2023 is a challenging year for the real estate industry as the market has started to cool down after years of hot growth. As a result, companies in the industry are also affected by the overall market as they report significant declines in profits.

In this downturn, the stories of Phat Dat Real Estate Joint Stock Company (stock code: PDR) and No Va Investment Corporation (Novaland, stock code: NVL) can be considered representative of the real estate industry as these companies are still finding solutions to overcome the “stormy” year of 2023. A common characteristic of these two companies is that at the end of 2022, both Phat Dat and Novaland witnessed their stocks hitting the floor for 17 consecutive sessions.

Profitability amidst concerns

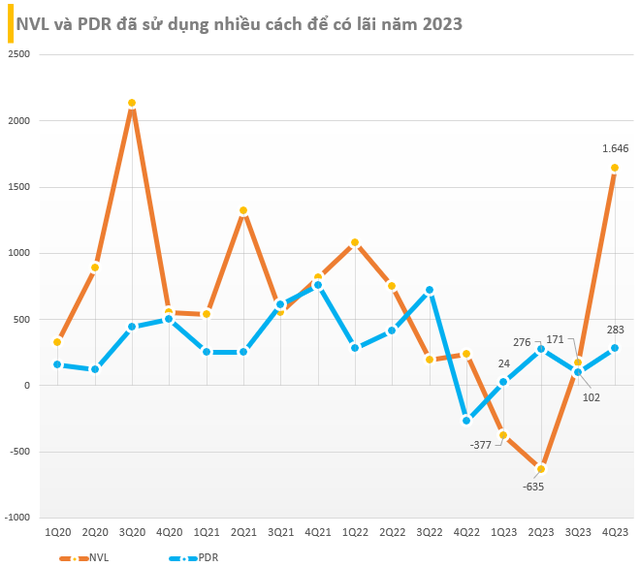

Despite the challenging year in the real estate industry, both Novaland and Phat Dat still managed to make profits. However, the majority of their profits did not come from pure business operations.

Regarding Novaland, the company recorded revenue of nearly 4,760 billion VND in 2023, a decrease of 57% compared to the same period last year. Among them, revenue from real estate transfers decreased by 55.5% to 4,090 billion VND. Revenue from management consulting and project development decreased by 71.2% to over 507 billion VND. As a result, Novaland’s net profit reached 805 billion VND, a decrease of 63% compared to the same period last year. The company incurred a loss of over 1,000 billion VND in the first half of the year.

Novaland’s profit mainly comes from two factors. Firstly, in the past year, the company recorded 5,741 billion VND in financial operating revenue. This revenue mainly comes from profits from investment cooperation contracts and divestment of subsidiary companies. In addition, the company also recorded other income of over 700 billion VND from penalties for contract violations.

As for Phat Dat, the company reported a nearly 60% decrease in annual revenue in 2023 compared to the previous year, reaching 618 billion VND. However, thanks to financial operating revenue of 954 billion VND from divestment of subsidiary companies, Phat Dat still achieved a net profit of 684 billion VND, although it decreased by nearly 40% compared to 2022.

Therefore, it can be seen that both Novaland and Phat Dat made profits mainly from other sources or financial operating revenue. Meanwhile, their real estate trading activities both experienced a sharp decline compared to 2022. Profit from other activities usually occurs only once and is not sustainable.

A year of struggling to pay off debts

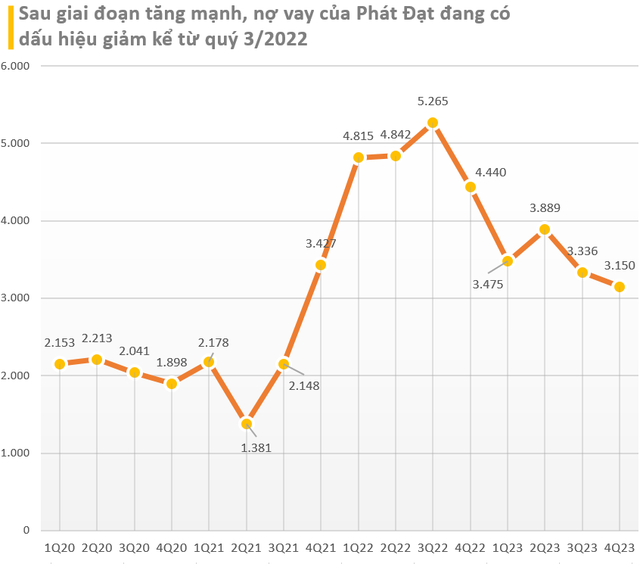

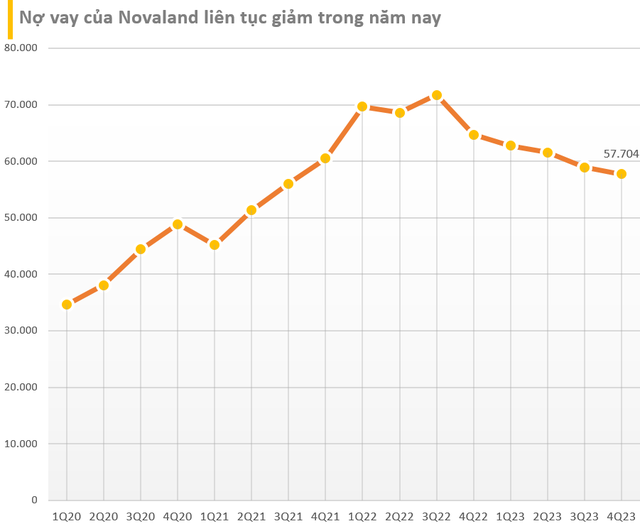

In the past year, as the real estate market faced difficulties, companies in the industry faced cash flow problems. For companies that have borrowed heavily in the period of 2020-2022 to implement projects like Novaland and Phat Dat, the difficulties are even greater. Therefore, the question of whether the debt can be repaid or not has attracted a lot of investors’ attention.

Looking back at 2023, Novaland and Phat Dat both made efforts to reduce their debts in order to reduce the pressure of interest expenses. Regarding Phat Dat, as of December 31, 2023, the company’s financial borrowing stood at 3,105 billion VND, a decrease of 1,290 billion VND compared to the beginning of the year. In particular, the company no longer has any bond debts. Phat Dat’s equity reached 9,579 billion VND, an increase of nearly 300 billion VND compared to the beginning of the year.

Regarding Novaland, the efforts to restructure the company’s debt by its management in the past year deserve recognition. As of December 31, 2023, Novaland’s financial borrowing stood at 57,704 billion VND, a decrease of nearly 7,000 billion VND compared to the beginning of the year. Among them, bond debt was 38,262 billion VND, a decrease of 5,900 billion VND. Bank loans amounted to 9,400 billion VND.

In 2023, news such as Novaland’s announcement of delayed principal and interest payment of bonds, or reaching debt extension agreements… happened frequently. However, the company has used various methods to repay its debts, including using real estate as collateral or major shareholders registering to sell shares to raise money to help Novaland repay its debts, which has somewhat eased the difficulties for the company.

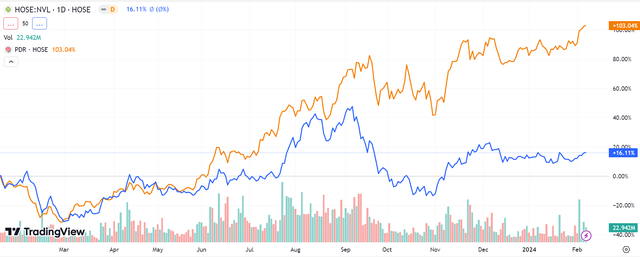

NVL and PDR stocks have different movements

Although both stocks reported profits, their movements were completely opposite. With PDR stock, as of the end of trading on February 7, the stock price reached 30,050 VND/share, an increase of 120% compared to the beginning of 2022.

As for NVL stock, its price fluctuated throughout 2023 and the beginning of 2024, but it still reached 17,300 VND/share at the last trading session, an increase of 22% compared to the beginning of 2022. However, Novaland’s stock price did not have any notable breakthroughs in the past year.

Blue line: PDR chart, Orange line: NVL chart.

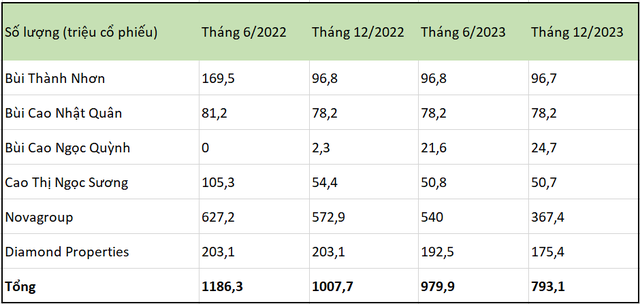

One of the first reasons to mention is that PDR or Phat Dat had a more impressive year because hundreds of millions of NVL shares “slipped” from the hands of the largest group of shareholders belonging to Mr. Bui Thanh Nhon – Chairman of Novaland’s BOD. Accordingly, in the past year, large shareholders of Novaland continued to have their pledged shares sold, as the leaders pledged the company’s shares for loans.

Currently, the group of shareholders related to the family of Novaland’s Chairman still holds about 793.1 million NVL shares (a 40.6% stake). In June last year, before the incident of NVL shares hitting the floor for 17 consecutive sessions occurred, this group of shareholders held nearly 1.19 billion NVL shares (a 60.85% stake). Therefore, in just over a year, about 393.2 million NVL shares (over 20% of the capital) slipped from Mr. Bui Thanh Nhon’s and related shareholders’ hands.

The continuous reduction of ownership by the leadership, along with the loss of control over the company, has prevented NVL stock from gaining momentum due to high trading volume.

As for Phat Dat, due to the use of shares as collateral for loans, it also encountered a similar 17-session floor hitting incident at the end of 2022. However, in the past year, there have been few incidents of share collateral sales related to the shareholders of this company. The shareholder group related to Mr. Nguyen Van Dat – Chairman of Phat Dat’s BOD still holds over 50% of the company’s capital.

In addition, another reason is that Phat Dat is currently focusing on residential real estate, apartments, and industrial parks – products that people are eager to own. Meanwhile, Novaland is currently facing many legal issues with its resort real estate projects and shop houses.