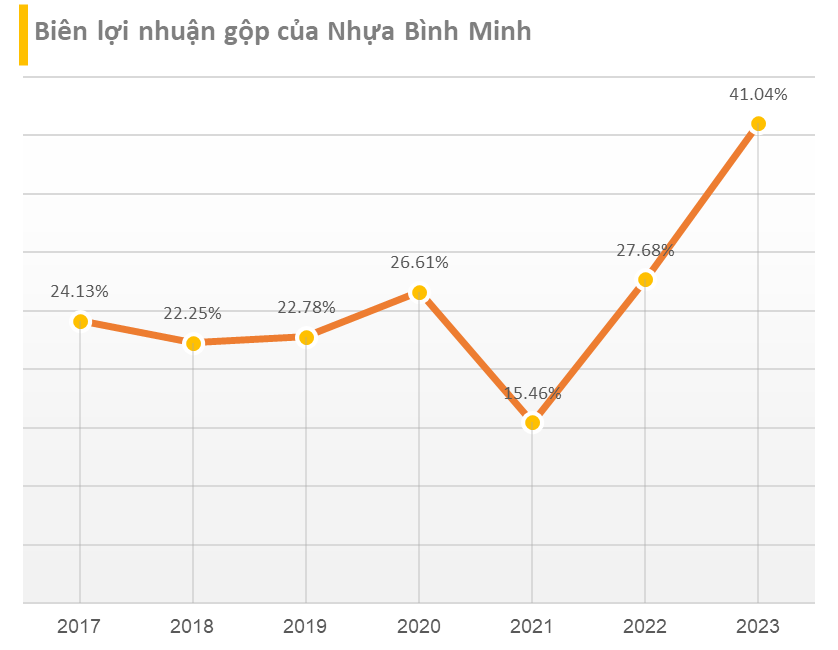

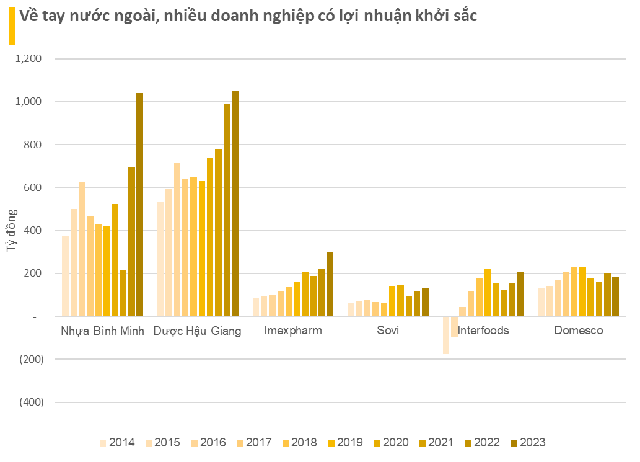

In 2023, Binh Minh Plastic (BMP) continued to achieve its highest profits in history. The company recorded revenue of VND 5,156 billion, a decrease of 12.6% compared to 2022. However, the sharp decrease in cost of goods sold helped the company achieve a net profit of VND 1,042 billion in the past year, an increase of 50% compared to the same period last year. EPS increased from VND 8,481 to VND 12,717.

Binh Minh Plastic’s gross profit margin in 2023 reached 41.04%, a significant improvement compared to 27.68% in 2022 and 22.3% in 2018, the year the SCG Group announced its successful acquisition of the company.

Binh Minh Plastic is currently in the hands of Thai tycoon – SCG Group. The conglomerate became a major shareholder of Binh Minh Plastic from March 2012 and has been continuously acquiring more shares. After “embracing” the entire BMP shares from SCIC in the auction in March 2018, SCG officially successfully acquired Binh Minh Plastic. The total amount the Thai conglomerate spent on this deal is estimated at about VND 2,800 billion. Currently, this Thai “tycoon” holds 55% of Binh Minh Plastic’s capital through its subsidiary Nawaplastic.

After Binh Minh Plastic, the SCG Group also continued its acquisition of Bien Hoa Packaging (Sovi, SVI) through its subsidiary TCG Solutions in 2020. As of present, TCG Solutions holds about 94% of SVI’s shares. Although it has not reached its peak profitability, Sovi also has the second consecutive year of profit growth with after-tax profit of over VND 132 billion, an increase of nearly 14% compared to the same period. EPS increased from VND 9,086 to VND 10,319. SVI’s gross profit margin in 2023 improved to 17.34% from 14.2% in 2022.

Japanese pharmaceutical company Taisho Pharmaceutical currently owns more than 51% of Hau Giang Pharmaceutical (DHG). Since 2020, DHG’s after-tax profit has been continuously growing each year. In 2023, DHG set a new profit record with net revenue reaching VND 5,015 billion and after-tax profit reaching VND 1,051 billion, increasing by 7% and 6% respectively compared to 2022. This is also the first time since its establishment that the leading pharmaceutical company has had a net profit of over a thousand billion in a year.

Another pharmaceutical company, Imexpharm (IMP), also reached its peak profit in 2023. Specifically, IMP’s net revenue reached VND 1,994 billion in 2023, an increase of 21% compared to the previous year. The estimated net profit was VND 300 billion, an increase of 34% compared to 2022.

Recently, IMP also announced its resolution at the General Meeting of Shareholders, approving the exemption from public offering for the transfer of shares between SK Investment Vina III Pte. Ltd. Specifically, Imexpharm’s shareholders approved the exemption from public offering for the transfer of shares between SK Investment and the existing shareholders of the company. With this resolution, SK Investment becomes an investor holding over 65% of Imexpharm’s shares.

SK Investment is a subsidiary of the SK Group, the 3rd largest conglomerate in South Korea. This company invested in Imexpharm since late May 2020 after receiving the transfer of 12.3 million IMP shares (accounting for 24.9% of capital) from funds of the Dragon Capital group along with CAM Vietnam Mother Fund, Kingsmead, and Mirae Asset.

Having gone through a severe crisis period from 2008-2015 after the melamine incident, IFS accumulated losses up to VND 853 billion by the end of 2015. In the midst of difficulties, in 2011, the main shareholder in Malaysia sold all Interfood shares to Kirin (a large food production corporation in Japan). Under the restructuring by the Kirin Group, IFS started to make a profit since 2016 and has been increasingly profitable over time. In 2023, IFS achieved an after-tax profit of VND 209 billion, an increase of 34%. Accumulated losses were completely erased since 2021. Currently, Kirin Holdings Singapore Pte. Ltd. holds nearly 96% of IFS shares.