The Indian economy has been growing at a strong pace over the past year. Meanwhile, growth in other major economies – including China – has slowed down. High GDP growth, industrialization, urbanization, and an increasing middle class are expected to shift the main source of oil demand growth from China to India.

Some analysts, such as Rystad Energy, forecast that the oil demand growth of the populous nation will decrease to 150,000 barrels per day (bpd) by 2024 from 290,000 bpd in 2023.

Despite predictions of slower demand growth, the country is boosting its refining capacity. It should add an additional 1.12 million barrels per day to the current output each year until 2028, an oil minister told India’s parliament last month.

Accordingly, India’s total refining capacity is expected to increase by 22% over 5 years from the current annual output of 254 million tonnes, equivalent to about 5.8 million bpd. The government expects that increasing refining capacity will be “enough” to meet the long-term domestic fuel demand.

The Indian economy is growing faster than any other major economies, and so is its energy demand.

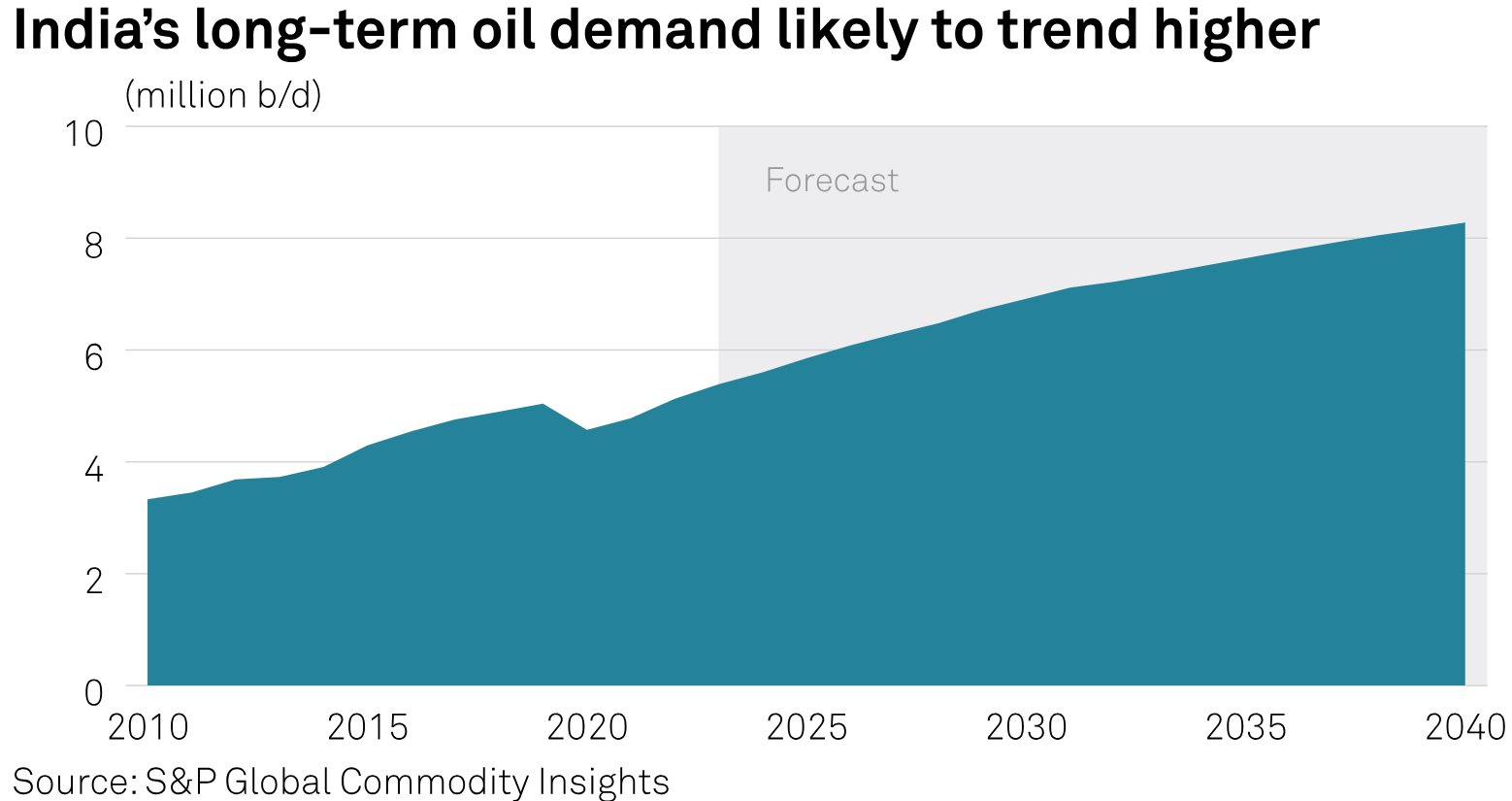

All major forecasters expect India to replace China as the biggest driver of global oil demand growth in the long term, which will happen before 2030.

India will be the largest source of crude oil demand growth in the world (Source: S&P Global)

In 2023, India’s oil consumption reached a record high of 231 million tonnes, up from 219 million tonnes in 2022, according to data from India’s Ministry of Petroleum and Natural Gas cited by Reuters market analyst John Kemp.

Besides being a major oil importer, India does not hesitate to buy crude oil from any supplier if they offer the lowest price. Over the past year, the country has become Russia’s top crude oil customer, along with China, taking advantage of the discount that Russian crude oil offers compared to international standards.

India imports more than 80% of the crude oil it consumes. In the past year and a half, the country has significantly increased its import of cheaper crude oil from Russia, which is banned in the West.

The Indian government and international investment banks have stated that the country’s economic growth is much higher than any other major economy and is expected to remain strong in the short and medium term.

Earlier this month, the National Statistical Office of India (NSO) announced that real GDP growth in the period 2023-24 is estimated at 7.3%, up from the 7.2% growth rate in the period 2022-23.

Shaktikanta Das, Governor of the Reserve Bank of India, said in Davos last week: “With strong domestic demand conditions, this country remains the fastest-growing large economy and is currently the fifth-largest economy in the world.”

“Robust domestic demand remains the main driver of growth, although India’s global integration has increased significantly through trade and financial channels. The central bank governor further added that a higher dependence on domestic demand helped the populous nation weather many external headwinds.

Analysts believe that a strong economy will increase the demand for oil, as well as the ongoing processes of urbanization and industrialization.

India will be the driving force behind oil demand growth until 2045, and is expected to add an additional 6.6 million bpd to the forecast demand, OPEC said in its latest year outlook.

Meanwhile, they have significantly raised long-term forecasts and now expected global oil demand to reach around 116 million bpd by 2045, an increase of 6 million bpd from their previous estimate, as energy consumption continues to rise and will need all forms of energy.

Analysts at Bernstein regard India as the largest growth driver in the next 20 years.

Reference: Oilprice