Alacarte Hạ Long Project by Taseco Land. Source: Taseco Land

|

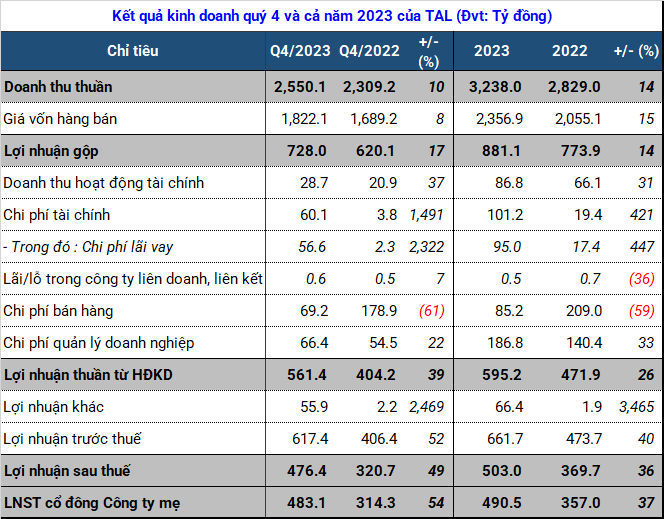

During the period, the revenue of Taseco Real Estate Investment Joint Stock Company (UPCoM: TAL) increased by 10%, reaching 2.5 trillion VND, mainly from the transfer of apartments in the NO1-T6 high-rise mixed-use building in the Diplomatic Compound area, the Alacarte Hạ Long mixed-use hotel-apartment project, and the City 4 project in Thanh Hoa city.

According to TAL, thanks to effective cost management measures, the company was able to save on cost of goods sold and therefore gross profit increased by 17% to 728 billion VND.

There were three other favorable factors that helped TAL achieve a favorable profit in the fourth quarter. First, financial operating revenue increased by 37% to 28 billion VND. Second, sales expenses decreased significantly by 61% to 70 billion VND, according to TAL, thanks to the efforts in sales team and marketing to promote and introduce apartments, which reduced commission and brokerage fees.

Source: VietstockFinance

|

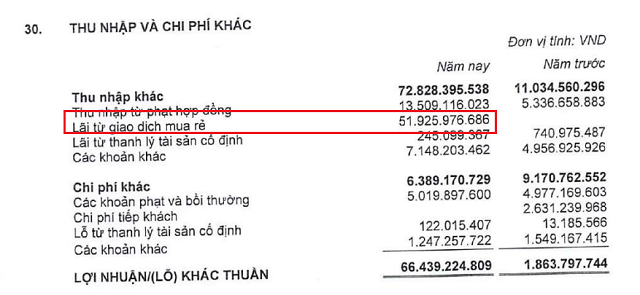

Finally, although not separately presented in the fourth quarter, it is very likely that the recognition of profit from cheap purchases, here referring to the acquisition of equity investments, corresponding to 60% of the capital of P&I Resort Co., Ltd., helped TAL generate an additional 52 billion VND, which was not available in the same period last year.

On the flip side, interest expense and business management expense increased significantly. In the past quarter, TAL’s interest expense increased 24 times compared to the same period in 2022, from 2.3 billion VND to 57 billion VND, not including exchange rate differences. Business management expenses increased by 22%.

Source: TAL

|

The substantial profit in the fourth quarter can be said to have helped TAL achieve favorable results for the whole year of 2023, even surpassing 37%, reaching 490 billion VND, as the profit for the first 9 months was only 7.5 billion VND. The revenue for 2023 increased by 14%, reaching 3.2 trillion VND, mainly from real estate transfers, accounting for 83%.

In terms of assets, the most notable is the significant increase in short-term receivables from customers, which doubled compared to the beginning of the year, reaching 877 billion VND, mostly from real estate business activities. In addition, prepayments to suppliers also increased by 70%, more than 120 billion VND.

Short-term receivables from lending by TAL decreased by 219 billion VND, but it increased by an equivalent amount for long-term loans, mainly to related parties.

Similarly, end-of-period inventories also increased by more than 56%, recording 3.8 trillion VND due to additional developments in new urban projects in the center of Thanh Hoa city (1.7 trillion VND), Hai Yen project (612 billion VND), and Nam Thai Nguyen project (382 billion VND), but decreased significantly in the NO1-T6 Diplomatic Compound project to 117 billion VND.

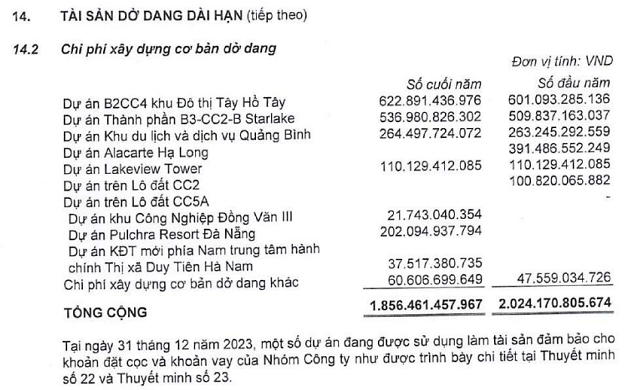

Accompanied by these changes, the unfinished construction costs of TAL also had some noteworthy changes at the end of the year. The company continued to recognize the B2CC4 project in Tay Ho Tay urban area, and the B3-CC2-B Starlake project with a slight increase in costs. The Alacarte Hạ Long project, the CC2 land lot project, and the CC5A land lot project are no longer present.

In addition, other new projects also appeared for the first time: Dong Van III Industrial Park project, Pulchra Resort Da Nang project, and the new South Central urban area project in Duy Tien town, Ha Nam, with recorded costs of 21.7 billion VND, 202 billion VND, and 37 billion VND respectively.

Source: TAL

|

Taseco Land withdraws from projects in Tay Ho Tay urban area

By the end of 2023, the long-term bank loan balance of TAL had increased by more than 1.6 trillion VND compared to one year earlier, reaching 1.8 trillion VND. Bond loans of 351 billion VND were generated during the year but 105 billion VND was paid.

It can be said that TAL’s favorable results in 2023 are due to the “trade-off” from flexible business policies in terms of increased receivables and inventories, not to mention superior investment in long-term assets leading to a significantly negative net cash flow from operating activities of TAL, amounting to 218 billion VND in 2022, to 1.5 trillion VND but the total annual cash flow was only slightly negative at 177 billion VND due to the increase in borrowing activities, as reflected in the total borrowing amount of 3.8 trillion VND, doubling the repayment amount and the same period last year.