The Most Stressful is Over

Mr. Nguyen The Minh – Director of Analysis at Yuanta Securities Vietnam – believes that the opportunities of the stock market in 2024 will be clearer and brighter than in 2023. According to the forecast, the growth rate of businesses will return to a positive figure of about 28% compared to 2023.

According to Mr. Minh, the two important stories of the stock market in 2024 are the launch of the KRX system and the expectation of market upgrading. “I expect that FTSE – an independent company specializing in creating indices for the global financial market – will make a decision on market upgrading when we solve the issue of the foreign investor’s capital adequacy ratio,” Mr. Minh shared.

The business performance on the exchange also continues the recovery trend, expected to provide momentum for the stock market this year.

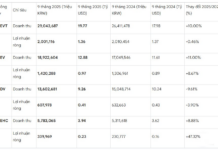

Mr. Nguyen Ngoc Hieu – an analyst from VNDirect Securities – said that in Q4/2023, the net profit of listed companies increased by 30.4% compared to the same period last year, ending the four consecutive quarters of decline. The market’s expectation for positive Q4 results is also the driving force to bring the stock market back after the strong selling-off in the previous Q3.

The banking sector continues to contribute the most to the overall market profit growth.

Steel and banking are the leading sectors in terms of growth contribution,

real estate

not too negative. Meanwhile, electricity and retail sectors still exert negative pressure. “We continue to expect that the loan interest costs will decrease in the coming quarters and boost the overall market profit,” Mr. Hieu expressed.

Regarding the medium-term prospects after the Lunar New Year holiday, in February 2024, experts from VNDirect believe that the market valuation is still attractive. The significant recovery in Q4 business results is a positive psychological support for the market. Liquidity may recover in the second half of February, when individual investors return to the stock market after the Tet holiday. Improved domestic capital flow could help

VN-Index

approaches the psychological resistance level around 1,200 – 1,220 points.

VDSC expects that in 2024, the average matching value can be maintained at 15,000 – 20,000 billion VND/session.

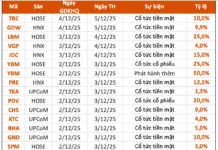

The investment theme in February can revolve around the fields of:

banking

, port – maritime transportation, and consumption. With the long-term outlook in 2024, VNDirect believes that VN-Index can target 1,350 points by the end of 2024.

The analysis team of Rong Viet Securities (VDSC) predicts that the stock market in 2024 will have strong fluctuations with many short waves. The most stressful pressures are over, but the path of economic recovery still faces many challenges.

In contrast to 2023 starting with many knots of the

financial market

in the country and headwinds from the global macro picture, 2024 is considered “easier” in most issues of the previous year. VDSC forecasts that VN-Index will fluctuate in the range of 1,080 – 1,390 points. The average matching value can be maintained at 15,000 – 20,000 billion VND/session.

Focus on KRX system, upgrading issue

Regarding the opportunities and challenges for the stock market this year, in an exchange with PV Tien Phong, Ms. Vu Thi Chan Phuong – Chairwoman of the State Securities Commission – said that the market continues to largely depend on macroeconomic policies and the prospects of the domestic and global economy.

According to the International Monetary Fund (IMF), tightening monetary policies have gradually rebalanced the overall demand for potential output, reduced supply chain disruptions, and lowered commodity prices. Global inflation is forecasted to gradually decrease and return to the target level of central banks by 2024.

Ms. Vu Thi Chan Phuong – Chairwoman of the State Securities Commission.

The overall Vietnamese economy and the securities industry are forecasted to continue to face many difficulties and challenges. Although global inflation has been controlled, core inflation is forecasted to remain high. Enterprises will continue to face numerous difficulties, with limited capital absorption capacity.

However, the development of the market in 2024 is still supported by positive factors. The government and the Prime Minister have actively and resolutely directed ministries, sectors, and localities to implement many solutions to overcome difficulties, stabilize, and promote economic growth such as reducing loan interest rates; stabilizing the foreign exchange market; promoting disbursement of public investment capital; implementing credit support packages for sectors, industries, addressing difficulties and obstacles in the real estate market,

bonds,

tax exemptions, reductions, extensions, supporting businesses.

In 2024, the State

Securities Commission will complete the legal framework and policy system for market development; cooperate with relevant units to deploy new information technology systems into official operation as soon as possible; strengthen inspection, examination, supervision, timely handling, and strict handling of violators of the law.

The State Securities Commission

will continue to restructure the stock market, strengthen the management of securities business organizations and securities practitioners; diversify the investor base, develop institutional investor systems, encourage long-term foreign investment, and train individual investors.

“Foreign relations and international cooperation will be strengthened, organize programs to promote foreign investment, work with foreign investors, rating agencies to upgrade the Vietnamese stock market from a frontier market to an emerging market as soon as possible; focus on preparations for the Conference of Securities Commissions of Asia Pacific region countries to be held in Vietnam in 2025,” Ms. Phuong shared.

Chairwoman of the State Securities Commission Vu Thi Chan Phuong expects a more positive trend to continue in many industries and fields this year. Vietnam’s economic prospects are highly appreciated by international organizations, especially after the event of upgrading the comprehensive strategic cooperation relationship with the United States recently.