Cautiously flowing cash inflows, especially before the holiday, resisted flowing into the three platforms, bringing liquidity down to a three-month low and preventing the Vn-Index from maintaining the bullish momentum of the previous session. The index fluctuated throughout the session before closing with a marginal decline of 0.64 points, holding firm at the 1,204-point level.

The market breadth was negative, with 293 stocks losing ground against 166 gainers. While the Retail and Information Technology sectors managed to maintain a rise of almost 2%, most other large-cap groups either declined or saw insignificant growth. Real Estate rose only 0.17%, Securities dropped by 0.78%, Banking fell by 0.40%, Oil & Gas declined by 0.54%, and Materials and Construction also decreased.

FPT remained the benchmark’s biggest contributor, lifting the index by 0.96 points with its 2.58% gain. The Retail sector saw MWG gain 2.87%, pushing up the index by 0.53 points. Other stocks that had a positive impact on the Vn-Index were VCB, MSN, VIC, VNM, and SAB. Conversely, TCB, BID, MBB, and HPG were the ones weighing down on the index the most.

The lack of cash inflows caused a significant drop in liquidity on the three platforms to 15.800 billion VND, out of which foreign investors net sold 393.9 billion VND, including a net sell value of 312.5 billion VND through order-matching transactions.

Foreign investors primarily bought shares in the Retail and Oil & Gas sectors through order-matching transactions. Top stocks in this category included MWG, VND, TPB, HPG, KDH, PVD, VCB, VNM, DGC, and SSI.

Meanwhile, foreign investors were net sellers in the Financial Services sector through order-matching transactions. Top stocks in this category included FUEVFVND, DIG, GAS, GEX, HDB, LPB, HDC, MSN, and EVF.

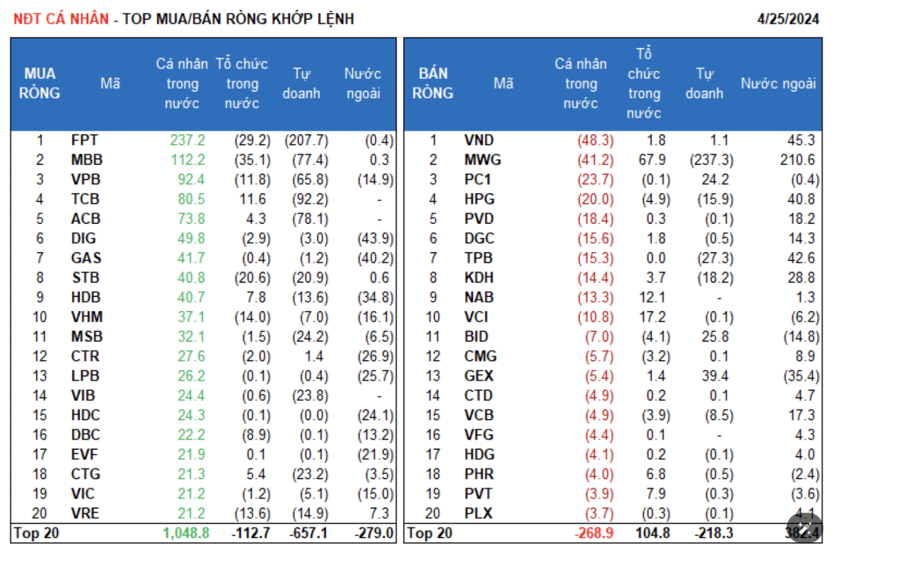

Domestic individual investors were net buyers with 1,039.5 billion VND, including a net buy value of 1,103.0 billion VND in order-matching transactions.

In terms of order-matching transactions alone, they bought into 14 out of 18 sectors, primarily the Banking sector. Top buys by domestic individual investors included FPT, MBB, VPB, TCB, ACB, DIG, GAS, STB, HDB, and VHM.

In contrast, they were net sellers in four out of 18 sectors through order-matching transactions, mainly in the Retail and Oil & Gas sectors. Top sells included VND, MWG, PC1, HPG, PVD, DGC, KDH, NAB, and VCI.

Proprietary traders were net sellers with 557.5 billion VND, including a net sell value of 854.8 billion VND in order-matching transactions. In order-matching transactions alone, proprietary traders bought into six out of 18 sectors. Financial Services, Construction, and Materials were the sectors with the strongest net buy value. Top buys by proprietary traders in order-matching transactions on the day included FUEVFVND, GEX, BID, PC1, E1VFVN30, EIB, DRC, APH, CTR, and DPM. Top sells were in the Banking sector. Top stocks in this category included MWG, FPT, TCB, ACB, MBB, VPB, MSN, TPB, PNJ, and MSB.

Domestic institutional investors were net sellers with 20.3 billion VND, including a net buy value of 64.4 billion VND in order-matching transactions.

In order-matching transactions alone, domestic institutions sold into 10 out of 18 sectors, with the largest being the Banking sector. Top sells included MBB, FPT, STB, FUEVFVND, VHM, VRE, BWE, VPB, DBC, and VTP. The largest net buy value was in the Retail sector. Top buys included MWG, MSN, PNJ, VCI, KBC, NAB, TCB, PDR, GMD, and VIX.

Negotiated transactions today amounted to 2,228.3 billion VND, a 28.9% decrease compared to the previous session, and accounted for 14.1% of the total trading value.

Of note was the significant negotiated transaction between foreign institutions in FPT and MSB. Today, proprietary traders were net buyers in a large number of FUEVFVND fund certificates from foreign institutions.

In addition, individuals also actively traded in banking stocks, including EIB and HDB, through negotiated transactions.

The proportion of cash flow allocation increased in the Banking, Retail, Food, Construction, Electrical Equipment, Aviation, and Telecommunications sectors, while it decreased in Real Estate, Securities, Software, Steel, Aquaculture, Chemicals, Plastics, Rubber, and Fibers.

Focusing on order-matching transactions, the proportion of trading value rose again in the large-cap VN30 group, while it decreased in the mid-cap VNMID and small-cap VNSML groups.