Recently, HSBC has released a report on the economic situation in Vietnam in 2024 with the title “‘Strongly catch’ consumers”. According to the report, Vietnam has started 2024 with strong signs of economic recovery. Even when factoring in the base effect, exports have rebounded at an astonishing pace, evidenced by stable trade turnover.

“Drop the iron hunt…”

After a challenging Year of the Cat, HSBC experts believe that the context of Vietnam is expected to improve in the Year of the Dragon. The report states that although it is still necessary to pay attention to the important export cycle, it is equally important to evaluate how domestic demand is evolving.

“The short answer is: while it is expected to compensate for the slowdown in external demand, domestic demand is also facing increasing pressure but is expected to improve, the initial signs being some consumer stocks recovering,” HSBC assessed.

In the context of Tet holidays approaching in mid-February 2024, according to HSBC, despite the impact of the base effect, Vietnam’s trade continues to recover steadily. Exports have grown at an astonishing pace of 42.0% compared to the same period last year, thanks to a stable recovery in electronic exports.

Furthermore, the number of pre-orders placed for the new Samsung Galaxy S24 phones is also somewhat optimistic. However, optimism is not limited to the electronics sector as exports are showing high growth across the board. Sectors that had suffered from stagnation in 2023, such as textiles, machinery, and wood products, have started to experience significant growth.

Nevertheless, the report also notes the need to be cautious about the overall recovery pace as the export machine needs additional impetus from the growth of large economies around the world. Meanwhile, inflation remains under control in general, but there are still price risk factors, from the potential for electricity price hikes to rising rice prices.

“Overall, January is truly a ‘fortunate’ start for Vietnam’s economic recovery despite the need to be cautious about associated risks,” the report emphasized.

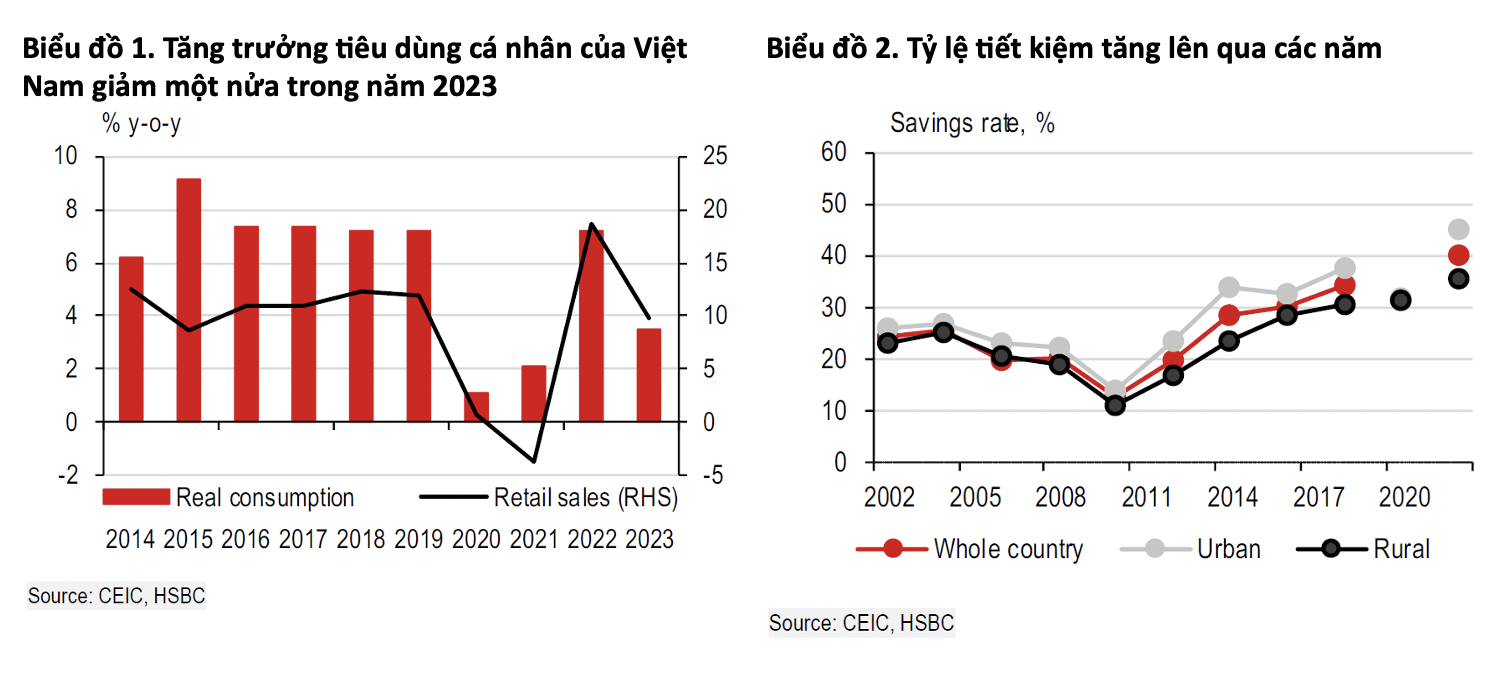

In fact, Vietnam has a large consumption proportion, accounting for over 50% of GDP. With an average annual growth rate of 7.5% before the pandemic, personal consumption has dropped significantly since the outbreak, except for the reopening period in 2022. In particular, personal consumption growth has halved in 2023, reflecting the significant impact of the economic slowdown on households.

The report explains that part of the reason is the effect of asset value fluctuations due to the real estate sector weakening in cycles, and another part is due to significant changes in consumer behavior since the pandemic. Consumers tend to be cautious about economic fluctuations, thus increasing their savings. Although data for 2023 has not been released, the 40% increase in the savings rate in 2022 shows this trend to some extent.

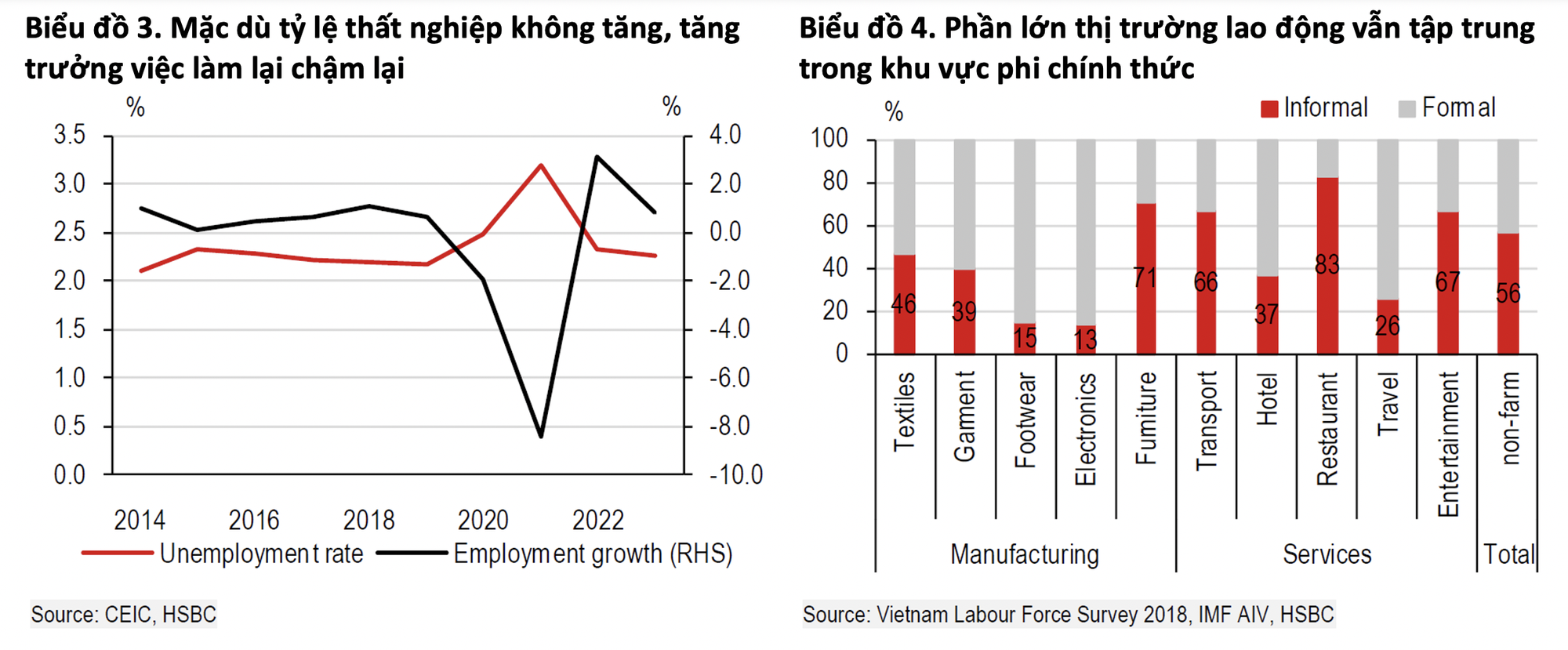

This is reinforced by looking at the Vietnamese labor market. While the unemployment rate remains at a low 2.3%, employment growth has slowed down in 2023 and is still heading towards recovery rather than reaching full recovery. Moreover, a large part of Vietnam’s labor market is concentrated in the informal sector, a trend not unique to ASEAN. In the textile and garment manufacturing industry, this rate accounts for nearly half and even up to 60% in some tourism-related service sectors.

In addition, the report states that Vietnam is anxiously awaiting the cyclical recovery in global trade, which is the main hope for the job market. Fortunately, the electronics sector has recently seen some positive signs, indicating that the darkest period for the commercial sector has passed.

However, each sector is different as the recovery is not evenly distributed. Industries that provide a large source of employment, such as textiles and footwear, have not completely escaped the difficult period. Asia is still in the early stages of the trade recovery process, and we need more evidence to see stable and sustainable recovery thanks to strong support from major economies worldwide.

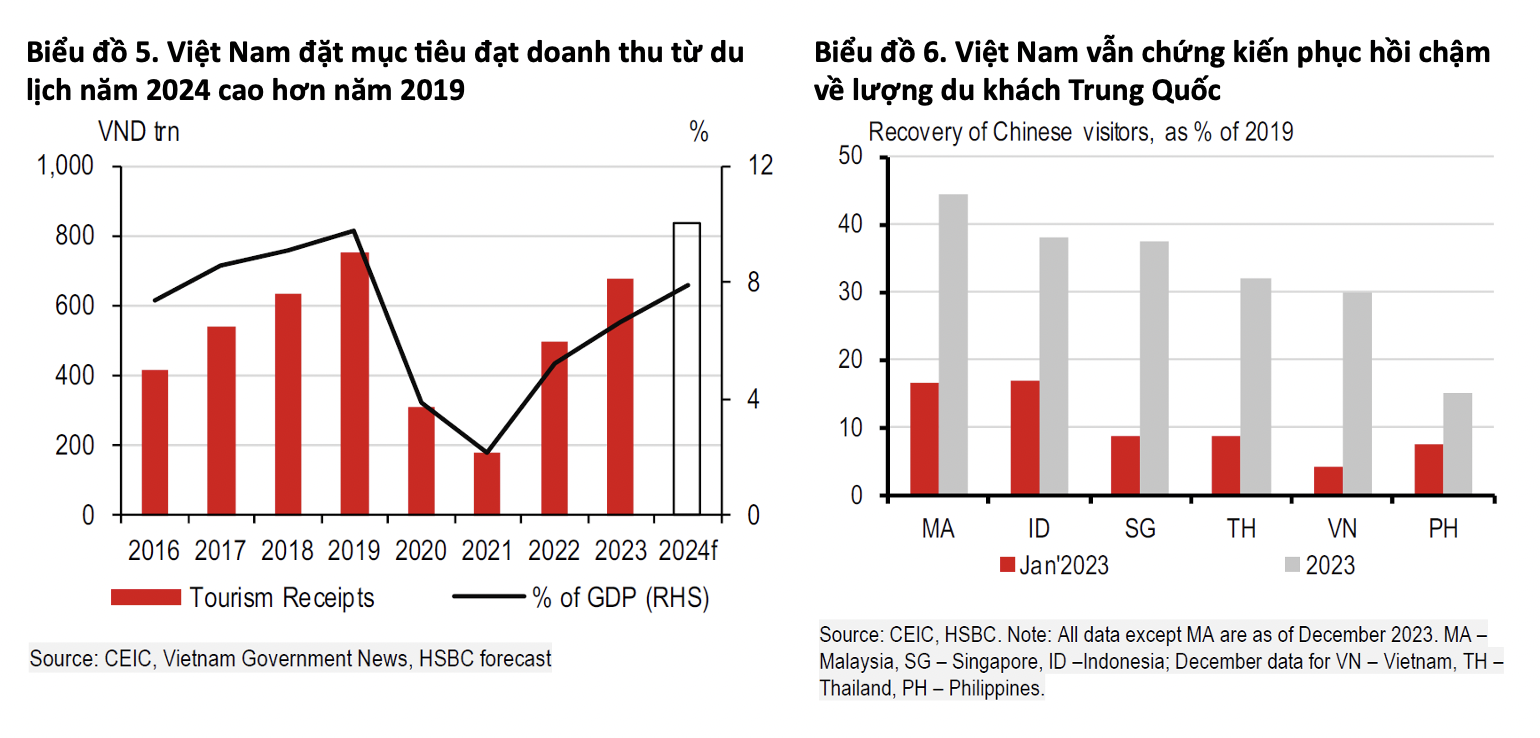

Meanwhile, complete recovery in the tourism sector is also important for the labor market, supporting workers in the service industry. Thanks to favorable policies such as extending visa-free stays for visitors from certain countries and granting e-visas to citizens of all countries since mid-August, Vietnam has welcomed about 12.6 million foreign visitors (70% of 2019’s level), far exceeding the state’s initial target of 8 million visitors.

This positive outlook even prompted the Vietnam National Administration of Tourism to set an ambitious target for this year of 17-18 million foreign visitors, nearing the record high of 2019, aiming for a total revenue of VND840 trillion (8% of GDP), surpassing the level of 2019 (see chart 6). Based on previous trends, this means that international tourism in 2024 could account for about 4% of GDP, equivalent to the pre-pandemic average of Asia.

Nevertheless, competition in the regional tourism market is becoming increasingly intense. While the recovery of Chinese tourists has been slower than expected, full recovery of ASEAN tourism would require a significant number of Chinese tourists, the largest supply source for tourism. Countries in the region, including Thailand, Malaysia, and Singapore, have all introduced visa-free programs for Chinese tourists, increasing the attractiveness of “spontaneous trips” for tourists.

“… Catch the ro fish”

HSBC experts assess that despite the cyclical challenges, structural trends continue to promise for Vietnam. Impressive development in the last 20 years, overall asset growth has driven stronger consumer spending, stimulating the shift towards non-essential goods and services.

In addition, the emerging middle class has attracted the attention of international companies seeking profit opportunities from increased Vietnamese spending. Japanese FDI flow into the retail and financial services sectors has grown strongly as a notable example. Although people’s assets are increasing, nearly 80% of the population still do not have access to or have incomplete access to banking services, according to the Asian Development Bank (ADB). The latest Comprehensive Financial Inclusion data from the World Bank also confirms this, showing that Vietnam has significant potential to develop mainstream lending channels, which are still in the early stages of development.

In addition to the potential, the report also highlights some noteworthy issues. The main issue to note is the increasing household debt. Although there is no data to measure in Vietnam, HSBC experts have estimated through analyzing the financial reports of four major banks, which may include loans to small businesses. From 2013 to 2022, household debt increased significantly from 28% of GDP to 50% of GDP. Unsustainable increases in consumer leverage could pose significant risks to the Vietnamese banking industry and future consumer spending as income must be further cut to repay debts.

Fortunately, the government has implemented a series of support measures for both businesses and households in 2023, such as extending tax reduction periods, reducing interest rates, and extending repayment terms. While financial strains may persist and need to be monitored in the short term, there are signs that the worst period has passed.

“In our viewpoint, cautious but improving sentiment in the real estate sector will boost overall consumer sentiment. Meanwhile, positive prospects for the labor market will support salary growth, thereby improving household debt repayment capacity,” HSBC concluded.

“Despite cyclical difficulties, we believe that Vietnam’s long-term potential as a rising star in domestic consumer spending remains intact, evidenced by the continued interest of global consumer companies,” the report emphasized.