Specifically, the Company expects to present its annual general meeting plan with revenue of VND 800 billion in 2024, a 30% increase compared to the previous year, with VND 790 billion in revenue from sales to customers. Of which, revenue from commercial business accounted for VND 237 billion (30%), while the remaining VND 553 billion was revenue from the Company’s manufacturing products.

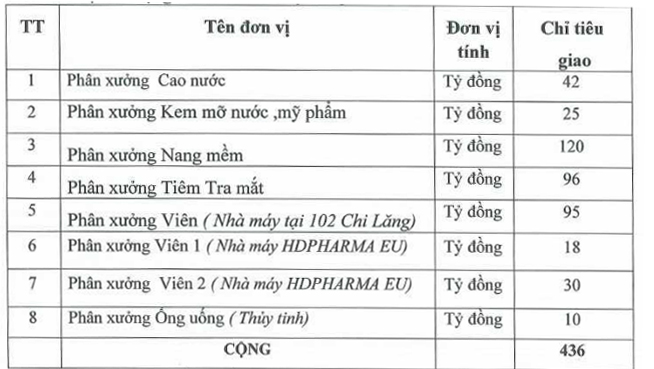

The estimated production output value reached VND 436 billion. After-tax profit is planned to slightly increase to VND 32 billion.

|

DHD’s revenue targets in 2024

Source: DHD

|

The dividend plan for 2023 is 3% in cash (equivalent to VND 300 per share, with a total expenditure of over VND 6.1 billion). Dividends for 2024 will be paid in shares or cash, with a ratio ranging from 2-6%. Remuneration for members of the Board of Directors and Supervisory Board is 3% and 1% of after-tax profit, respectively.

DHD will also present specific plans to the general meeting with regard to its factories. Specifically, Factory 1 is expected to maintain its production line until relocation; HDPharma EU factory will proceed with Phase 2 construction (consisting of 2 production lines for Cephalosporin powder injections) and Phase 3 development (maximizing the production line to meet EU GMP standards).

Regarding the election of members of the Board of Directors and the Supervisory Board, DHD plans to elect 3 members to the Board of Directors and 3 members to the Supervisory Board for the term 2024-2029.

Desire to issue over 7.5 million new shares

DHD plans to propose a plan to issue shares at the General Meeting of Shareholders in order to increase capital, with sources from the development investment fund (VND 50 billion) and undistributed after-tax profit as of December 31, 2023 (over VND 25 billion).

The number of shares to be issued is over 7.5 million, equivalent to an increase in charter capital of over VND 75 billion, to be issued to existing shareholders. The implementation ratio is 100:37, meaning that shareholders holding 100 shares will receive 37 new shares. The implementation will take place in the second and third quarters of 2024, after being approved by the General Meeting of Shareholders and announced in writing by the State Securities Commission (SSC).

After the issuance, DHD’s charter capital is estimated to reach VND 279 billion. In 2023, DHD issued nearly 5.4 million new shares to increase capital.