history, with physical branches as the main access point (1472-1980 period).

Banking 2.0: Self-service banking trend, identified by banks providing services outside working hours (starting from ATM systems and accelerating from 1995) (1980-2007 period).

Banking 3.0: Banking transactions occur at the time and place of demand, starting with the emergence of smartphones in 2007 and accelerating with the shift to mobile payments, P2P (2007-2017 period).

Banking 4.0: Banking transactions take place everywhere, integrated into people’s daily lives, and carried out in real-time through technology platforms (from 2017 onwards). This is the model of an open bank.

In Vietnam, some banks have made strong transformations to keep up with the trend of open banking, aiming to integrate banking services into all aspects of human life, in real-time, based on new technologies, and minimizing barriers that slow down the connection process between banks and customers. In this development roadmap, banking service products will become increasingly diverse, abundant, and personalized to meet all customer needs. This will be a very favorable factor for banks to gradually reduce their dependence on income from traditional banking activities…

The complete content of the article was published in the Vietnam Economic Magazine No. 7+8-2024, issued on February 12-25, 2024. Readers are invited to read it on here https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam.