Financial activities “bear” the entire 2023

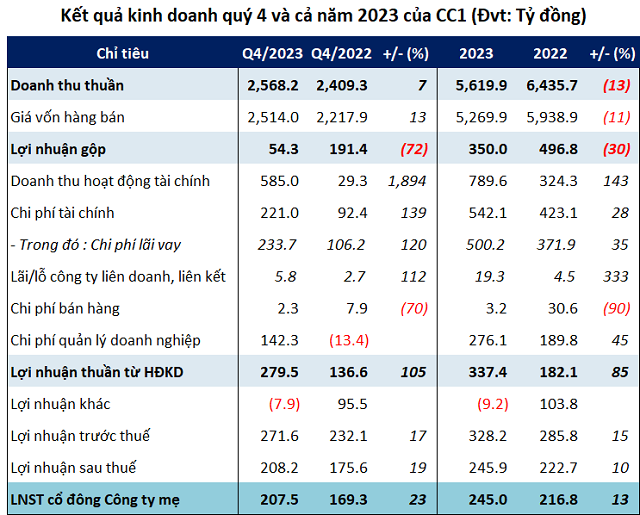

In the fourth quarter of 2023, although CC1 recorded revenue of over 2,568 billion dong, an increase of 7% compared to the same period; however, due to higher cost of goods sold, the company’s gross profit was only over 54 billion dong, a decrease of 72%. The gross profit margin also decreased from 8% to 2%.

Moreover, the total expenses for this period of CC1 reached 366 billion dong, 4.2 times higher than the same period; of which, interest expenses accounted for the majority with 234 billion dong and business management expenses exceeded 142 billion dong. However, CC1 still reported a net profit of over 207 billion dong, an increase of 23% compared to the same period.

Source: VietstockFinance

|

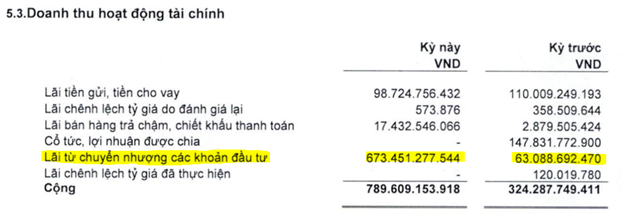

To have profit in this period, the most noteworthy highlight of CC1 is the financial operating revenue reaching 585 billion dong, 20 times higher than the same period and accounting for 74% of the total financial revenue for the year. According to the company’s explanation, this is the profit from the transfer of investment contracts and is also the main reason for the increase in net profit in the fourth quarter.

|

The financial operating revenue for the whole year 2023 of CC1

Source: CC1

|

At the end of 2023, CC1‘s net revenue reached nearly 5,620 billion dong, a decrease of 13%; while pre-tax profit exceeded 328 billion dong and net profit was 245 billion dong, an increase of 15% and 13% compared to 2022.

Compared to the 2023 plan, CC1 only achieved 52% of the net revenue target but exceeded 42% of the pre-tax profit target for the year.

| Net revenue and net profit of CC1 from 2017 – 2023 |

“Stashing” over 2,000 billion dong in the bank

As of December 31, 2023, CC1‘s total assets reached 14,966 billion dong, a decrease of 4% compared to the beginning of the year. The majority is concentrated in short-term assets of nearly 9,866 billion dong, accounting for 66%. Notably, CC1‘s cash and cash equivalents increased by 62% to over 2,663 billion dong, and short-term financial investments were 190 billion dong; of which, CC1 is currently depositing money in commercial banks about 2,047 billion dong, accounting for 14% of total assets.

Inventory decreased by 9% to 915 billion dong, with 2 notable projects being the Tropicana Nha Trang Commercial – Hotel – Apartment complex with over 145 billion dong and the Binh Duong General Hospital project with 1,500 beds with nearly 127 billion dong.

Meanwhile, the unfinished basic construction costs increased by 25% to 2,641 billion dong, focusing on the Hai Phong – Thai Binh coastal road projects PPP (2,014 billion dong) and the Hanh Phuc residential area (over 605 billion dong).

On the other side of the balance sheet, CC1‘s total liabilities amount to 10,693 billion dong, a decrease of 6% compared to the beginning of the year. Of which, the total financial debt both short-term and long-term is nearly 4,289 billion dong, a decrease of 37%, accounting for 40% of the total debt and 29% of the company’s capital.