Illustration

Oil rises due to political tensions

Oil prices edged higher on Tuesday as political tensions in the Middle East and Eastern Europe continued,

but the increase was limited due to investors lowering their expectations of an interest rate cut by the U.S.

Federal Reserve.

Brent crude futures ended the session up 77 US cents, or 0.94 percent, at $82.77 per barrel. U.S. West Texas

Intermediate (WTI) crude rose 95 cents, or 1.24 percent, to $77.87 per barrel.

The U.S. reportedly rejected Russian President Vladimir Putin’s proposal for a ceasefire in Ukraine. Meanwhile,

concerns over further escalation of the conflict in the Middle East have also raised concerns about the

prospects of oil supply.

Data from the U.S. Energy Information Administration showed that crude oil inventories in the country rose by

8.52 million barrels for the week ending February 9, while gasoline inventories decreased by 7.23 million

barrels and distillate inventories decreased by 4.02 million barrels.

OPEC still maintains its forecast for relatively strong global oil demand growth in 2024 and 2025, while also

raising economic growth forecasts for both years. The producer group and allies, including Russia, known as

OPEC+, will decide in March whether to extend the oil production cuts.

Natural gas lowest in 3.5 years

U.S. natural gas futures fell about 5 percent on Tuesday to their lowest level in over 3.5 years due to near-record

production, abundant fuel stocks, warmer weather in the upcoming week, and lower heating demand compared to

previous expectations.

Analysts estimate that natural gas inventories are currently about 15 percent higher than normal for this time

of year.

March natural gas futures on the New York Mercantile Exchange fell 7.9 U.S. cents, or 4.5 percent, to $1.689 per

million British thermal units (mmBtu), the second consecutive day of closing at the lowest level since July

2020. Over the past 6 sessions, prices have dropped by about 19 percent.

Gold falls below $2,000/oz for the first time in two months

Gold prices fell below the crucial $2,000-per-ounce level to the lowest in two months as stronger-than-expected

U.S. inflation data dampened prospects for an early interest rate cut by the Federal Reserve.

Spot gold ended the session down 1.3% at $1,993.29 per ounce, the lowest level since December 13. April gold

futures fell 1.3% to $2,007.2 per ounce.

Data showed that U.S. consumer prices rose more than expected in January amid higher housing and healthcare

costs.

Federal Reserve policy makers may wait until June before cutting interest rates. Higher interest rates increase

the opportunity cost of holding gold bullion.

After the inflation data, the U.S. dollar rose 0.7% to its highest level in three months against its rivals,

making gold more expensive for those holding other currencies. U.S. 10-year Treasury bond yields also rose.

Copper rises

Copper prices rose on Tuesday as the U.S. dollar strengthened after stronger-than-expected U.S. inflation data

reinforced the view that the Federal Reserve will hold interest rates steady in March.

Three-month copper contract on the London Metal Exchange (LME) ended the session up 0.1% at $8,244 per tonne.

Copper prices have fallen 4% this month due to concerns about demand from the world’s top consumer – China – and

the real estate sector in particular, although activity has been subdued this week due to China’s Lunar New

Year celebrations.

LME registered copper inventories hit their lowest level since September after declining by 850 tonnes.

Cocoa returns to near record high

Cocoa futures on ICE rose on Tuesday. May contract on London exchange rose £91, or 2%, to £4,701 per tonne.

Exporters estimate cocoa deliveries to Ivorian ports from October 1 to February 11 have fallen 33% compared

to the same period a year ago.

May cocoa on the New York Exchange rose 1.2% to $5,652 per tonne.

Rubber highest in a week

Rubber futures in Japan rose to their highest level in a week on Tuesday, supported by a strong Nikkei index and

a weaker yen. Rising oil prices also helped bolster rubber.

The July contract on the Osaka Exchange (OSE) closed up 5.2 yen, or 1.87 percent, at 283.2 yen ($1.89)/kg, the highest

closing level since February 7.

Japan’s Nikkei index closed up 2.89% at 38,010, not far from its all-time high of 38,957 set on December 29, 1989.

The March contract on Singapore’s SICOM closed at 152.50 U.S. cents/kg, up 0.53%.

Mainland China’s financial markets were closed for the Lunar New Year holiday and will resume trading on Monday,

February 19, leaving Asian trading muted.

Coffee falls

Arabica coffee futures for May fell 3.1 cents, or 1.6%, to $1.8805 per pound.

Dealers noted that certified stocks of Arabica coffee on ICE have risen to high levels, which could put pressure

on prices.

However, they also noted concerns about delays in container discharge at Antwerp port.

Robusta coffee for May fell 0.9% to $3,163 per tonne.

Soybeans falls, corn rises slightly

Corn futures on the Chicago Board of Trade (CBOT) ticked higher on Tuesday on technical trading, but still traded near

the lowest level in three years due to ample global supplies, improved South American crop prospects, and strong

export competition.

Soybean prices fell as improved weather in South America alleviated some concerns about the soybean market.

Wheat futures ended the session unchanged, remaining under pressure from lower Russian grain prices.

At the close of trading, May soybeans fell 6-3/4 cents to $11.86-1/4 per bushel, while corn rose 1/4 cent to

$4.30-3/4 per bushel and wheat was steady at $5.97-1/2 per bushel.

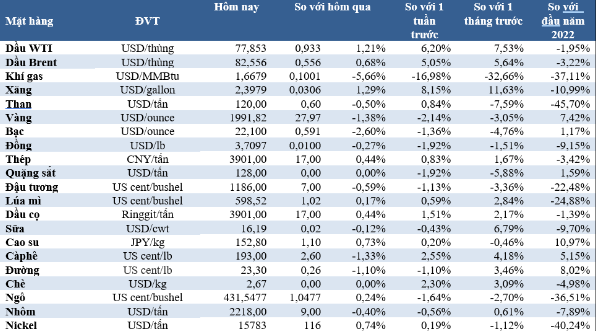

Key commodity prices on the morning of February 14: