Illustrative image

Rising oil prices

Oil prices rose in the end of the week, up 6% this week amidst continued tensions in the Middle East after Israel rejected Hamas’ cease-fire offer and supply constraints in the filtered product market due to halted oil refining activities.

At the close of February 9, Brent crude rose 56 US cents or 0.7% to $82.19 per barrel, while WTI crude rose 62 US cents or 0.8% to $76.84 per barrel. WTI crude rose more than $1 in early trading sessions.

Oil prices have risen for the fifth consecutive day as Israeli Prime Minister Benjamin Netanyahu rejected Hamas’ cease-fire proposal.

The Energy Services Agency Baker Hughes said this week that US energy companies added four oil and natural gas drilling rigs, bringing the total to 623, the highest since mid-December 2023.

According to the US Energy Information Administration, oil production in the country rose to a record high of 13.3 million barrels per day this week.

On the last day of the week, Israel continued deadly airstrikes in Gaza Strip after a bomb attack on the southern border town of Rafah pushed oil prices up about 3% in this session.

Crude oil is supported by strong gasoline and diesel prices due to significant downtime of both planned and unplanned oil refineries, tightening the product market.

Gasoline futures rose 9% this week to $2.34 per gallon, while heating oil rose 11% to $2.96 per gallon.

Ukraine launched drone strikes against two oil refineries in southern Russia on Friday, causing a fire at the Ilsky oil refinery. The Afipsky oil refinery in Krasnodar Krai is another target of the attack.

Russia is exporting more crude oil this February than expected under the OPEC+ agreement, following a combination of drone attacks and technical failures at the country’s oil refineries.

Gold falls

Gold prices declined and marked a weekly decline, pressured by rising yields on US Silver bonds as investors waited for US inflation data this week for more clues on the timing of the Fed interest rate cut.

Spot gold fell 0.5% to $2,022.86 per ounce and fell 0.8% this week. US gold for April delivery closed down 0.4% at $2,038.7 per ounce.

The yield on the US 10-year Silver bond rose to a two-week high, while the two-year yield hit a two-month high, making gold less attractive to investors.

The Fed may keep rates high for longer, meaning most central banks may follow suit.

Copper continues to decline

Copper prices continued to decline in the last session to the lowest level in nearly three months as US speculators bet on lower prices regardless of news that the top consumer of the world’s leading metal, China, has bolstered its economy with financial measures.

Zinc and lead hit new lows as increased inventory highlight weak demand and oversupply.

Copper delivered after three months on the London Metal Exchange closed down 0.2% at $8,177 per ton, the lowest since November 14, 2023.

This contract lost 3.6% for the week and set the largest weekly decline since May 2023.

Comex copper in the US fell 0.6% to $3.68 per pound.

In morning trading sessions in Europe, copper rose slightly after data showed that new bank lending in China rose more than expected to a record high in January, reinforcing expectations for more stimulus measures in the coming months.

The Shanghai Stock Exchange closes until the end of next week for the Lunar New Year holidays.

The prolonged real estate crisis in China has put pressure on sentiment, as construction is a major sector of base metals.

Japanese rubber increases, but has a second consecutive week of price decline

Japanese rubber prices increased, supported by a weak JPY and rising oil prices, despite this market having a second consecutive week of price decline.

The July delivery rubber contract on the Osaka Exchange closed up 0.1% at JPY 278 per kilogram. This contract has fallen 1.7% this week.

The JPY fell to its lowest level in 10 weeks, while the USD rose for the fourth consecutive week as traders returned to betting on how fast the Bank of Japan will raise interest rates and how soon the Federal Reserve will cut its interest rates.

Weak supply pushes rice prices in India to a new record

The price of exported rice from India is expected to continue to rise this week, rising for the fourth consecutive week to a new record level as supply remains limited.

5% broken rice from India was offered at a record price of $542 to $550 per ton this week, up from $537 to $546 per ton a week ago.

Pakistani rice exports may reach a record high by the end of the year in June after India’s export restrictions forced buyers to return to Islamabad, where prices were the highest in nearly 16 years.

Thai 5% broken rice was offered at $630 per ton, down from $640 per ton a week earlier due to sluggish market activity.

A trader based in Bangkok said there were no large orders, adding that previous orders were being fulfilled.

Another trader suggested that the price decrease was due to recent auction sales in Indonesia that achieved low prices.

Vietnamese 5% broken rice was offered at $635 to $640 per ton, unchanged from a week ago.

Cocoa prices reach record levels for the 9th consecutive day

World cocoa prices hit a new record for the 9th consecutive day, causing market participants to fear that the supply shortage will become system-wide and will extend to the fourth consecutive season.

Industry experts say this price increase is also expected to have a deeper impact on consumers’ wallets for chocolate.

London cocoa reached a record high of 4,916 GBP per ton before closing up 2.1% at 4,757 GBP per ton. Prices have more than doubled since the beginning of last year.

A Reuters survey showed a global shortfall of 375,000 tons this crop year, more than double the estimate in an August survey.

Raw sugar closed up 0.2% at 24.02 US cents per pound, while white sugar changed little at $665.5 per ton.

Arabica coffee closed up 5.65 US cents or 3% at $1.915 per pound, and robusta coffee rose nearly 3.5% to $3,217 per ton.

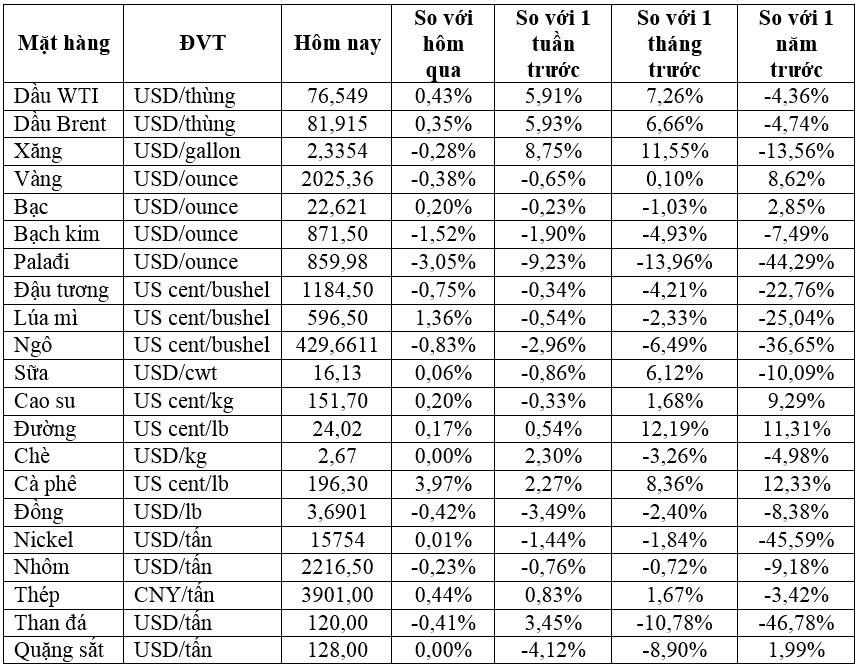

Prices of some key commodities as of the morning of February 10

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)